AARP Hearing Center

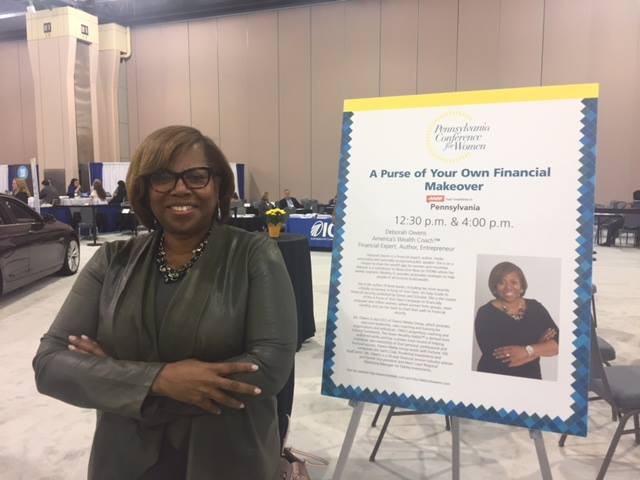

On Thursday, October 6, AARP joined the PA Conference for Women to talk about Financial Security. With the help of Deborah Owens, a wealth coach and leading authority on financial security, hundreds of women were able to learn valuable tools to become financially stable.

Owens spoke to women at two separate workshops at the PA Conference for Women, outlining what she believes are the seven wealthy habits necessary for financial success:

- Have a wealthy outlook: Owens refers to this as the habit of adding value. When paying bills, you should consider paying yourself first; you could use that opportunity to set some money aside for your “purse.” Owens also cautions that many younger women feel that they have more time to prepare and save, but she advises starting as early as possible.

- Have a wealthy vision: Owens suggests the habit of leveraging your unique strengths. Know what your strengths are and let that be your pathway to wealth. Whatever you are good at, you should take advantage of. Consider what people compliment you on, because that could be one of your strengths. For example, if you are a great writer, consider becoming a published author as a career or opportunity to increase your financial situation.

- Have a wealthy appetite: You should consider getting in the habit of life-long learning to develop your financial acumen. Consider developing your skill and then hone it. In order to stay competitive in the marketplace, it may be beneficial to reinvest in yourself and your knowledge base.

- Have a wealthy focus: Identify what is important to you: Owens suggests getting in the habit of setting goals and putting a price tag on them. You could create a vision board to provide you guidance. Having some form of GPS may help you to say “no” to things that don't align to your goals. In order to do this though, you have to identify your goals first.

- Have a wealthy mindset: Look at problems as opportunities: According to Owens, many women are risk averse. She purports that men and women making the same amount of money, placing the same amount of money in investment – don’t fair the same in gains. In fact, Owens claims that men have 30 percent more in assets than women do. Owens attributes this to the fact that women invest in less risky options than men. She also suggests that risk or downturns in the market can be the greatest opportunities for investing.

- Have a wealthy system: Owens suggests having your savings on “auto-pilot.” You may consider having money automatically deposited into a retirement account or savings account. This savings and investment structure could help you “squirrel away” money. She also suggests taking the time to understand your investment portfolio. Don't let it sit on autopilot and assume it will all work itself out. Owens further asserts that any money you need in the next five to seven years should be in a cash reserve (like a savings account) rather than in stocks; any money needed after that time, could be invested in stocks.

- Create a wealthy legacy: Owens warns to “Get in the habit of paying it forward.” She suggests having a legacy for your family – such as a will or trust. These could help ensure that your assets will be passed onto your loved ones.

In addition to Owens’ 7 tips, she also gave advice on what to do before retirement, encouraging people to check out free AARP resources available online. AARP offers a Retirement Calculator that could help you figure out how much money you will need, as well as resources for retirement security information.

Owens also recommends being mortgage-free by retirement. She pointed out that people who are on a fixed income often do not consider how that will affect their finances. AARP offers a Mortgage Calculator that can be used to figure out your potential payments, how long the payments will last, and the various interest rates.

AARP is collaborating with Deborah Owens for additional appearances in Philadelphia, including the Sharon Baptist Church Women of Grace Conference on November 5 and am AARP-sponsored telephone town hall where Owens will speak to thousands of AARP members to answer their questions on preparing for retirement.

*Comments provided by Deborah Owens represent her views and do not represent AARP. AARP recommends consulting your financial adviser or lawyer for advice regarding your personal situation.