AARP Hearing Center

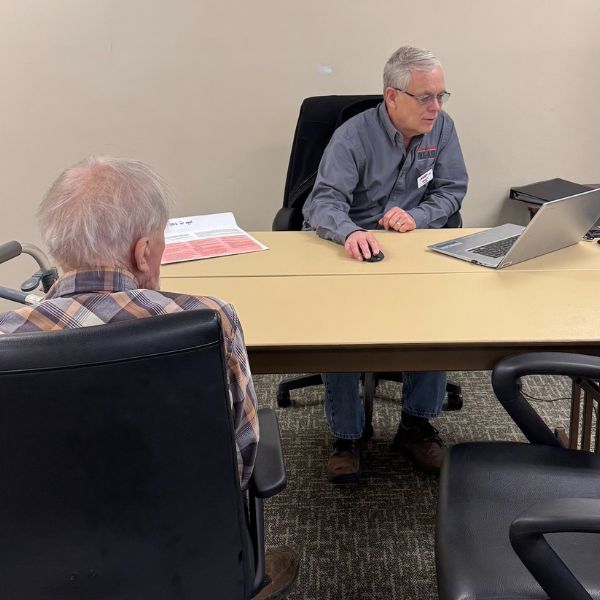

AARP Utah Tax Aide volunteers recently wrapped up a highly successful tax season, marked by positive experiences for taxpayers and impressive volunteer efforts. This year, taxpayers not only understood their obligations but also achieved their desired outcomes, either a refund or owing minimal taxes.

Volunteer Contributions

A total of 135 volunteers across 29 sites played a crucial role in assisting 6,245 taxpayers, a notable increase from 5,893 in 2023 (a 106% increase!). Every district in Utah exceeded their prior-year production numbers, showcasing the dedication and efficiency of the volunteers.

Demographics and Financial Impact

Among those assisted, 5,041 individuals (81%) were over the age of 60, highlighting the importance of support for senior citizens. Additionally, 4,050 taxpayers (65%) received a combined total of $4.7 million in refunds. The average Adjusted Gross Income (AGI) of these taxpayers was $47,596, underscoring the financial challenges they face in affording federal and state tax preparation and e-filing services.

Accuracy and Efficiency

The IRS conducted field site visits for FY2025, resulting in an impressive 99% accuracy rate for individual tax return reviews, with an overall accuracy rate of 96%. These outstanding results reflect the high standards and meticulous efforts of our amazing group of volunteers.

Utah's tax season success is a testament to the power of community and volunteerism. The positive experiences of taxpayers, coupled with the remarkable accuracy and efficiency of tax return processing, demonstrate a model that other states can aspire to. As we look forward to future tax seasons, the collaborative efforts in Utah serve as an inspiring example of what can be achieved when a community comes together to support its members.