AARP Hearing Center

Most of us want to be able to stay in our own homes and communities as we age or face challenges caring for ourselves due to a serious long-term illness, injury or disability. We also know that 70% of those 65 and older, will require some assistance to do that.

To help working Washingtonians prepare for a day when we need these types of services, Washington State developed a new and innovative way to make long-term care more affordable for all workers.

AARP advocated for the WA Cares Fund because hard-working Washingtonians deserve access to flexible and affordable long-term care coverage when needed.

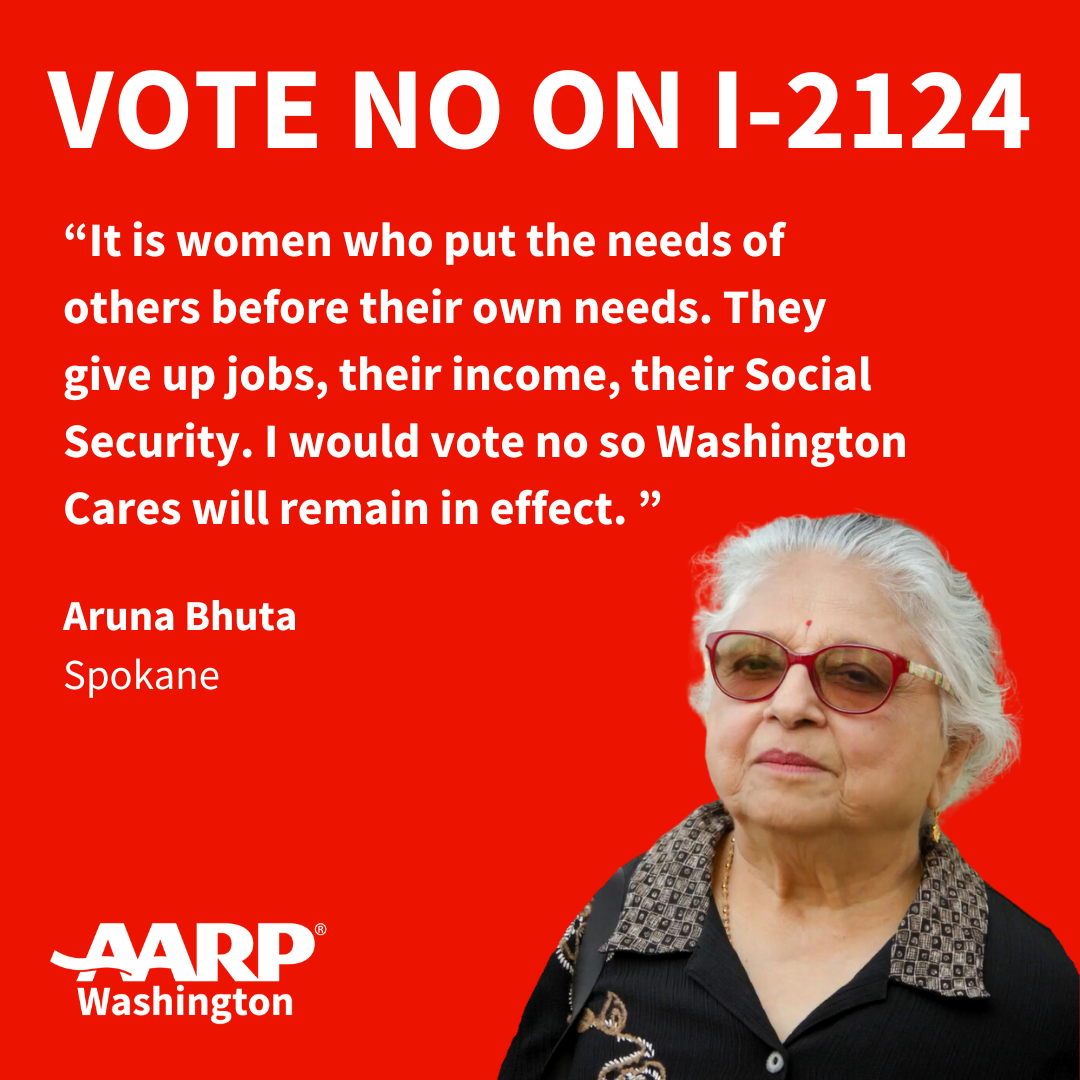

This November, an initiative on the ballot (I-2124) could take away our public long-term care benefit program, which is designed to help Washington families when they need it most.

I-2124 IS BAD FOR WASHINGTONIANS

I-2124 TAKES AWAY CARE WHEN YOU NEED IT MOST

If passed, Ballot Initiative 2124 will take away important support from Washingtonians when they face serious long-term illness, injury or disability—or if they have pre-existing conditions.

I-2124 HURTS FAMILY CAREGIVERS

Family caregivers help older loved ones with bathing and dressing, meals, managing medications, trips to the doctor and more.

More than 820,000 Washingtonians are currently unpaid family caregivers. They are the backbone of our state's long-term care system, providing $16.8 Billion a year in unpaid care and spending an average of $7,200 a year out of their own pockets to care for their loved ones.

By ending our long-term care insurance program, I-2124 will take away help from family caregivers who help their older parents, spouses, and other loved ones remain in their homes for as long as possible, where they consistently tell us they would rather be.

I-2124 eliminates critical support, including the ability to help pay family caregivers to offset lost income while providing care. It also takes away resources that could provide family caregivers with some help, like homecare aides, home safety modifications, meal delivery, transportation, assistive technology and more.

I-2124 will also hurt working women – the majority of family caregivers – who often leave their jobs or scale back their hours to care for older loved ones.

I-2124 PUTS WORKING FAMILIES AT FINANCIAL RISK

If passed, I-2124 will leave working families holding the bill if they face serious long-term illness, injury or disability. Washingtonians either must pay out-of-pocket for long-term care services or purchase expensive, often unattainable long-term care insurance. It will also hurt those with pre-existing conditions, who often don't qualify for long-term care insurance, even if they can afford it.

Visit the No on I-2124 coalition page for more information.

In the News

Should WA Cares be Optional? The case for NO on I-2124

KUOW

Oct. 17, 2024

Listen to this deep dive into the potential fallout I-2124 with Cathy MacCaul, a member of Washington State’s Long-Term Services & Supports Trust Commission that helps oversee WA Cares and is the policy & advocacy director for AARP Washington. ~ by Libby Denkmann and Jason Burrows, reporters with KUOW

OPINION | I-2124 Hurts Workers and Businesses

South Seattle Emerald

Oct. 15, 2024

"Like so many middle-aged workers, I juggle the responsibilities of my work, while making sure my mother, who has dementia, and my son, who has a chronic debilitating disease, are both getting the care and support they need. I-2124 will make the “sandwich generation” squeeze even worse. Right now, more than 800,000 Washingtonians are unpaid family caregivers, whose labor is valued at more than $16 billion a year.

I-2124 will exacerbate the labor shortage. Businesses are already struggling to find and keep workers because of the lack of long-term care and childcare coverage. Today, 1 in 4 workers, most often women, are scaling back or leaving their jobs to care for family members. By destroying the benefit fund meant to help cover the expense of home care aides, medical equipment, home modifications, and help with meals and transportation, more workers will have no choice but to quit their jobs, losing their income and their ability to save for their own needs while they care for their loved ones."

~ Lisa Michaud lives on Beacon Hill and is the owner of Two Big Blondes in Seattle’s Central District.

Kathleen Thompson: Initiative 2124 will take away essential home care, increase preventable visits to the hospital

Spokesman Review

Oct. 6, 2024

"When I speak to younger adults they can’t envision a time where this could be them. The term “long-term care” conjures an image of very elderly people in a nursing home. But the fact is 40% of people who need help with daily living activities as a result of a serious injury, illness or disease are under the age of 65. And most people don’t need 24/7 care. They need the support of a home care aide, modifications like grab bars, a ramp, walk-in shower or medical equipment like a wheelchair or hospital bed. These are examples of support that our state’s long-term care benefits will help us pay for."

~ by Kathleen Thompson, nurse at Providence VNA Home Health, a resident of Spokane and a member of the Washington State Nurses Association.

Opinion: Why we are voting ‘no’ on Washington’s I-2124 concerning long-term care insurance

Bellingham Herald

Oct. 4, 2024

"In our lines of work, we have had front row seats to witness how challenging it has become for folks to get the support they need to live with safety and dignity in their own homes. When a patient is through with the acute care that doctors and nurses can provide, they often need support at home to help with medications and meals, equipment like a wheelchair, safety bars in the shower or a ramp to replace steps. But too many people simply can’t afford these supports and services, and most don’t realize that “long term care” whether you receive it in a residential facility or at home, is not covered by health insurance or Medicare.

We believe everyone deserves to have the support they need to live safely and with dignity no matter what challenges life throws at them. We’re sure glad today’s workers are going to have benefits that will help their families through what can be the most physically, emotionally and financially stressful times of our lives. Lawmakers have strengthened our state’s long-term care program by covering near retirees and part time workers, and made benefits portable so people can keep them if they move out of state someday for work, family or to retire. Instead of continuing to improve this lifeline, I-2124 would destroy it. That’s why we are joining the more than 140 organizations that advocate for consumers, patients, retirees and working families in voting No on I-2124."

~ Jim Hopper, MD is a retired family physician. Chris Phillips is former director of community health for PeaceHealth St. Joseph Medical Center and a Unity Care Northwest board member.

Editorial: Opt-out of WA Cares would cost most more later

Everett Herald Editorial Board, September 24, 2024

"I-2124 would make the long-term care program unsustainable, denying many needed funds later in life.

Most of us will need that help.

As with other initiatives this election, voters are offered a false economic choice, a chance to save a little money now at likely greater cost later.

Like Social Security, WA Cares asks Washington residents to stand together, pitch in a modest amount of their wages and assure some additional stability for a growing segment of society — and for themselves, later in life — when they are in need of long-term care supports and services."

Vote No on I-2124. The future of WA long-term care for the aging depends on it

Editorial BY THE TRI-CITY HERALD EDITORIAL BOARD, SEPTEMBER 13, 2024

"By rejecting I-2124 and preserving WA Cares, Washingtonians can ensure that their friends, family and neighbors have the support they need to face life’s challenges with dignity and security.

The choice voters make in November will have far-reaching consequences for future generations.

WA Cares represents a forward-thinking approach to a problem that affects everyone, either directly or indirectly. By maintaining and improving this program, Washingtonians invest in a more secure and compassionate future for all. Vote no on I-2124 to help ensure that WA Cares can continue to evolve and serve the state’s needs."

The Caregiving Journey

Seattle Magazine, August 22, 2024

"Washingtonians will soon benefit from a long-term care insurance program which offers a safety net, like Social Security or Medicare, helping seniors and disabled or severely ill adults live with dignity and stability. The guaranteed benefit ($36,500 adjusted for inflation in the future) will help to cover some of the costs of long-term care such as a family member’s caregiving time, a home-care aide that can help an older adult can stay in his or her home, or modifications that make homes safer and more accessible for older adults.

The reality is that 70% of us will need caregiving support, and the vast majority of us do not have a way to pay for long-term care expenses, as these expenses are not covered by traditional health insurance or Medicare. However, voters face an important decision on November’s ballot that threatens to eliminate this important program. If passed, Initiative 2124 would take away support for family caregivers, increase our out-of-pocket costs, and leave us with few alternatives other than expensive long-term care insurance that most of us can’t afford."

~ Marguerite Ro, State Director at AARP Washington

WA Cares is a small lifeline to those workers struggling to pay for long-term care. Voters this fall will decide whether you can opt-out

Spokesman-Review, September 10, 2024

“The world felt like it was falling apart beneath my feet while I did everything for her. I couldn’t focus on school, and it ultimately led to mishaps for me. My life was totally derailed from it all,” Sam Sparkman said. “I wish things hadn’t gone the way they did for her or myself, but I really don’t regret throwing my life away like that for her, even though I know she wishes I hadn’t.”

Julie Sparkman believes the $36,500 from WA Cares would have been a “lifesaver” after her surgery. And as a result, she is telling her story to help defeat Initiative 2124 and volunteering with the pro-WA Cares campaign.

“If I had had WA Cares, I would have just hired someone. My children wouldn’t have felt afraid that I would go without something I needed because they couldn’t provide it. And they would have been able to concentrate more on their school and their emotional wellbeing,” she said. “That’s why I support WA Cares. I am happy to do my part to know that someone else’s daughter isn’t going to throw away their high school diploma trying to save their mother.”

~ Amanda Sullender, staff writer at Spokesman-Review

Initiative 2124 will ask voters if they want to make long-term care insurance optional, which could doom the WA Cares Fund

The Inlander, September 05, 2024

"For those unable to pay for insurance or professional care, long-term caregiving often falls to friends or family members who bear the financial burden in other ways. Caregiving most often falls on women, many of whom give up their jobs to care for aging family members, says Ai-jen Poo, executive director of Caring Across Generations.

AARP Washington reports that there were nearly 820,000 unpaid caregivers in Washington in 2021. They worked nearly 770 million hours for free, valued at $16.8 billion.

Cynthia Stewart of the League of Women Voters of Washington worries that eliminating the WA Cares Fund will not only decrease women in the workforce and widen the gender gap, but "harm the majority of voters," who, even if they are part of the 30% who never needs long-term care, will probably end up shouldering the burden for someone else."

~ Eliza Billingham, staff writer at The Inlander

Don’t be fooled: I-2124 will effectively demolish state’s long-term care insurance

Cascadia Daily News, August 5, 2024

"If I-2124 passes, millions of us, including frontline essential workers like nurses, grocery store clerks, teachers and firefighters, will lose our long-term care benefits. Nurses can’t afford the expensive premiums private insurers charge. And those with pre-existing conditions — such as cancer, diabetes or high blood pressure — wouldn’t be eligible for those policies, even if they could afford them. Our focus should be on continuing to strengthen this state program, not tearing it down and harming the patients and families that will need it."

~ Justin Gill, Guest Writer for Washington State Nurses Association

Comment: Protect a benefit many will need as they age

Everett Herald, August 3, 2024

"Initiative backers misleadingly drafted the measure to sound like a reasonable change; make the program voluntary. But as anyone with a basic understanding of how insurance works knows, that change would bankrupt the program, draining funding to pay out benefits to those who need them most."

~ Jackie Boschok, vice president of the Washington State Labor Council and president of the Washington State Alliance for Retired Americans

Family caregivers, nurses launch campaign to protect Washington’s long-term care benefit, defeat I-2124

The Columbian, July 25, 2024

"Last week, hundreds of family caregivers, advocates and nurses across the state launched a campaign to defeat a Washington ballot initiative that would cut funding to long-term health care benefits.

While proponents of I-2124 argue the WA Cares tax burdens state residents, Vancouver resident Christina Keys is among those who want the program to continue. She adds her voice to the campaign urging voters to reject the Nov. 5 ballot measure."

~ Chrissy Booker, Columbian staff writer

About Washington's Long-Term Care Benefit

70% of us will need help with daily living activities as a result of a serious injury, illness, disease or other challenge that can happen at any age. Washington’s long-term care benefit is a safety net, like Social Security or Medicare, set up to allow seniors and disabled or severely ill adults to live with dignity and stability.

Lawmakers have steadily strengthened Washington’s long-term care benefit—first making near-retirees eligible, even if they work part-time. Thanks to new changes, Washingtonians who have paid into the program can keep their benefits even if they move out of state for work, family, or retirement.

The vast majority of us do not have a way to pay for long-term care expenses, which are not covered by traditional health insurance or Medicare.

Today, Washingtonians have an affordable, guaranteed benefit we can tap into to help cover the costs of long-term care. Benefits start at $36,500 in 2026 (growing to as much as $60,000 in 20 years, indexed to inflation). Benefits cover: home care aide so you can stay in your own home; family member’s time caring for you; wheelchairs, hospital beds, lifts, and other equipment; ramps, grab bars, and other home modifications; and residential care.