AARP Hearing Center

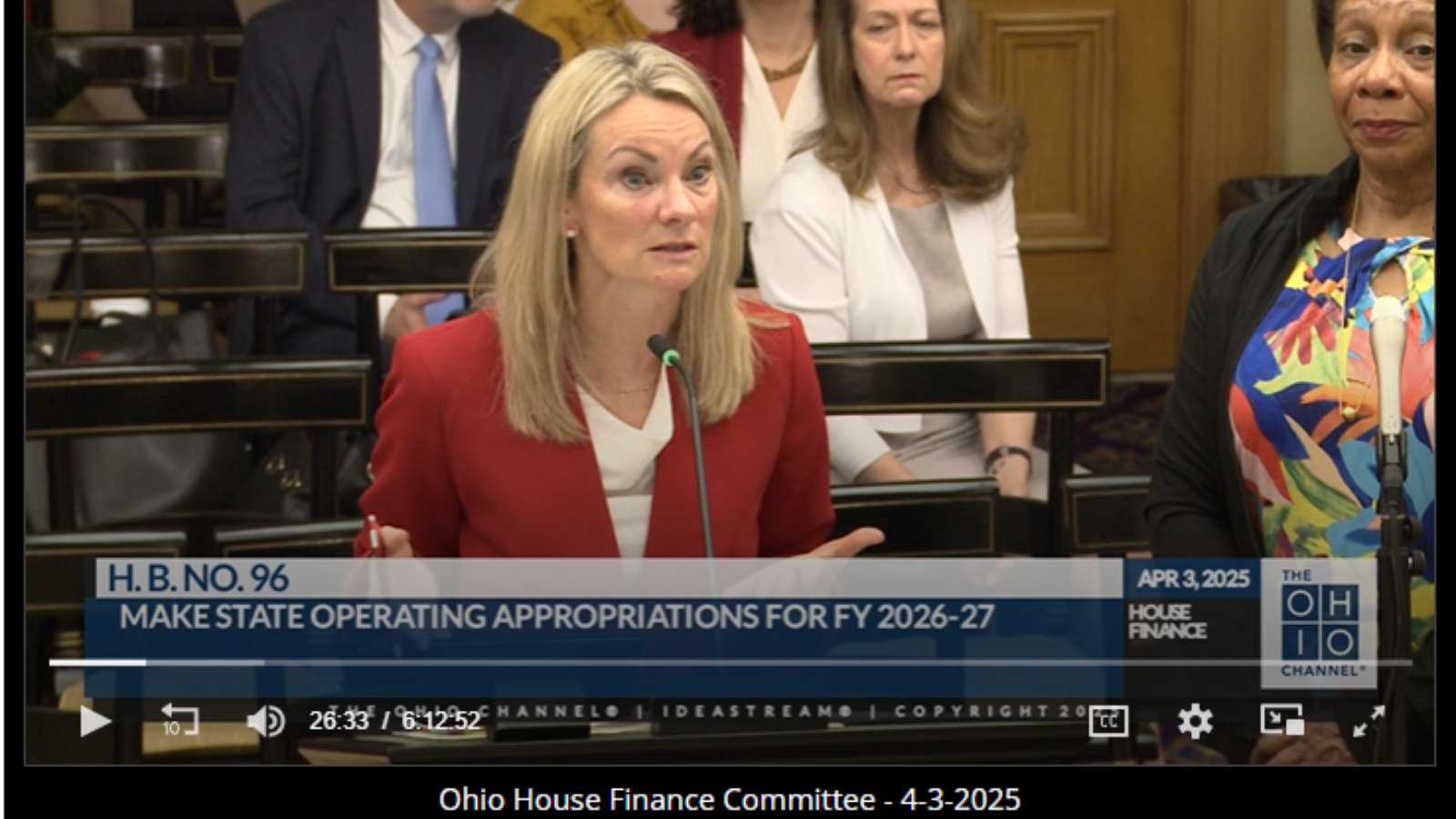

On April 3, AARP Ohio State Director Jenny Carlson presented testimony to the Ohio House Finance Committee urging the inclusion of HC 2336, in the Ohio Biennial Budget. The amendment would create the Supporting Family Caregivers Tax Credit, a nonrefundable tax credit for working family caregivers providing care for their older loved ones.

“Family caregivers are the backbone of the U.S. care system. In Ohio, 1.5 million adults are family caregivers who provide $21 billion worth of uncompensated care annually. Without family caregivers’ support, many Americans would be forced into costly nursing homes with the government and taxpayers paying the bill.

Many family caregivers are balancing caregiver responsibilities with work and are paying care expenses out of their own pockets, averaging $7,200 a year, making it harder for them to afford groceries, pay bills and save for the future.

This tax credit would help working family caregivers continue to provide essential care that keeps their older loved ones at home, while also stabilizing the workforce and economy. It is essential working family caregivers receive this much-needed tax credit to these dedicated individuals.

We urge the Ohio legislature to include the Supporting Family Caregivers Tax Credit in the omnibus bill and will continue to fight for Ohio’s family caregivers and their loved ones.”