AARP Hearing Center

Español | National Cyber Security Month

October is National Cyber Security Month and there are three keys to staying safe online: Own it, Secure it, and Protect it. The “it” is your digital profile – the personal things about yourself that you put online. Living in the digital age means putting a lot of personal information online like your home address, where you work, family members, and much more. Keeping that information safe requires a bit of work. First, you need to own it by understanding what you’re putting out there (such as what you’re posting on social media). Next, you have to secure it with strong passwords or using a password manager and enabling two-step authentication where available. Lastly, you need to protect it by staying current with the latest security updates on your devices and using Public Wi-Fi safely. Learn more at staysafeonline.org.

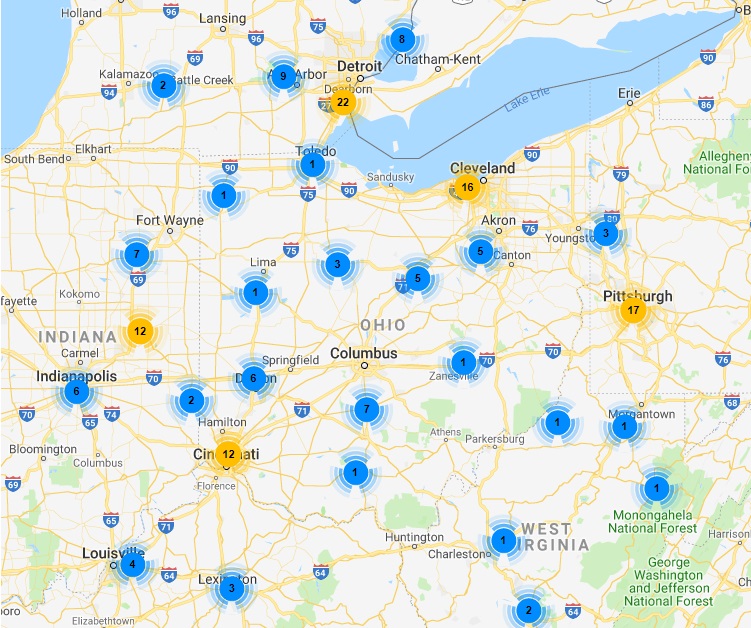

Scam Tracker Map

Scammers work 24 hours a day, seven days a week looking for their next victims. The unfortunate reality is that millions of people fall victim to scams carried out by sophisticated national and international criminal organizations every year. You can get a sense of how widespread this is by visiting the AARP scam-tracking map at www.aarp.org/scammap. Understanding how widespread scams are and which ones are trending in your community can help us all stay safe.

Medicare Open Enrollment Scam

Medicare Open Enrollment season is here, which means it is also Medicare fraud season. Between now and December 7th seniors across the country will be shopping for the best deal for their health care dollar. Unfortunately some of the deals they will be offered won’t be deals at all.

Medicare scams are expected to spike during open enrollment season with scammers posing as impostors calling and emailing seniors offering free gifts or limited time offers. These scams are all designed to capture your Medicare number so the crooks can charge Medicare for services you didn’t receive.

Be suspicious of anyone who calls, emails or visits you promoting a Medicare plan. Legitimate health plans can only contact you if you’ve requested information. Don’t give personal information to anyone who calls or visits out of the blue and always review your Medicare statement to ensure fraudulent charges aren’t included.

Password Managers

One of the best ways to protect your online information is to use strong, unique passwords for each password-protected website you use. But keeping track of all of these passwords is not easy. One solution is to use a password manager – a software program that creates, stores and retrieves strong and unique passwords for you. Do some research to find an option that best suits your needs and budget.

ID Theft: What to Do Next

We take a lot of precautions to protect our personal information, but we’re not the only people responsible for our data. So many different entities have our personal information it’s hard to keep track of. Our banks, health providers, email TV and Internet provider, retailers and more all have our data and many of them have been hacked. The reality is that most Americans have already had their identity compromised. So what can we do to protect ourselves after the fact?

Here are 3 steps to protecting yourself after your personal information has been stolen. 1) Sign up for credit monitoring that will alert you if someone tried to open an account in your name. 2) Place a free security freeze on your credit to help stop identity thieves from opening new accounts in your name. 3) Establish online access to all of your bank accounts, credit cards and retirement accounts and check them frequently.

Be a fraud fighter! If you can spot a scam, you can stop a scam.

Visit the AARP Fraud Watch Network at www.aarp.org/fraudwatchnetwork or call the AARP Fraud Watch Network Helpline at 1-877-908-3360 to report a scam or get help if you’ve fallen victim.