AARP Hearing Center

New research by AARP Ohio and Case Western Reserve University shows startling gaps between the financial well-being of Ohio’s older Black residents and their white counterparts, likely due to inequities entrenched over generations.

The study on racial and economic disparities will be released this summer. It’s part of a broader effort by AARP Ohio to reduce inequities across the state and help people become more financially resilient, says Nicole Ware, the group’s associate state director for advocacy and community engagement.

Among the study’s key findings:

- Black residents 50-plus were nearly twice as likely as their white peers to say they were not prepared for retirement.

- Older Black Ohioans were three times more likely to say they were “finding it difficult to get by.”

- Fifteen percent of older Black Ohioans had expenses or emergencies in the previous 12 months that led them to tap their retirement savings, compared with 4.5 percent of older white residents.

The gap in retirement preparedness was among the most striking findings in the AARP Ohio study, says Francisca García-Cobián Richter, a Case Western research associate professor of applied social sciences, who led the research. That gap was also apparent in small group discussions the researchers conducted to supplement the data analysis.

“I’m working two jobs as a person that is way past the retirement age,” one woman told the researchers.

Nationally, Black families in the U.S. have only about 15 percent of the median wealth of white families, data shows, and the wealth gap widens with age.

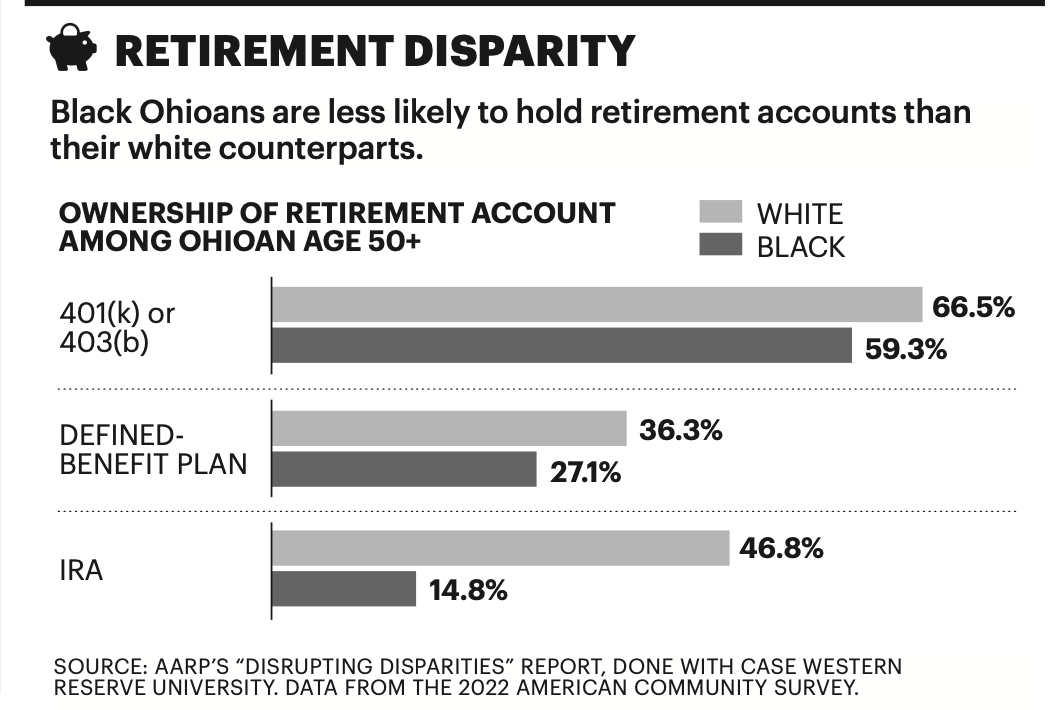

Across the U.S., Black workers ages 51 to 64 are less likely to have a retirement account than their white counterparts, according to a 2023 report from the Government Accountability Office. The median balance for those who do have one is far lower than that of older white adults.

For the report, the Case Western researchers analyzed the U.S. Census Bureau’s 2022 American Community Survey and 2018–2022 data from the Federal Reserve’s Survey of Household Economics and Decisionmaking.

The researchers collaborated with the Urban League, a nonpartisan civil rights group, on the group discussions. Sixteen African Americans, all over 50, participated in those sessions, which were held in September 2023.

From income levels to housing stability to employment, “the gaps we continue to see are really large,” Richter says. She and other researchers say the findings were tied to decades of discriminatory policies, such as racially restrictive covenants and real estate redlining, as well as historic discrimination in education and employment and by financial institutions.

The AARP report comes as Ohio’s population grows older and more diverse. The share of Ohioans age 50-plus grew from 29 percent in 2002 to nearly 38 percent in 2022.

Changing the status quo?

AARP Ohio initiated its study to help shape its legislative advocacy and inform its work to address long-standing racial and age disparities, Ware says. By spotlighting the racial financial gulf, AARP hopes the new research will be a catalyst to move conversations toward solutions, she says.

The report outlines a range of policy proposals aimed at reducing inequality, from creating a state-facilitated retirement savings program to making housing more affordable.

When it comes to housing, the study found that among Ohioans age 50 and over, about half of Black households own a home, compared with 8 in 10 white households. And close to a fourth of Black households pay rent amounting to more than 30 percent of their income—a standard measure of affordable housing—compared to 8.5 percent of their white peers.

Richter says closing the gaps between white and Black Ohioans will benefit the state as a whole by unlocking more human capital. She pointed to comments from a church pastor during one of the group discussions: “Being poor is expensive.”

People can’t afford to retire, and they have a sense of hopelessness, the pastor added.

Learn more about the study at aarp.org/oh.

Rita Beamish, based in California, is a former Associated Press reporter and San Francisco Chronicle editor. She has written for the Bulletin for 15 years.

More on retirement