AARP Hearing Center

Financial strain of family caregiving hits low-income and Hispanic/Latino caregivers hardest

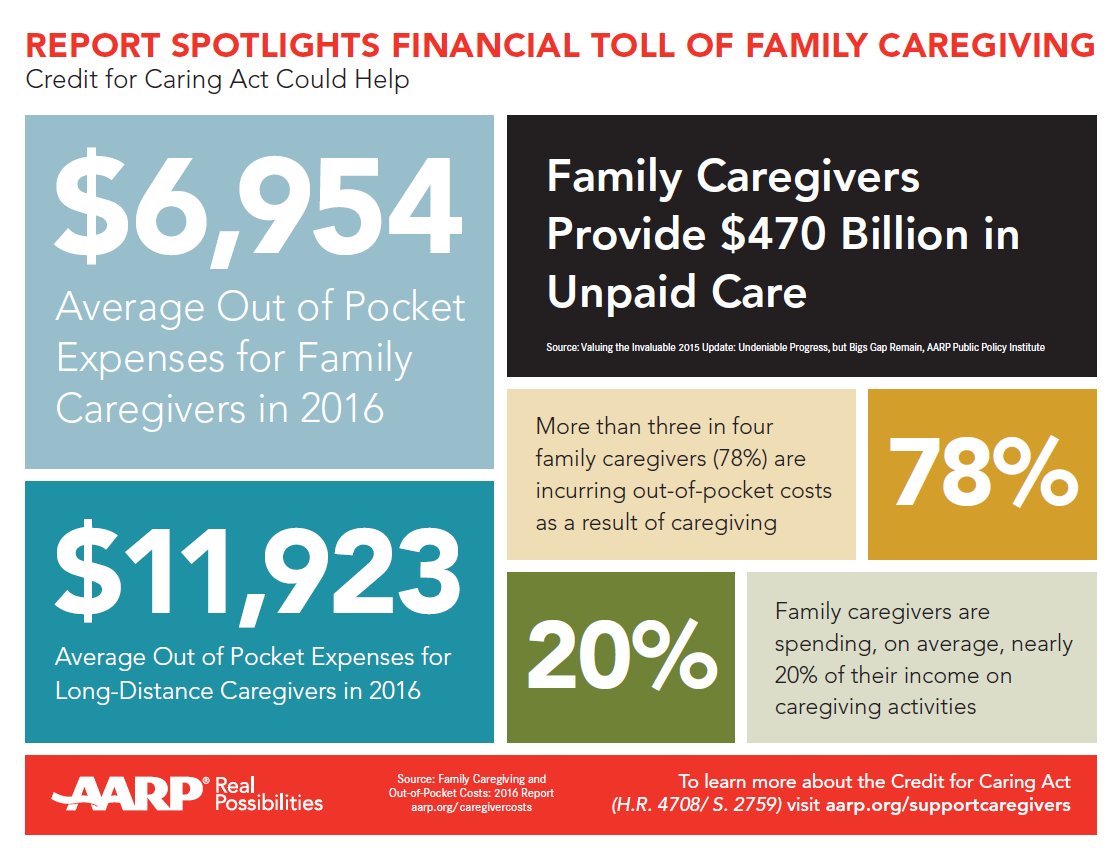

Family caregivers spend an average of nearly 20 percent of their income providing care for a family member or other loved one, according to a new AARP Research Report, “ Family Caregiving and Out-of-Pocket Costs: 2016 Report.” The report shows that family caregivers spend an average of $6,954 in out-of-pocket (OOP) costs related to caregiving, with Hispanic/Latino and low-income family caregivers spending an average of 44 percent of their total annual income.

The new AARP report determined the amount of money that family caregivers spent over the last year providing help or assistance to a loved one. Certain groups of family caregivers spend disproportionately more in OOP expenses.

Specifically in Connecticut, family caregivers provided 427 million hours of care to their parents, spouses, partners, and other adult loved ones in 2013, according to AARP Public Policy Institute’s new report Valuing the Invaluable: 2015 Update.

The unpaid care they provide – everything from cooking, cleaning, transportation to doctor appointments and grocery shopping, to more medically oriented tasks, such as wound care and medication management – is valued at more than $5.9 billion annually.

“This study, combined with the results of the previous report, is especially timely given the status of the state’s budget and news of potential cuts or restrictions to family respite care and the CT Home Care programs,” said AARP Connecticut State Director Nora Duncan. “Family caregivers rely on those programs to help defray some of the costs associated with keeping their loved one safe and at home, which is double when caring for someone with dementia.”

AARP Executive Vice President and Chief Advocacy and Engagement Officer Nancy LeaMond added, “This study spotlights the financial toll on family caregivers – particularly those with modest incomes. Whether helping to pay for services or make home modifications, the costs can be enormous and may put their own economic and retirement security at risk. As a nation, we need to do more to support America’s greatest support system. Passing the bipartisan Credit for Caring Act that provides a federal tax credit of up to $3,000 would give some sorely needed financial relief to eligible family caregivers.”

Some striking findings from the report:

• Family caregivers of all ages spend $6,954 in OOP costs related to caregiving on average.

• Family caregivers earning less than $32,500 are under significant financial strain, spending an average of 44% of their annual income on caregiving.

• Family caregivers for adults with dementia reported nearly twice the OOP costs ($10,697) than those caring for adults without dementia ($5,758).

• Hispanic/Latino family caregivers spend an average of $9,022 representing 44 percent of their total income per year. By comparison, African American family caregivers spend $6,616 or 34 percent, white family caregivers spend $6,964 or 14 percent, and Asian Americans/Pacific Islanders spend $2,935 or 9 percent.

• Long-distance family caregivers had the highest OOP costs at $11,923 compared with family caregivers living with or nearby their care recipients.

Family caregivers report dipping into savings, cutting back on personal spending, saving less for retirement, or taking out loans to make ends meet. More than half of family caregivers reported a work-related strain such as having to take unpaid time off.

“Many family caregivers experience a great deal of physical, emotional, and financial strain,” added Susan Reinhard, RN, PhD, Senior Vice President and Director, AARP Public Policy Institute. “This report highlights why AARP supports the bipartisan Recognize, Assist, Include, Support, and Engage (RAISE) Family Caregivers Act that would require the development of a national strategy to support family caregivers.”

The full results of the report can be found here: www.aarp.org/caregivercosts

About the Survey

This study of a nationally representative sample of 1,864 family caregivers was conducted by GfK from July 18–August 28, 2016. All study respondents were currently providing unpaid care to a relative or friend age 18 or older to help them take care of themselves. Caregivers completed a retrospective survey and a daily diary tracking out-of-pocket expenses spent on caregiving. Caregivers in this study included men and women, as well as whites, African-Americans, Asian American/Pacific Islanders, and Hispanic/Latinos.

Resources

• Valuing the Invaluable: 2015 Update

• AARP Caregiving Resource Center

• RAISE Family Caregivers Act

• Credit for Caring Act

-30-

About AARP

AARP is a nonprofit, nonpartisan organization, with a membership of nearly 38 million that helps people turn their goals and dreams into “Real Possibilities” by changing the way America defines aging. With staffed offices in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, AARP works to strengthen communities and promote the issues that matter most to families such as healthcare security, financial security, and personal fulfillment. AARP also advocates for individuals in the marketplace by selecting products and services of high quality and value to carry the AARP name. As a trusted source for news and information, AARP produces the world’s largest circulation magazine, AARP The Magazine, and AARP Bulletin. AARP does not endorse candidates for public office or make contributions to political campaigns or candidates. To learn more, visit www.aarp.org or follow @aarp on Twitter.