AARP Hearing Center

“Hardworking Rhode Islanders deserve to retire with dignity and that is why we are thrilled to celebrate the passage of (RISavers, formerly Secure Choice),” said Catherine Taylor, AARP Rhode Island State Director. “On behalf of our members and the 172,000 Rhode Island workers who do not currently have access to retirement savings options on the job – AARP Rhode Island commends House and Senate leadership for uniting on this vital legislation that will make it easier for workers to build towards a secure retirement and plan for their futures."

House Bill 7127: Sponsored by Chairman Evan P. Shanley

Senate Bill 2045: Sponsored by Senator Meghan Kallman

Send a Thank You Email to Lawmakers Who Made RISavers Possible

CLICK HERE TO VISIT THE RISAVER WEBSITE

Why was RISavers a top priority for AARP Rhode Island?

AARP's mission is to empower people to choose how we live as we age. Financial security makes it possible to have choices and retirement savings are an essential component of financial security.

What is RISavers?

RI Savers is a portable, voluntary retirement savings program that will be accessible to over 172,000 private sector employees in Rhode Island. Learn more and to read AARP Rhode Island research on why employees and employers support the legislation.

Learn More About RISavers

We have assembled an extensive Secure Choice Q&A. Click here to see why RI Savers makes sense for employees and their employers.

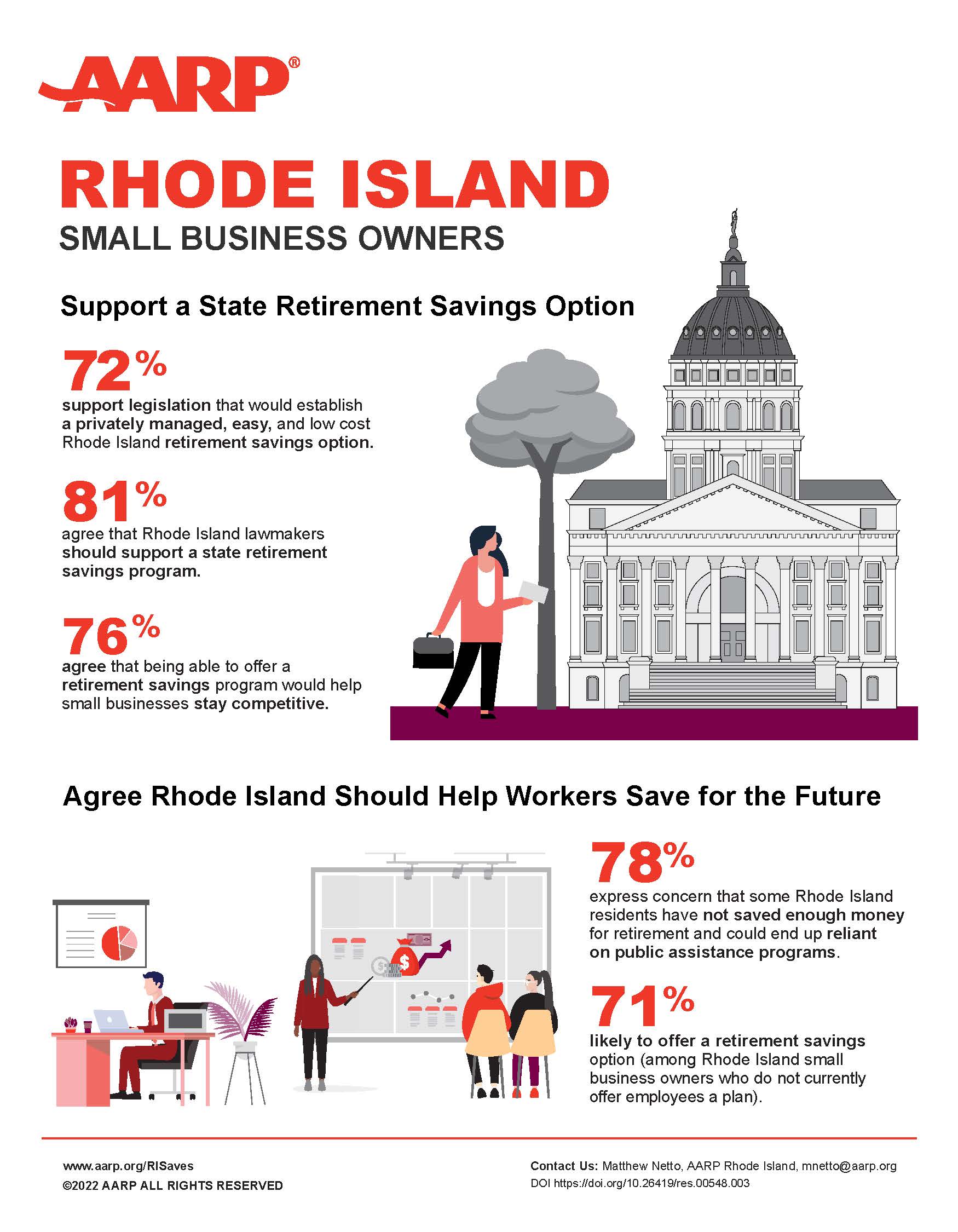

An AARP Rhode Island survey found that small business owners in Rhode Island support Secure Choice/RISavers as a low-cost, low-risk retirement savings option managed in a public–private partnership by the State of Rhode Island.

Fighting For You At The State House

Click to watch Catherine Taylor at the February 14, 2023 Secure Choice News Conference