AARP Hearing Center

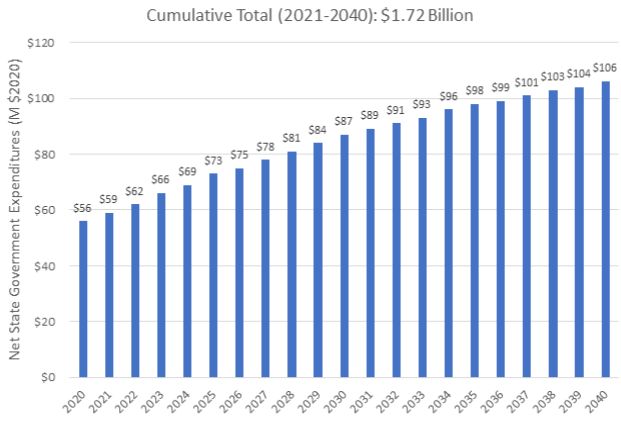

Hawai`i taxpayers are paying $62 million this year and will pay $1.72 billion over 20 years for the state’s share of social service programs to support workers and their families reaching retirement age without adequate savings, a new study estimates.

The Cost of Doing Nothing Report, prepared by Econsult Solutions Inc. for the Hawaii Retirement Savings Task Force, looked at the economic and taxpayer impact of Hawai`i’s retirement savings crisis. Econsult looked at Medicaid and other social service program spending and estimated what would happen if current savings, or lack of savings, trends continue through 2040 compared to what would happen if workers retire with adequate savings. The difference --$1.72 billion – is the amount of state social services spending that could be avoided if Hawai`i can get more workers to save.

“AARP Hawai`i has been trying to pass a common-sense bill to address the state’s retirement savings crisis for years. But House leaders have kicked the can down the road and let the bill die by doing nothing. Doing nothing is not an option anymore,” said Keali`i Lopez, AARP Hawai`i State Director. “There are now 1.72 billion reasons to pass Senate Bill 3289.”

Senate Bill 3289 would act on a Legislative task force recommendation to create a Hawai`i retirement savings program to help small businesses offer their workers an easy way to save through payroll deduction.

The bill passed the Senate and the House. But there are differences between the Senate and House versions of the bill and those differences must be resolved before the bill can pass the Legislature and go to the governor.

Go to action.aarp.org/hisaves to send an email to House and Senate leaders and tell them to pass Senate Bill 3289.

A Hawai`i Retirement Savings Task Force, created by a Senate resolution last year, found that an automatic IRA savings program similar to programs adopted in Oregon, California, Illinois, Connecticut, Maryland, New York, New Jersey, Colorado, Maine and Virginia will help Hawai`i workers save their own money, help small businesses offer an additional benefit to their workers, and help Hawai`i taxpayers by reducing the need for expanded social services programs.

The task force report estimates that about 215,000 Hawai`i workers, most of whom work for small businesses, do not have access to 401ks or other payroll savings programs – the most effective way to get people to save.

In Oregon, California and Illinois, nearly 70 percent of workers offered an easy way to save at work open accounts. So far, the three states with operating programs have enrolled 441,000 workers who have saved more than $407 million.

“It’s common sense,” Lopez said. “If money can be taken out of your paycheck before you get a chance to spend it, people will save. If more workers save, then fewer working families will need state support as they age and everyone benefits from that.”

“It’s a no-brainer,” said Buddy Bess, the owner of local book publisher Bess Press. “A program like this would allow us to offer retirement savings to our workers and save taxpayers money in the future. Why would anyone oppose it?”

Other findings from the Econsult study:

- Federal spending on Medicaid and other government social services for older Hawai`i families without adequate savings is expected to increase from $57 million in 2020 to $109 million in 2040, totaling $1.76 billion from 2021 to 2040.

- Total state and federal spending on government health and social services for older residents without adequate savings is $3.48 billion, meaning $3.48 billion in combined state and federal taxpayer spending could be reduced if more workers can save for retirement.

- The 65+ population in Hawai`i is projected to grow in numbers and percentage of the population from 280,000 in 2020 to 384,000 in 2040; from 32 percent of households in 2020 to 39 percent of households in 2040.

- The increase in the percentage of older households means that there will be fewer working-age households who pay traditional taxes to support older residents who need government social services.

- About 60 percent of households headed by residents 65 and older had an annual income of less than $75,000 and could need state support as they age. That translates to 92,300 households in 2020 and rises to about 120,200 households in 2040. The average income of those families was $32,940 in 2020.

- Households who reaching retirement age in 2040 are expected to have an annual income shortage of $8,100 (up from $7,500 in 2020). They would need to save an additional $181,000 by age 65 to replace 75 percent of their income during retirement. (75 percent of current income is considered by most financial experts to be enough money to maintain living standards in retirement.)

- Workers who can save an average of just $1,970 a year will achieve savings goals over 30 years because of compounding interest and that goal is achievable based on savings rates in automatic IRA savings programs in Oregon, California and Illinois.

- Accumulated retirement savings, even if the amount falls short of retirement goals, will still benefit workers. The savings can be used as emergency funds which can reduce the need for high interest credit card spending for unexpected expenses; the money may also help household delay Social Security which will increase benefits.

- More kupuna with sufficient savings will benefit the economy because of increased spending. The state also benefits from increased tax collection. However, the report did not attempt to quantify the increased spending and tax collection from higher spending by households 65+.