AARP Hearing Center

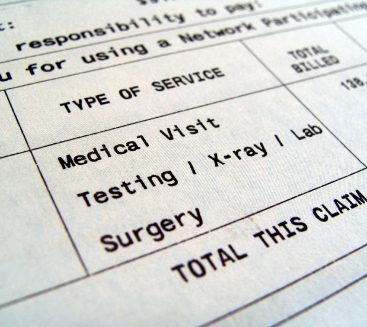

Statistically, 70% of today’s 65-year-olds will need long-term care at some point. “Many people make the mistake of assuming Medicare covers it, and they’re wrong,” says Jeffrey Brown, professor of finance at the University of Illinois, who has spent the last decade researching long-term care insurance markets. There are only three choices: out-of-pocket, Medicaid, or insurance. “Long-term care is exactly the kind of low-probability, high-cost risk that you want to insure against,” he says.

There are a couple of important exceptions, Brown adds. People with very little income or savings can qualify for Medicaid. It is the single biggest underwriter of nursing-home care, but, to qualify, you must have no meaningful assets or income. And the very wealthy can simply pay for care themselves if they need it, since $100,000 a year for a nursing home won’t dent their finances. It’s the middle and upper-middle-class who would benefit most. That would include “families in the top third of the wealth distribution, but below the top 1%,” Brown says. “For them, a truly catastrophic event, like 20 years of care for an Alzheimer’s patient, could easily burn through their assets.”

In simple terms, that means anyone with $500,000 to $5 million in assets should consider long-term care insurance. But in the end, the decision is guided less by statistics and more by who you are and who depends on your financial resources, says Kathleen L. Weber, executive director of the Weber Nagan Group at Morgan Stanley in Bellevue, Wash.

WEDNESDAY, AUGUST 26, 11:00am-1:00pm, Lunch and Learn, catered by Panera Bread:

Covenant Village

9153 S. Yarrow St., Westminster, CO 80128

RSVP: (303) 468-2820

TUESDAY, SEPTEMBER 1:

11:00am-1:00pm, Lunch and Learn, catered by Panera Bread:

5:30pm-7:30pm, Dinner and Learn, catered by Panera Bread:

Covenant Village

9153 S. Yarrow St., Westminster, CO 80128

RSVP: (303) 468-2820

TUESDAY, SEPTEMBER 2:

11:00am-1:00pm, Lunch and Learn, catered by Panera Bread:

5:30pm-7:30pm, Dinner and Learn, catered by Panera Bread:

Covenant Village

9153 S. Yarrow St., Westminster, CO 80128

RSVP: (303) 468-2820

MONDAY, SEPTEMBER 14, 5:00pm-7:00pm, Lunch and Learn, catered by Panera Bread:

Covenant Village

9153 S. Yarrow St., Westminster, CO 80128

RSP: (303) 468-2820

WEDNESDAY, SEPTEMBER 16, 10:45-12:30, Lunch and Learn,

catered by Panera Bread:

Highlands Ranch Northridge Recreation Center

8801 S Broadway, Highlands Ranch, CO 80126

RSVP: (303) 468-2820

SATURDAY, SEPTEMBER 26, 11:30am-1:30pm, Lunch and Learn, catered by Panera Bread:

Covenant Village

9153 S. Yarrow St., Westminster, CO 80128

RSVP: (303) 468-2820

“Many people make the mistake of assuming Medicare covers it, and they’re wrong,” says Jeffrey Brown, professor of finance at the University of Illinois, who has researched long-term care insurance markets over time. For every Baby Boomer today, there are only three options: out-of-pocket, Medicaid, or insurance. “Long-term care is exactly the kind of low-probability, high-cost risk that you want to insure against,” he says.

According to a recent article in Barron’s, its the middle and upper-middle-class who would benefit most…. and who stand to lose the most. That would include “families in the top third of the wealth distribution, but below the top 1%,” Brown says. “For them, a truly catastrophic event, like 20 years of care for an Alzheimer’s patient, could easily burn through their assets.” (Barron’s, April, 2015.)

If your health is not excellent, you may not qualify for insurance at all; 25% of applicants between 60 and 69 are denied coverage. Most companies won’t offer coverage past age 75. “The sweet spot is the late 50s,” Conklin says. “The price is still very affordable, and people are starting to think seriously about retirement.”

This workshop in Littleton is intended to cover planning tips, strategies and laws to avoid the dilemma of spending down the hard-earned nest egg when a medical crisis occurs. Long-term care costs are one of the main reasons that retirees deplete their savings and lose assets. Speakers will represent alternatives for retirees to purchasing long-term care insurance. No products will be endorsed or sold. Solutions offered include insights about 2015 estate plan laws that may help protect families and their aging lives ones.

According to the Colorado Department of Human Services website, “Colorado has one of the fastest growing aging populations in the U.S. From the years 2011 to 2021, the number of older adults in Colorado will increase 54%.” (Colorado Commission on Aging, 2014.)

“Colorado is home approximately 1.5 million persons over age 50; 820,000 persons over 60; 370,000 over 70; and 140,000 over 80. The proportion of females rises with each age group to 63% of the 80+ group.” (http://www.aoa.gov, June, 2012.)

Space is limited at each workshop. Call (303) 468-2820 to RSVP or to inquire about additional dates that may be added.

Scheduled speakers include:

Jim Brown, Long Term Care Specialist and Senior Advisor to the Council of Aging in Jefferson, Douglas and Arapahoe Counties. Jim has worked in the insurance and financial planning industry for nearly 30 years. He is an advocate for senior rights and a speaker on the topic of long-term care strategies designed to help aging loved ones find the right pre-planning solution to pay for care and stay in their own homes without placing their personal assets at risk.

*This is not an AARP event. Any information you provide to the host organization will be governed by its privacy policy.