AARP Hearing Center

Debbie Richman of Plymouth sprang into caregiver mode five years ago after her mother’s cancer diagnosis. Now she’s managing both her 91-year-old father’s care and a full-time job as a staff development trainer.

“It’s just this unbelievable juggling match,” says Richman, 62, whose mother died in 2020.

When Richman can’t do it all, she uses vacation days or considers taking time off without pay. Neither option, she says, is healthy or sustainable.

Soon, Richman and others like her will be able to apply for relief through Minnesota’s new paid family and medical leave program.

It is one of two significant changes to benefits for workers in the state that AARP fought for and that kick in next year.

The second is Secure Choice, a state-facilitated retirement savings program for private sector employees who don’t have workplace retirement options.

Supporting job flexibility and retirement savings will boost financial security in the long run, says AARP Minnesota State Director Cathy McLeer.

Starting Jan. 1, paid leave will operate as a state-run insurance program, similar to unemployment. It covers full-time, part-time, temporary and most seasonal workers at nearly every employer.

Funding will come from premiums shared between employees and employers, totaling .88 percent of wages. So, for example, a worker earning $50,000 a year would pay no more than $220 annually, and the employer would pay the rest.

Workers must earn at least $3,900 in the previous year to qualify for coverage, and the tax is estimated to apply only to the first $183,600 of income in 2026.

Employees can apply for up to 12 weeks of either family or medical leave each year, or up to 20 weeks when combining the two. Time off can be used weekly, daily or even hourly.

“Making the application process as straightforward and easy as possible has been a real priority,” says Greg Norfleet, director of Minnesota’s paid leave program.

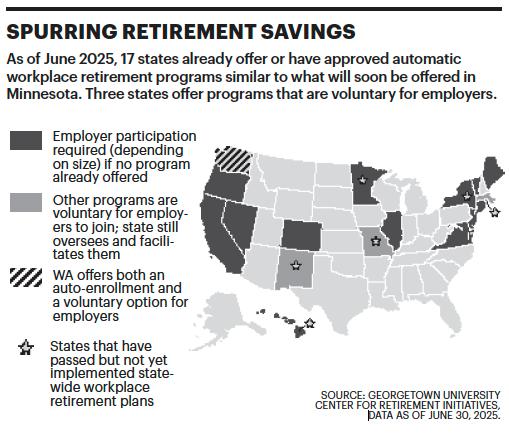

Minnesota studied best practices from the dozen other states and D.C. with similar mandatory paid family and medical leave programs. (Minnesota is one of four states in the process of implementing programs.)

In Minnesota, pay can equal up to 90 percent of an employee’s regular income, with higher-wage earners getting a lower percentage. The benefit maxes out at $1,423 a week.

In addition to caring for oneself or a loved one with a serious health condition, qualifying reasons include time off for bonding with a new child, supporting a military family member on active duty and responding to domestic violence or other personal safety challenges.

The definition of family includes relatives as well as friends, neighbors or others who depend on the employee like family.

Caregivers can expect better job security and career outcomes, while those they care for enjoy the stability and continuity of care that a loved one can provide, says Joseph Gaugler, a professor at the University of Minnesota’s School of Public Health.

“From a research standpoint, we do know having the availability of a caregiver does help an older person live at home and live at home longer, which certainly is a goal,” Gaugler says.

NEW RETIREMENT OPTION

Nearly one-third of employees in the state — about 722,000 — don’t have access to a 401(k) or other retirement option through work, according to AARP Public Policy Institute research published in 2024.

Minnesota employers with five or more workers who don’t offer a plan must sign up for the Secure Choice individual retirement account program.

Employees choose how much, if anything, to contribute through automatic payroll deductions.

More savings should prevent dependence on taxpayer supported safety net programs, an important consideration given the expected growth in Minnesota’s older adult population, AARP’s McLeer says.

Mathew Graske, 36, co-owner of Caydence Records & Coffee in St. Paul, is optimistic about Secure Choice.

Graske wanted to offer private retirement benefits to his seven employees, but it was too expensive. He says the new state Individual Retirement Account should help retain workers who might otherwise have left for better benefits at a larger company.

“I do believe that it could be a great opportunity for hospitality [and] small business employees who wish to work like this long term,” Graske says.

For more information, go to paidleave.mn.gov and securechoice.mn.gov.

Sarah Hollander, a freelance writer and former daily newspaper reporter in Cleveland, has written for the Bulletin for 16 years.

MORE ON ADVOCACY