AARP Eye Center

I try to keep up with the news and activities in Washington as much as I am able. But there are so many abbreviations and unfamiliar terms in the news coming from current activities and debates that I feel like that famous groundhog who sticks his head out in the spring, looks around, dislikes what he sees or hears and decides to go back to sleep. I think that there are many who have similar reactions to news from Washington. But now, more than ever, that news has the potential to dramatically change my life and the lives of my loved ones, so I’m trying to educate myself.

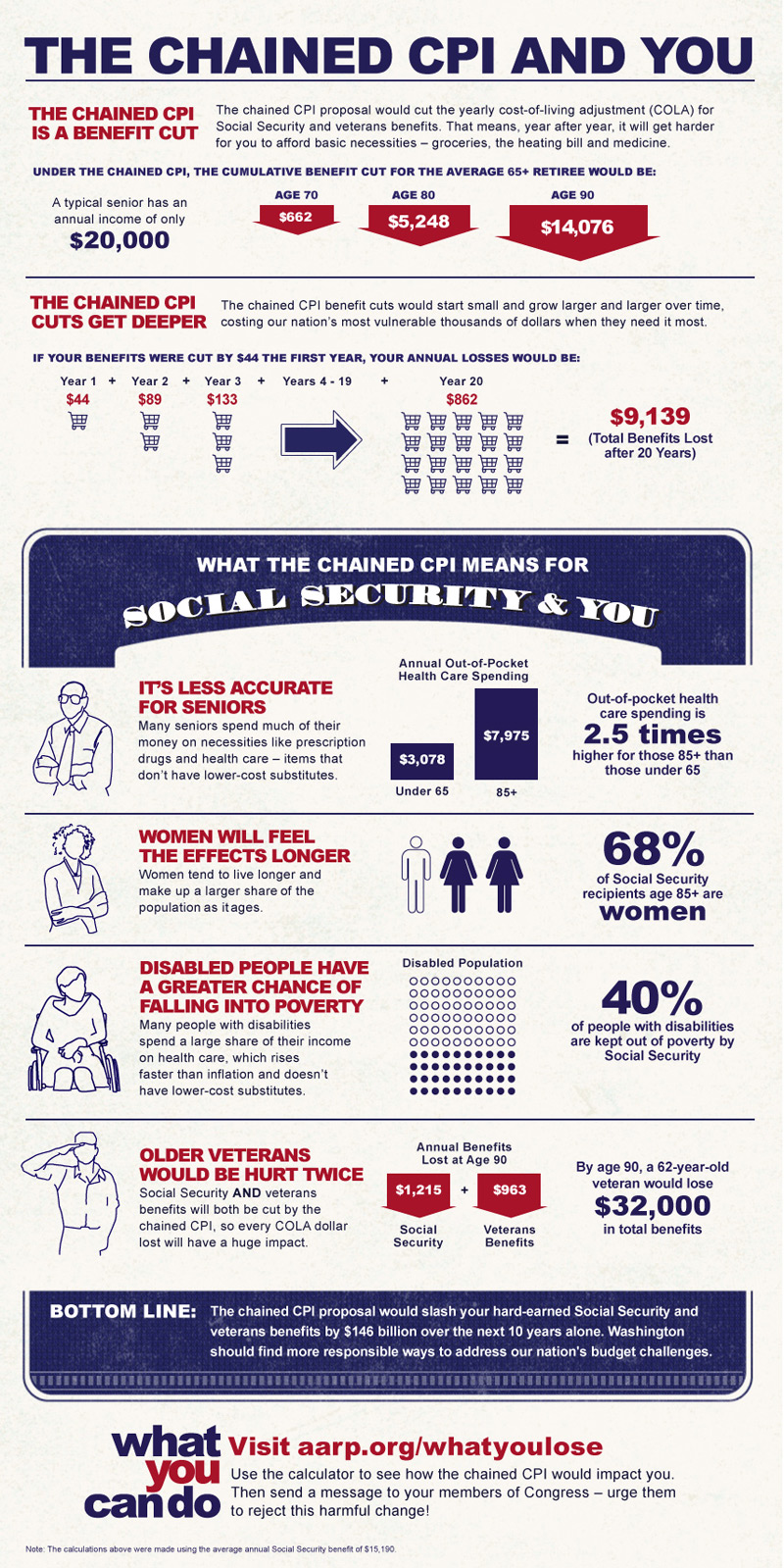

The current and ongoing discussion this year seems to be around “Chained CPI” and whether it is a good or bad thing. I decided I should learn more about what Chained CPI really means. So I went exploring. This is what I found.

CPI stands for Consumer Price Index. This much I knew, but I needed to grasp the basics about what the Consumer Price Index is or does for me. The Institute for Research on Poverty (IRP) at the University of Wisconsin-Madison explains the Consumer Price Index as “a measure of the average change over time in the price paid by urban households for a set of consumer goods and services.” The IRP adds that the items are classified into some 200 categories arranged into eight groups such as food and beverages or medical care. While this research-and-averaging process looks at spending patterns of only urban consumers and wage earners, that group represents about 87 percent of the U.S. population, according to the Institute.

Now there is a new measurement being taken – the Chained Consumer Price Index for All Urban Consumers, or C-CPI-U. This measurement adjusts the CPI according to substitutions people make in their purchases in reactions to price increases.

OK, now I have a superficial grasp on the definition of “Chained CPI,” but how is a research measurement good or bad? Isn’t it just a set of statistics? By actual definition, the “Chained CPI” is exactly that – a set of statistics. However, our country’s leaders have used that term to refer to proposals to reduce federal spending using the chained CPI as a tool. But how?

Social Security recipients have traditionally received an adjustment in their benefits at the beginning of most years that corresponds to the COLA, or Cost-of-Living-Adjustment, which is based on the percentage of increase in the traditional Consumer Price Index (CPI) from the third quarter of the previous year. The proposals currently referred to as “Chained CPI” suggest that the COLA for Social Security benefit increases should be calculated using the C-CPI to reflect or to encourage consumers’ substitutions of lower-priced items when prices of preferred items rise. Essentially, using the C-CPI to calculate Social Security COLAs tells Social Security recipients, “You will need to choose generic bread rather than bakery or name-brand versions.” The same decision might need to be made as well regarding prescription medications, household supplies, and other purchases. Essentially, if C-CPI is used as the basis for COLA calculations, Social Security recipients will get a reduction in spending power – in some instances that may relate to a reduction in actual dollars and other instances it will mean that the same dollars will purchase fewer goods and services. David Certner, Legislative Counsel and Legislative Policy Director for AARP, has a short YouTube video called "Wh at in the heck is Chained CPI?" that explains quite well how implementing Chained CPI will affect the average Social Security recipient. Certner’s explanation brings to light the fact that using the Chained CPI may result in a small loss of spending power or dollars each year, but that yearly loss is cumulative. And each year’s changes in spending habits would affect the next year’s C-CPI calculations. The total loss over five or ten years would be substantial and detrimental to the financial well-being of our most economically endangered Americans.

A website called Retirement Statistics used U.S. Census Bureau and other resources to arrive at an average retirement age of 62 and an average retirement span of 18 years. Over 18 years, “Chained-CPI” could cost that retiree thousands. In fact, AARP has created a calculator that anyone can use to estimate the extent of loss they would experience as a Social Security recipient under “Chained CPI.” I used the tool to calculate the loss of a relative currently receiving Social Security Benefits. Over 10 years, she could lose over $2,300! As for that 62 year old retiree, using the calculator’s average annual Social Security benefit of $15,190, he will lose over $9,100 in retirement resources.

Are you willing to accept that for your parents? For yourself? If the answer is “no”, let your representatives in Washington know by completing the form on the AARP calculator web site telling them to say “no” to Chained CPI!