AARP Eye Center

AARP urges you to oppose House Joint Resolution 66 and 67. They revoke a rule and guidance providing states and cities with the flexibility to set up retirement savings options for small businesses and their employees.

House Joint Resolutions 66 and 67 represent the kind of federal overreach we expect Colorado senators to oppose.

Urge Sens. Michael Bennet and Cory Gardner to protect state flexibility on retirement savings programs by asking leadership not to take up Joint Resolutions 66 and 67, and oppose the resolutions if they are brought to a vote.

Senator Michael Bennet (202) 224-5852

Senator Cory Gardner (202) 224-5941

Here are the facts:

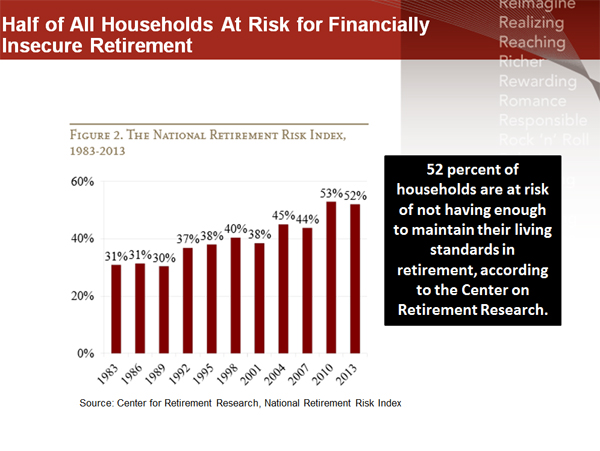

55 million working Americans do not have a way to save for retirement out of their regular paycheck because their employer does not offer a retirement plan. Yet employees are 15 times more likely to save if they have a payroll deduction savings plan at work.

A 2016 Department of Labor rule provides guidance on how states can do this through public-private partnerships. The rule is clear: states have the flexibility they need to implement innovative retirement solutions. Small business owners have no operational burden for these plans. Their only interaction with a Work and Save plan is to facilitate payroll deductions for these individual savings plans.

Two Congressional Review Act resolutions – H.J. Res. 66 and 67 – to overturn this rulemaking is expected to be voted on in Congress this week. This represents significant overreach by the federal government. Congress should not block states from enacting public-private partnerships to address the retirement needs of millions of workers if they want to.

A recent survey found that voters highly approve of states leading the way on retirement security. More than three in four (77 percent) political conservatives support a state-facilitated retirement savings plan, and 76 percent agree elected officials should do more to make it easier for small business to provide retirement savings options to their employees. (2017 AARP Retirement Security National Survey of Employed Adults Ages 18-64, January)