AARP Eye Center

AARP Tennessee is supporting a new way for Tennesseans to save for retirement. A bill in the Tennessee General Assembly would create the Voluntary Employee Retirement Accounts plan which will allow the state treasurer to authorize the establishment of a voluntary employee retirement account program. If established, employers and employees may voluntarily participate in the program.

"We know that people are 15 times more likely to save for retirement through payroll deduction, but many small business across Tennessee do not have any kind of retirement saving plan for their employees," said Shelley Courington, AARP Tennessee Advocacy Director. "This proposal would create a new option and still make it 100% optional to both the employer and the employee."

Here are some key points on why AARP Tennessee support the Voluntary Employee Retirement Accounts plan:

- Enables Treasurer’s office to create retirement accounts for businesses and their employees to promote and provide retirement savings.

- Encourages personal responsibility by creating a pathway for retirement savings for small businesses, and will ultimately save the state money by reducing dependency on social services.

- Currently, 1 million Tennesseans do not have access to retirement savings plan through work.

- Workers are 15 times more likely to save for retirement if they can do so through payroll deduction.

- Levels the playing field for small businesses by offering a similar benefit as larger employers have to their employees.

- Since Tennessee does not have a state income tax, the state is able to choose pre-tax or post-tax for the retirement savings plan.

- The program is voluntary-voluntary. Voluntary employer participation and voluntary employee participation

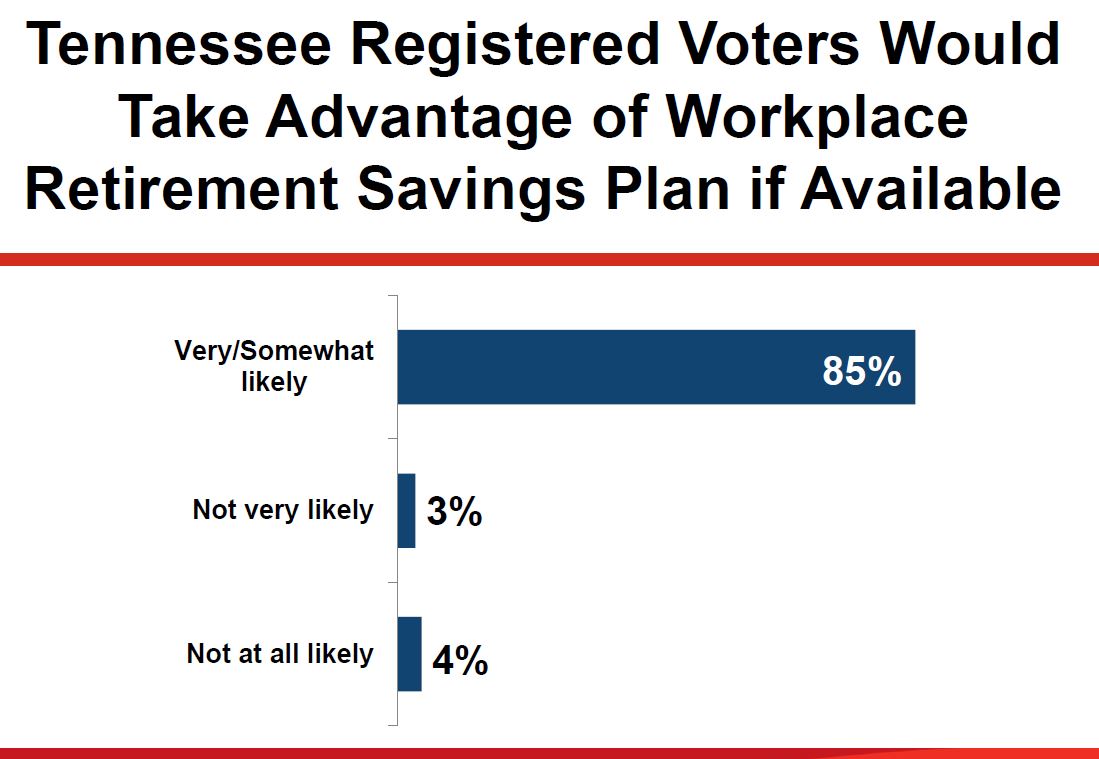

A recent statewide survey of registered voters (ages 18-64) and small businesses in Tennessee found:

- 85% of registered voters would take advantage of a retirement savings program if it was available.

Naylor, Robert B

Naylor, Robert B - 87% of registered voters agree that lawmakers should support a Tennessee retirement savings option.

- 56% of registered voters feel behind schedule on retirement savings.

- 79% of small business owners feel offering a retirement savings account provides a competitive edge for recruiting employees.

- 68% of small business owners said they would likely offer a retirement savings program if it were available.

Here are some helpful resources if you'd like to know more or get involved:

- Check out our infographics on the survey of registered voters and the survey of small business owners.

- Facebook offers directory of your elected officials called Facebook Townhall.

- To let your elected officials know you support this program, you can contact them by visiting www.tn.gov