AARP Hearing Center

For an older couple in Beaufort County, the scam that drained their life savings began with a single phone call.

The caller, posing as an FBI agent, warned that their bank account had been compromised and to protect their money they should transfer funds to a “federally insured cryptocurrency account,” recalls Lt. Eric Calendine, a fraud investigator with the Beaufort County Sheriff’s Office.

Over several months in 2024, the couple made 22 deposits into a cryptocurrency ATM. By the time they realized the truth, their entire savings—$320,000—was gone. “They were just devastated,” Calendine says.

Such cases are becoming more common as scammers increasingly turn to cryptocurrency ATMs to steal money, he says. The kiosks—often located in gas stations, groceries or convenience stores—convert cash into difficult-to-trace digital currency. Growth in such scams has led to calls for legislation to better protect consumers.

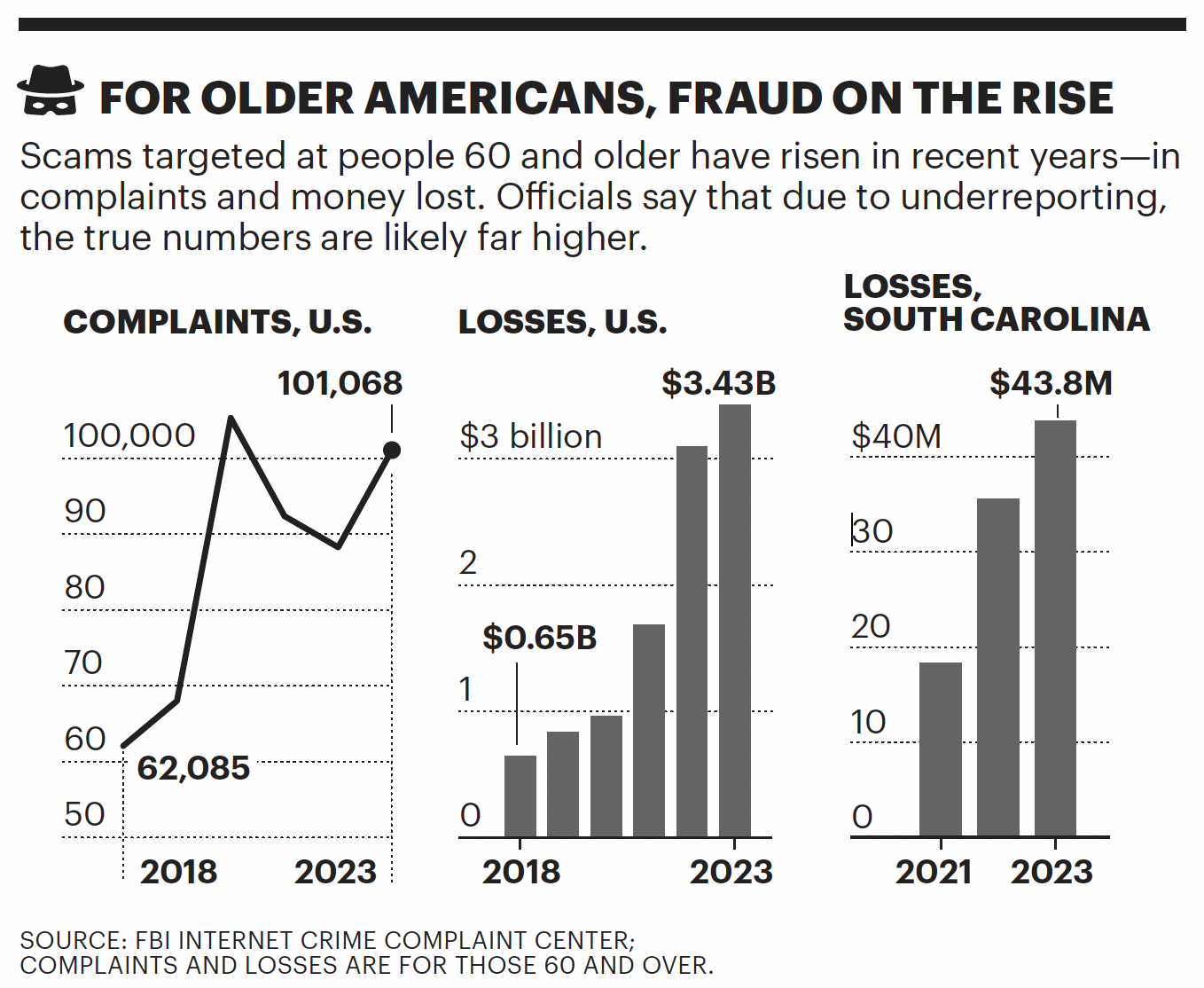

Nationwide in 2023, consumers reported losing more than $110 million to scams involving crypto ATMs that take Bitcoin and other digital currencies, according to Federal Trade Commission data. That’s a nearly tenfold increase from 2020. Beyond that, officials say fraud is vastly underreported, so losses are likely much higher.

Data from the first half of last year also shows that people over 60 were more than three times as likely as younger adults to report a loss using one of the machines, the FTC notes.

In Beaufort County, home to Hilton Head Island, there were at least 50 cryptocurrency-related fraud cases in 2024, with losses exceeding $2 million, Calendine says. Most cases involved crypto ATMs, he notes.

In one common scheme, criminals impersonate court officials who claim that you missed jury duty and face arrest unless you pay a fine immediately, he says. You’re then instructed to deposit the “fine” into a cryptocurrency ATM and present the receipt to the sheriff’s office.

Across the state, the largest consumer fraud losses in recent years were from fake lotteries or sweepstakes, investment fraud and romance scams, according to the South Carolina Department of Consumer Affairs. Criminals involved in such scams are increasingly using crypto ATMs instead of more traditional methods of money transfer, such as wire transfers or gift cards, notes Carri Grube Lybarker, consumer advocate with the department.

Protecting consumers

AARP South Carolina is working with state consumer affairs officials on potential legislation to regulate crypto ATMs to protect consumers, says Jo Pauling-Jones, associate state director for advocacy and outreach.

AARP-backed initiatives have already been enacted in other states, says Seth Boffeli, senior fraud adviser in AARP’s national office. For example, Vermont has a $1,000 daily cash transaction limit. In Minnesota, new cryptocurrency ATM users can get refunds for fraud losses that are reported within 14 days, and daily transactions are capped at $2,000 for new customers.

“So many of these victims have never used a crypto ATM before, and they usually use it one time in their lifetime, which is to put all this money in,” Boffeli says. “So if they have some sort of liability protection ... that’s a key safeguard.”

In addition to advocating for legislation, AARP South Carolina will hold a series of fraud prevention workshops, telephone town halls and document shredding events this year to help raise awareness about scams. Learn more at aarp.org/sc.

The state’s consumer affairs department also offers tips on how to avoid fraud. It notes that common tactics by scammers include:

- Pretending to be a person you know or from an agency you recognize.

- Saying there’s a problem or a prize.

- Pressuring you to act now.

- Telling you to pay in a certain way, such as via a crypto ATM.

Go to consumer.sc.gov or call 800-922-1594 to learn more.

Michelle Crouch is a North Carolina–based journalist who covers health care and consumer issues. She has written for the Bulletin for 10 years.

More on Fraud

- 25 Great Ways to Avoid Scams

- 10 Read Flags Your Tax Preparer is a Fraud

- Five of the Biggest Scams to Watch For in 2025