AARP Hearing Center

A new AARP survey, released in conjunction with Social Security’s 90th anniversary, confirms that Americans highly value Social Security, and even more so than five years ago. The vast majority of Americans – 95% of Republicans, 98% of Democrats, and 93% of Independents – consider Social Security vital to the financial security of all Americans, and 67% believe it is even more important for retirees than it was five years ago.

The survey findings reinforce Social Security’s reputation for being one of the most successful and popular initiatives in American history, helping generations of older Minnesotans stay out of poverty and live with dignity after a lifetime of hard work. AARP will never stop fighting to protect the Social Security payments you earned.

Nearly two in three retired Americans say they rely substantially on Social Security, while another 21% say they rely on it somewhat. In 2020, 63% of retired Americans said they relied substantially on Social Security, jumping from 58% in both 2015 and 2010. In our state, more than 1.1 million Minnesotans rely on Social Security payments. Social Security is a way for hardworking Americans to earn a foundation for financial security in retirement. It allows older Minnesotans to put a roof over their head, food on the table, or the freedom to spend time with family, pursue a passion or take a well-earned break.

“My life would be just drastically changed if benefit payments are reduced,” said Phyllis Emmel, a retired counselor from Moorhead, MN. “My husband has a pension from his teaching job, but Social Security represents about half our monthly income.”

Phyllis Emmel is one of 1,123,666 people in Minnesota counting on the Social Security they’ve earned to be there when they need it. 43% of Minnesota residents ages 65+ rely on Social Security for at least 50% of their income, and for 19%, it is 90% of their income. Social Security lifts 278,000 Minnesotans ages 65+ out of poverty each year.

AARP’s survey found that Social Security is a key source of income and economic stability in retirement, but Americans have concerns about whether it will be enough.

- More than three-quarters of Americans (78%) are worried that Social Security will not provide enough to live on during retirement. In 2020, 74% of people said the same.

- Sixty-two percent of people think the average Social Security payment of $2,000 a month is too low. In 2020, 65% thought the average monthly payment was too low, compared to 61% in 2015 and 54% in 2010.

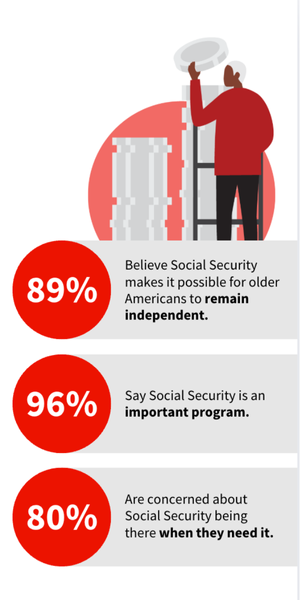

- Consistent with previous surveys, 89% of people believe Social Security allows older Americans to remain independent.

The 90th anniversary report builds on AARP’s long-standing public opinion research on Social Security and examines how views have changed since 2005 on Social Security’s role in retirement, its importance to future generations, and the barriers Americans face in saving for retirement.

Source: Social Security Opinions and Attitudes on Its 90th Anniversary report. This nationally representative survey of 3,599 adults ages 18-plus was fielded June 18-23, 2025.