AARP Hearing Center

A new report, to be released nationally later this week, examines the performance of every state in meeting their commitments to fund their public employee pension plans. The report, which was compiled by the National Association of State Retirement Administrators, with financial support from AARP, can be accessed online here: http://www.nasra.org/files/JointPublications/NASRA_ARC_Spotlight.pdf.

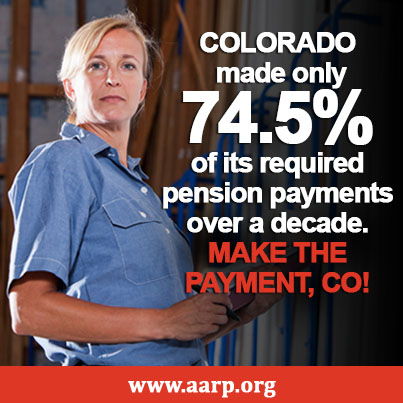

As detailed on page 14, Colorado has made 74.5 percent of its annual required contribution to its public employee retirement plans from Fiscal Year 2001 through Fiscal Year 2013. That average contribution level places Colorado behind 46 other states. More detail on the Colorado pension plans can be found on page 21.

Overall, the report shows that in most states, well-funded pension plans consistently receive the annual required contribution to their pension systems. AARP feels strongly that public employees who worked hard and paid into the system their whole lives should receive the payments they were promised, and that initiatives to close defined benefit plans and replace them with riskier and less secure defined contribution and hybrid plans remain unnecessary, unwise, and unfair.

Most states are meeting their commitments to fund their public employee pension funds with only a few conspicuously failing, according to a new report by the National Association of State Retirement Administrators. While having a policy requirement to annually fund a plan generally results in a higher percentage of required contributions paid in a given year, some without such a policy still consistently make adequate appropriations.

The report, “Spotlight on The ARC Experience of State Retirement Plans, FY 01 to FY 13,” examines how state governments performed meeting the annual required contribution (ARC) of their public employee retirement plans. It details the ARC experience of 112 state-wide and state-sponsored public pension plans in the U.S. Together, these plans account for more than 80 percent of all public pension assets and participants.

Among the findings are:

- Policies (i.e., statutes, constitutional provisions, or retirement board requirements) that require payment of the ARC generally produced better pension funding outcomes than polices that do not require payment of the ARC; although some plan sponsors consistently paid their ARC without a requirement to do so.

- Some states that have statutory requirements still failed to fund their pension plans. Failing to make even a good-faith effort to fund the ARC increases future costs of funding the pension.

- Policy constraints that limit payment of the full actuarially determined contributions were more likely to negatively affect the ability of employers to fund the pension plan.

Even though the period of study included two economic recessions, most state and local governments increased pension contributions and maintained funding discipline to be able to provide pension benefits for former, current and future employees. However, the few states that conspicuously failed to fund their pension plans have a disproportionate effect on the aggregate experience.

The report, which was produced with support from AARP, details the ARC experience for each state and plan in the study showing that on a weighted average basis for the 13-year measurement period:

- All but six states paid at least 75 percent of their ARC.

- The average plan received 89.3 percent of its ARC.

Despite perceptions that many states have fallen far short of their pension funding requirements, in fact, most states have made a reasonable effort to fund their share of pension contributions during the period covered by this study.

The full paper is at: http://www.nasra.org/files/JointPublications/NASRA_ARC_Spotlight.pdf

The National Association of State Retirement Administrators (NASRA) is a non-profit association whose members are the directors of the nation's state, territorial, and largest statewide public retirement systems. NASRA members oversee retirement systems that hold more than two-thirds of the $3.7 trillion held in trust for 15 million working and 8 million retired employees of state and local government.