AARP Hearing Center

Brenda Johnson of Fishers, an Indianapolis suburb, retired last year at 66 with a few sources of income, including a pension and a Substack blog she writes called Older, Bolder & Better.

“But Social Security is the one thing that doesn’t fluctuate,” she says. It’s “a constant in my portfolio.”

Beyond that, it’s the only part of her retirement income with a cost-of-living adjustment — a vital feature her pension doesn’t have.

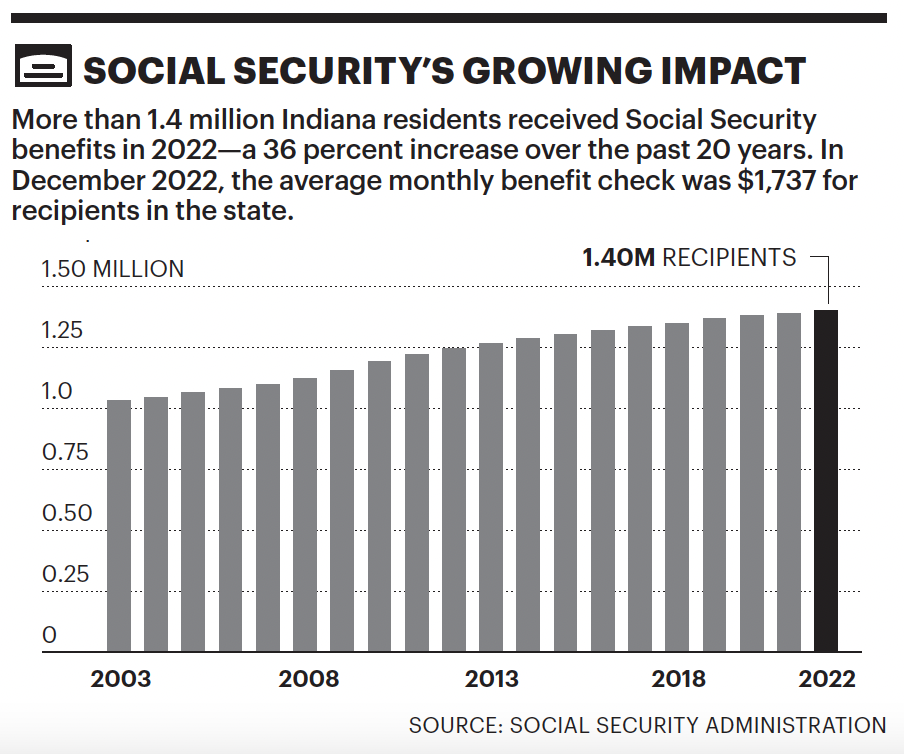

For Johnson and the more than 1.4 million Indiana residents who receive Social Security, those attributes — its steadiness, its cost-of-living raises and above all its dependability — are what make the program so valuable.

And it’s also why recipients and experts alike are worried about the program’s future. Unless Congress steps in, the program’s trust fund reserves will continue to dwindle, and a little more than a decade from now, the program may not have enough money to fully cover benefits, according to the latest federal projections.

AARP is working nationally and in Indiana to educate Hoosiers about the program — and how to ensure its sustainability.

“Nearly half of Americans don’t have access to a retirement savings plan through their place of work,” says Joel Eskovitz, senior director for Social Security and savings at the AARP Public Policy Institute. “So for them, Social Security may be all they have.”

Program combats poverty

In Indiana and elsewhere, Social Security is more than just retiree income. In all, it provides income for more than 1 in 5 people in the state. Of all recipients, retirees represent 72 percent of the total, and the remainder are those receiving disability, spousal or survivor benefits.

It’s also a poverty fighter. According to the Center on Budget and Policy Priorities, the program lifted 357,000 Indiana residents 65 and older out of poverty from 2020 through 2022. With the program in place, nearly 8 percent of Hoosiers 65 and up were in poverty those years; without it, nearly 41 percent would have been.

The average Social Security monthly benefit for all recipients in the state is $1,737.

Explaining the range of people Social Security helps will be among the topics at the AARP Indiana Bipartisan Social Security Forum. The event will be held virtually on Tuesday, Aug. 20, timed to coincide with Congress’ annual summer recess. It’s aimed at raising awareness about the need to maintain the program’s solvency beyond 2035, says Addison Pollock, director of community engagement for AARP Indiana.

Johnson, from Fishers, will be one of hundreds of AARP members and guests tuning in to the forum. An AARP volunteer, she’s spoken with members of Congress about Social Security.

“My main message is that Social Security is not an entitlement,” Johnson says. “I paid into it for 46 years.” Johnson retired after a career mostly in health care sales.

Looming shortfall

Employers and employees each pay 6.2 percent of wages to fund the system; self-employed workers pay the full 12.4 percent.

But the program is facing a shortfall over the next decade. By 2035, absent action by Congress, annual revenue will be able to cover only 83 percent of program benefits, according to projections this year by the Social Security Board of Trustees.

“I think the future of Social Security should be a concern of everyone who’s paying into the program and those that are receiving benefits,” Johnson says.

Eskovitz, of the AARP Public Policy Institute, says that among the program’s most important features is its cost-of-living adjustments. “If you didn’t have them these last few years, those benefits would be much, much smaller — and people would have a lot of difficulty dealing with this high inflation period,” he says.

One possible fix, Eskovitz says, is modifying Social Security’s maximum taxable earnings, which limits how much income is subject to Social Security taxes. (The figure in 2024 is $168,600.)

For details on the Social Security forum, see aarp.org/in.

Frederic J. Frommer has worked as a journalist for more than 30 years, including 16 years at the Associated Press, and is the author of several books.

More on Social Security

- Social Security Tips, Tools and Other Resources

- 7 Things to Know About Social Security and Taxes

- AARP Talks to Social Security's Chief O'Malley