AARP Hearing Center

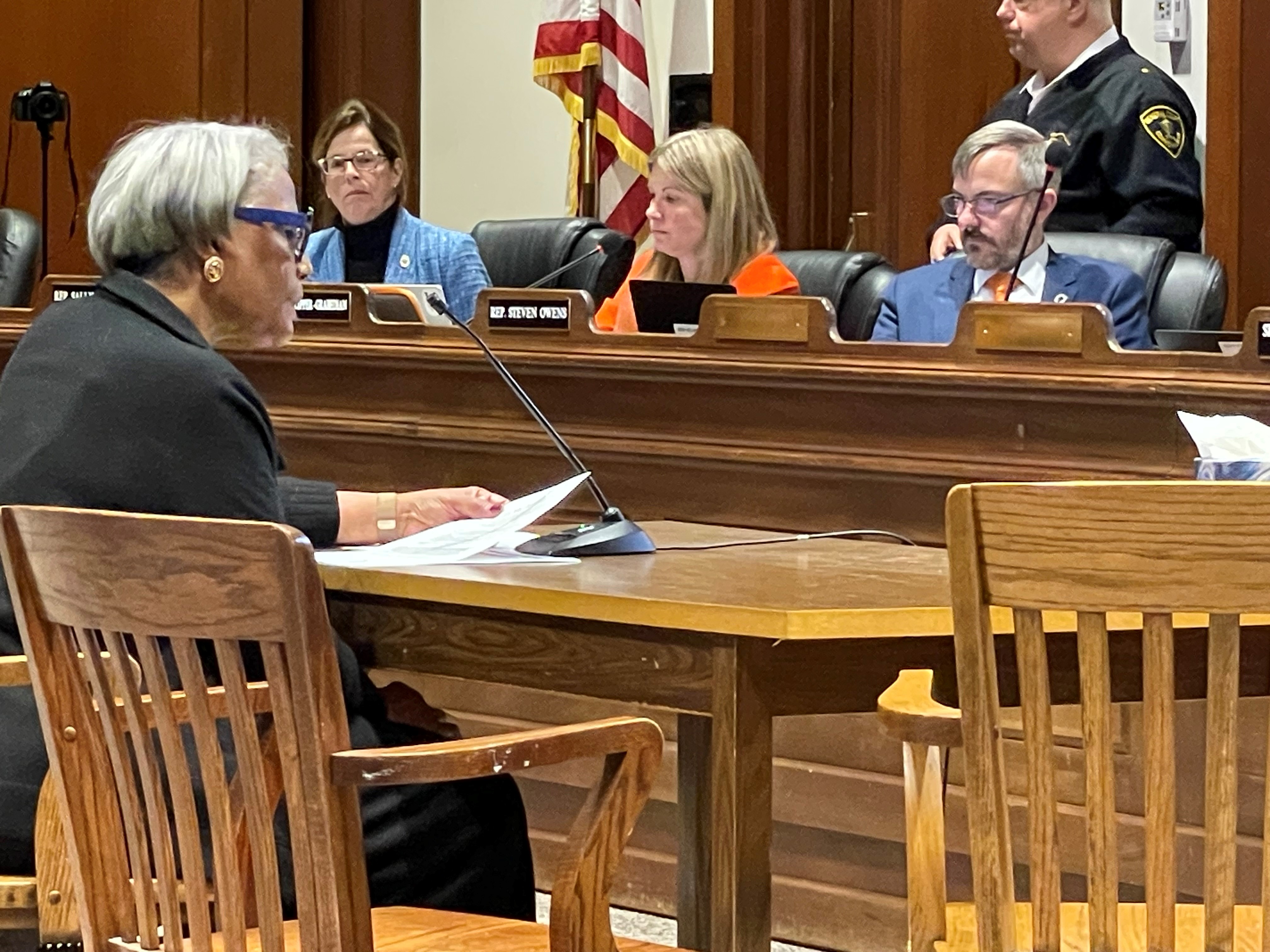

AARP Massachusetts is working to expand access to retirement programs in the Commonwealth. On Tuesday, October 24, AARP testified in favor of Senate Bill no.624 and House Bill No. 998, An Act To Encourage Retirement Planning, before the Joint Committee On Financial Services

43% of Massachusetts private sector employees—roughly 1,220,000 people—work for an employer that does not offer either a traditional pension or a retirement savings plan. Access to an employer-based retirement plan is critical for building financial security later in life.

Legislation introduced earlier this year would establish the Massachusetts Secure Choice Savings Program. The savings plan would create an individual retirement account program—at no cost to employers—that would automatically enroll workers who don’t have access to employer-based retirement benefits such as pension plans and 401(k) plans.

“Making it easier for people to save their own money for retirement isn’t just the right thing to do- it’s also fiscally responsible,” said Sandra Harris, AARP Massachusetts State President. “There are no ongoing costs to the state. The program is designed to be self-sustaining, and participant funded.”

Read Sandra's testimony hereAARP Testimony Sandra Harris - SB624 HB998 An Act to Encourage Retirement Planning 102423.pdf

Although individuals without access to a way to save for retirement at work could open up their own individual retirement accounts, this rarely happens. Only 5% of people will go out on their own and open an IRA, and the numbers haven’t changed in decades. Yet, we do know Americans are 15 times more likely to save when they can do so at work.

New programs are necessary to reach a huge and underserved population. The higher rate of part-time employment among women is a large factor in their low eligibility rates for employer-sponsored retirement plans. Employees of color are significantly less likely to have access to workplace retirement plans, and households of color have disproportionately lower retirement savings than white households. The contingent workforce, including gig workers, tend to also lack this critical access to employer-sponsored retirement plans.

Massachusetts – By the Numbers

- Small businesses are less likely to have a plan. The smaller the employer, the less likely its workers are to have access to a retirement plan. Over 73 percent of workers at Massachusetts firms with under 10 employees, and about 54 percent at companies with between 10 and 24 employees lack a plan. In businesses with under 100 employees, about 563,000 workers do not have access to a retirement plan, compared with about 657,000 workers in businesses with 100 or more employees.

- Workers at all education levels lack a plan. About 72 percent of workers who do not have a high school degree do not have access to an employer-provided retirement plan—compared with 54 percent of Massachusetts workers with some college and 30 percent of those with a bachelor’s degree or higher. Looking at the actual numbers of workers without access to a employer plan, those with at least some college exceeded those workers without a high school degree (775,000 versus 100,000).

- Employees at all earnings levels do not have access to a plan. Nearly 904,000 Massachusetts workers with annual earnings of $50,000 or less (74 percent of the 1,220,000 total) do not have access to an employer-provided retirement plan. In addition, almost 316,000 employees earning more than $50,000 do not have access to a workplace plan.

- Access to a plan differs substantially by race, ethnicity, and gender. About 56 percent of Hispanic workers, 48 percent of Black workers, and 42 percent of Asian American workers in Massachusetts lack access to an employer-provided retirement plan. Together, these employees account for about 33 percent (399,000) of the roughly 1,220,000 employees without a workplace retirement plan. In addition, 41 percent of all men and 45 percent of all women do not have access to an employer-provided plan.

Work & Save accounts help Americans save for retirement and reduce reliance on taxpayer-funded programs. Making it easier for people to set aside even modest levels of savings during their working years will pay dividends for workers and taxpayers in the long run.

15 states that have passed similar bills: California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maine, Maryland, Minnesota, Nevada, New Jersey, New York, Oregon, Vermont, and Virginia.

If you think this is a good idea and would like to join in the fight, let us know. Send us an email to ma@aarp.org. AARP advocates for what matters most to the more than 100 million Americans 50-plus and their families: health security, financial stability and personal fulfillment. Join us in the fight. AARP advocacy volunteers partner with staff at the state and federal levels to influence important legislative issues. You can sign up to be an E-advocate at www.aarp.org/getinvolved.