AARP Hearing Center

Texas Appleseed and AARP today released five “Managing Someone Else’s Money” guides, a toolkit for financial caregivers in Texas who manage money or property for those unable to do so for themselves. This interactive series of guides, in English and Spanish, is available in print and online at www.ProtectTheirMoneyTx.org.

Nearly 3.5 million unpaid family caregivers in Texas provide a great labor of love by helping their parents, spouses and others manage their financial affairs – but they often lack the tools they need to avoid scams, fraud and unintended conflicts of interest. In addition, about $5 billion in Texans' assets are controlled by a court or guardian, a complicated task that few individuals are prepared for. The new toolkit, with five guides, fills this void and helps financial caregivers know the best ways to safeguard loved ones and their assets.

“Millions of Texans face situations where a family member or loved one can no longer manage their money due to illness or a disability. Now there is a resource that can help,” said Ann Baddour, director of Texas Appleseed's Fair Financial Services Project. “This toolkit includes five targeted guides that help people navigate complex systems, like being a guardian or an agent under a power of attorney.”

Each of the guides is tailored to the needs of different fiduciary/supporter capacities, including people who are:

- agents under a power of attorney,

- appointed by a court to be guardians or conservators,

- named as trustees under revocable living trusts,

- appointed by a government agency to manage income benefits, and

- acting as a supporter under a supported decision-making agreement.

The series of guides is being released during National Consumer Protection Week, which runs March 5 to 11 and is a good time for consumers, caregivers and others to have a careful look at the precautions they’re taking with their loved one’s assets.

“The ‘Managing Someone Else’s Money’ guides include tips for avoiding conflicts of interests and for safeguarding against scams. They also have information to help folks know where to go in the case that something does go wrong,” said Bob Jackson, director of AARP Texas. “These pocketbook issues are increasingly on Texans’ minds, and the unbiased information in the guides is sorely needed.”

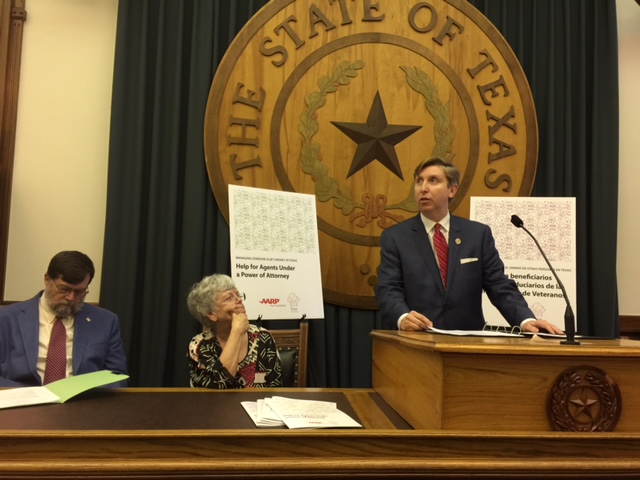

The Texas Legislature has taken an interest in finding new ways to protect Texans from financial exploitation. State Rep. Tan Parker (R-Flower Mound), chair of the House Investments and Financial Services Committee and a champion for older Texans and their families in helping to prevent elder financial abuse, spoke Wednesday about the need for Texans to have quality information on how to protect themselves and their assets.

A legal team from Baker Botts, led by former Texas Supreme Court Chief Justice Tom Phillips and Keri Brown, provided pro bono support to create these guides, adapted for Texas from the Consumer Financial Protection Bureau’s “Managing Someone Else’s Money” series.