AARP Hearing Center

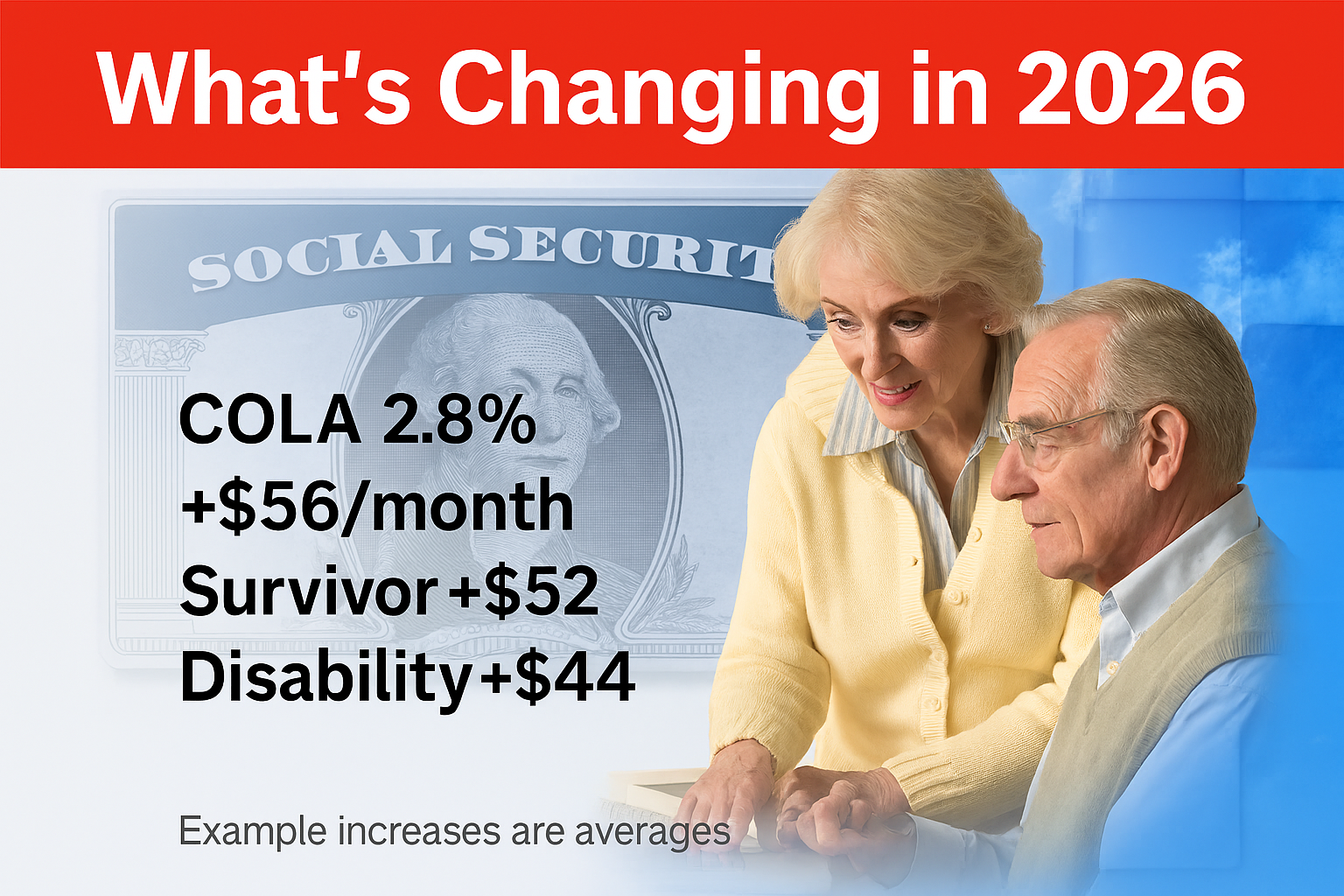

Starting January 2026, Social Security payments will increase by 2.8%. This cost-of-living adjustment (COLA) means the average monthly retirement payment will rise by about $56, from $2,015 to $2,071. Survivor benefits will go up by roughly $52, and disability payments will increase by $44. Supplemental Security Income (SSI) recipients will see their first boosted payment on December, payable in January 2026.

This adjustment reflects recent inflation trends and will impact about 75 million Americans, including mare than 1.6 million New Jersey residents. While the increase offers some relief, many older adults say it’s not enough to keep pace with rising costs for essentials like groceries, housing, and healthcare.

There’s also a new $6,000 tax deduction for people 65 and older, which could reduce or eliminate taxes on Social Security income. However, experts warn this change may accelerate the depletion of Social Security’s trust fund by six months.

Since AARP’s inception 67 years ago, we have been a fierce advocate for this essential program, fighting to ensure it is protected and preserved. AARP continues to advocate for long-term solutions to strengthen Social Security for current and future generations. Add your name and pledge to protect Social Security.

Key ways AARP is fighting for Social Security

• Defending against cuts to Social Security’s phone services

• Demanding better customer service from Social Security

• Keeping more Social Security income in your pocket

• Calling on Congress to secure Social Security’s financial future

• Opposing the privatization of Social Security

For more details and resources, visit aarp.org/social-security.

Source:

Social Security COLA Set at 2.8% for 2026

6 Big Social Security Changes for 2026