AARP Hearing Center

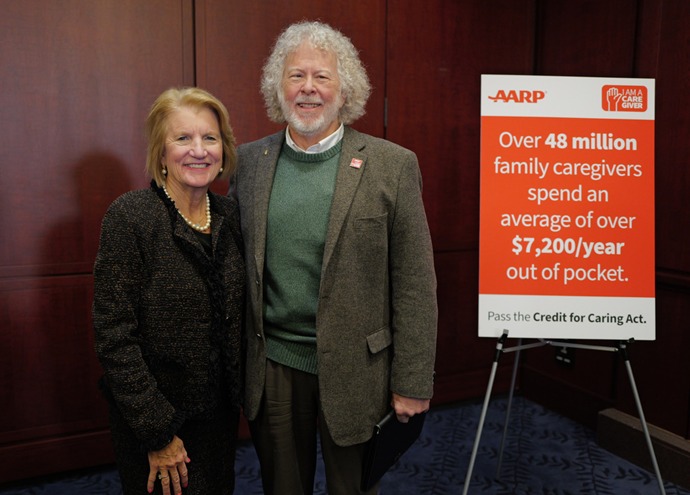

CHARLESTON (March 11, 2025) - AARP West Virginia commends the reintroduction of the Credit for Caring Act, legislation that would provide financial relief to eligible working family caregivers. The bill, sponsored by Senator Shelley Moore Capito, offers up to a $5,000 nonrefundable federal tax credit to help offset caregiving expenses, addressing the significant personal and financial sacrifices caregivers make to support their loved ones. On average, family caregivers spend over $7,200 annually—26% of their income—on out-of-pocket expenses.

“Family caregivers play an essential role in supporting their loved ones and keeping our communities strong, yet they often face steep personal and financial challenges,” said Gaylene Miller, AARP West Virginia State Director.

“The Credit for Caring Act represents an investment in our families, our economy, and our values. We thank Senator Capito for sponsoring the bill and we urge Congress to pass this legislation to ease the challenge on family caregivers and help them continue their vital work.”

More than 250,000 West Virginians are caregivers who dedicate themselves to caring for aging parents, spouses, and others in need, enabling them to remain in their homes and communities. However, caregiving often comes at a steep personal cost. Sixty-one percent of family caregivers nationwide work either full- or part-time, but many have had to cut back on work or leave their jobs, sacrificing income, retirement savings, and financial security.

The Credit for Caring Act addresses these challenges by providing a nonrefundable federal tax credit of up to $5,000 for specific caregiving-related expenses, such as home care aides, adult day services, home modifications, and respite care.

“I am a public-school teacher and a full-time caregiver for my sister who lives in my home. I have a part-time caregiver for 4 hours a day (that's all I can afford) and have to hire another person when I need to grocery shop or run other errands,” said Catherine, a Mountain State family caregiver. “[With caregiving tax credit] I could afford additional help to give me time for myself. My health is not as good as it should be because my sister's needs come first so I sacrifice my needs to make sure hers are met.”

Caregivers provide immense economic value by delaying or avoiding costly institutional care. Collectively in West Virginia, they contribute an estimated 230 million hours of unpaid care annually. An AARP analysis estimates that if caregivers aged 50 and older received better workplace support, the U.S. GDP could grow by an additional $1.7 trillion in 2030.

————————————————————-

AARP WV Media Contact: Tom Hunter, 304.340.4605, tphunter@aarp.org