AARP Hearing Center

.

In today's world, scammers are more sophisticated than ever, stealing a staggering $12.5 billion from Americans in 2024 alone—a 25% jump from the previous year, according to the Federal Trade Commission (FTC). Many of these criminals operate from overseas, making recovery nearly impossible, while outdated laws and limited resources hinder prosecutions.

The devastating truth? Victims rarely get their money back. The emotional and financial toll hits hardest on older Montanans, who often face greater losses and may struggle to rebuild their savings—losses that can shatter retirement dreams and affect entire families.

But here's the good news: Knowledge is your strongest shield. Arming yourself with the right information can stop scams in their tracks before they strike.

For over two decades, AARP Montana has been at the forefront of fraud prevention in the Big Sky State. We've empowered thousands through hands-on workshops, informative webinars, community town halls, document shredding events, and close partnerships with law enforcement and local media.

Explore these free Montana-specific resources from AARP Montana to stay one step ahead of scammers and safeguard what you've worked hard for:

Fraud Prevention Presentations

Receive a fraud prevention presentation for your group from AARP Montana. AARP Montana offers fraud prevention workshops -- both virtually and in-person.

To request a free presentation, send an e-mail to: MTAARP@aarp.org.

Contact Info for Montana Agencies

Important Montana Consumer Protection Contact Information >>

AARP collaborates with several federal and Montana State Agencies and to combat fraud and financial exploitation. If you believe you have been the victim of a fraud or scam, contact the appropriate agency on the contact sheet. If you aren't sure who to contact, the Montana Consumer Protection Office (800-481-6896) can direct you to the correct agency.

- Click here for a downloadable resource sheet of important Montana consumer protection phone numbers and web sites.

Video of Fraud Prevention Workshop

AARP Montana recently partnered with Big Sky Senior Services to hold a fraud prevention workshop. We recorded the workshop so you can watch it at your convenience. The fraud prevention video can also be used for group presentations.

📽️ Watch the Video here >>

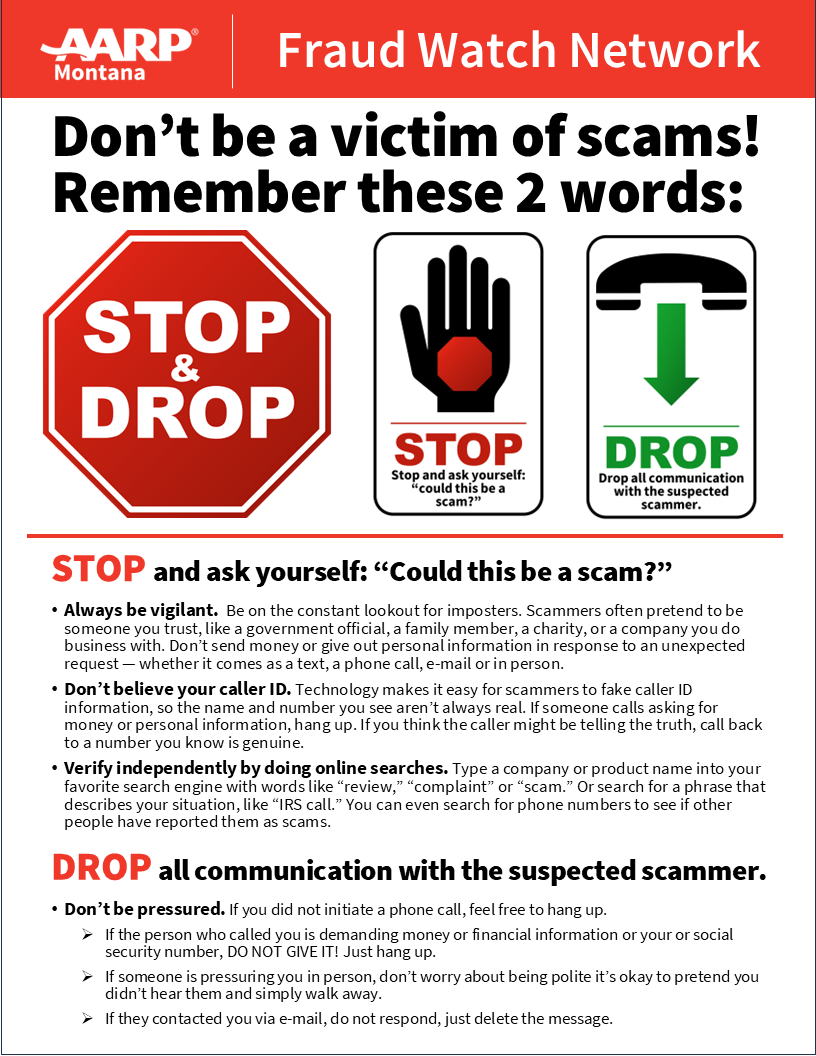

STOP & DROP Handout

"Stop & Drop" is a fraud prevention campaign based on an easy-to-remember phrase to help people avoid nearly all types of scams. The phrase and graphics convey the points: STOP and ask yourself, could this be a scam. DROP all communications with the suspected scammer. The handout outlines how to avoid nearly all types of scams, since they share common threads. This fraud prevention campaign was adopted by the FBI in Montana as a focal point of their fraud prevention training and messaging.

Download the Stop & Drop Handout here >>

The AARP Fraud Watch Network

The AARP Fraud Watch Network is a free resource for all. With AARP as your partner, you’ll learn how to proactively spot scams, get guidance from our fraud specialists if you’ve been targeted, and feel more secure knowing that we advocate at the federal, state, and local levels to protect consumers and enforce the law. Protecting consumers goes back to AARP’s founding. Learn more about our history.

AARP Fraud Prevention Resources:

- Look up a scam in AARP’s Fraud Resource Center, with dozens of tip sheets on how to recognize and avoid common scams, including videos that break down how scams work.

- See or report scams in your area with our Scam-Tracking Map.

- Get regular updates on the latest scams by signing up for biweekly Watchdog Alerts or text FWN to 50757 to receive text alerts.

- Hear directly from fraud experts at one of our webinars, tele-town halls or live events in communities around the country.

- Hear stories of real scams on our award-winning podcast, The Perfect Scam. Explore fraud from the viewpoint of victims, law enforcement and the con artists themselves.

- Get social with the AARP Fraud Watch Network on Facebook and Twitter, where you’ll also have access to online events. You can also connect with others on the Scams & Fraud channel in AARP’s online community.

- Find out if your financial organization has received the AARP BankSafe training to fight financial exploitation at aarp.org/banksafe.

- Learn more at: www.aarp.org/FraudWatchNetwork

What To Know About Credit Freezes and Fraud Alerts from the Federal Trade Commission (FTC)

A credit freeze (also known as a security freeze) is one of the most effective ways to prevent identity theft. A credit freeze allows consumers to proactively “lock up” their credit information so no one can access it without your permission. This prevents a thief from falsely using your information to establish new credit such as to take out a new mortgage, apply for a credit card, or get financing. A security freeze will not lower your credit score or prevent you from getting a copy of your own credit report. A security freeze will protect your credit information from third parties.

A fraud alert will make it harder for someone to open a new credit account in your name. A business must verify your identity before it issues new credit in your name.

Find out how to request a credit freeze and fraud alert >>

The AARP BankSafe Initiative

The BankSafe Initiative helps the financial industry better meet consumers’ financial needs and safeguard their assets. The initiative focuses on four key areas:

- Preventing financial exploitation

- Empowering family caregivers

- Helping those with dementia

- Making banking tools and environments easier to access

With the average victim losing $120,000, prevention of financial exploitation is critical to AARP’s mission to empower people to choose how they live as they age. BankSafe meets this need by conducting research into consumer insights, facilitating partnerships between the aging network and the financial industry, and developing the innovative BankSafe training platform to help financial professionals identify and stop suspected exploitation.