AARP Hearing Center

In July 2015, I was waiting in the Oregon Governor’s ceremonial office with more than 50 other advocates. It was a beautiful day and hot even inside the massive stone capitol building with its stately staircases and wood-paneled walls. In breezed petite Oregon Governor Kate Brown with her chestnut bobbed haircut and the pearl necklace she frequently wears for special events. She sat at the ceremonial desk and signed legislation into law to create OregonSaves – the first-in-the-nation, state-based IRA program.

I was standing right behind her.

Only five years earlier, I was like the majority of American boomers who hadn’t put much thought into retirement savings. It felt ironic that I had the opportunity to lead AARP Oregon’s effort to help create this new program because retirement savings had never been a passion for me -- until the 2008 recession struck.

AARP Oregon reacted to the 2008 massive job losses by offering workshops called “Finding Work@50+.” The demand was as incredible as the heartbreaking stories. Former professionals started visiting Costco to get a free lunch by tasting samples. When older applicants landed a job interview, hiring managers took one look at them, diverted their eyes and escorted them out the door.

Since the average American had less than $1000 in savings at the time, bank accounts dried up. Bills mounted. Crushing debt soared. Where once there had been the hope of a trip to Hawaii or at least a visit to see the grandkids became a sort of gloom.

One day a woman walked up to me after an AARP event and said, “What can AARP do to help me? I’ve lost my job, and I’m afraid I’m going to lose my house.” I felt desperate to help. Personal finance and retirement planning may have sounded boring in 2007, but by the end of 2008, I couldn’t think of anything I’d rather be working on.

By 2013, the economy was turning around, and while it was still tough for older adults to find jobs, one piece of the American Dream seemed even further out of reach – a chance to retire and enjoy a few good years after 30, 40 or even 50 years in the workforce.

We learned that 1 million Oregonians didn’t have access to a retirement savings plan adding to a national retirement savings deficit of between $6.8 and $14 trillion. To put that into perspective, if you were to clock it, a million seconds would be 11.5 days. A trillion seconds, would be 32,000 years. This seemed like another financial bombshell waiting to happen.

It was time for action in Oregon - and in other states around the country.

AARP Oregon teamed up with local SEIU and a dozen other advocacy organizations to lobby for a new program. Then Treasurer Ted Wheeler was intrigued by the idea and took the project on. State senator Lee Beyer and Rep. Tobias Read (now Treasurer Read) had the guts to sponsor the legislation.

After an extensive public education and lobbying effort, the Oregon Legislature passed the first-in-the-nation, state-facilitated IRA program after two legislative sessions in 2015.

The program went live with 11 small business owners in July 2017 including business owner Saleem Noorani of Corvallis who volunteers with AARP (pictured here being videotaped about his experiences.) These business owners and nonprofit managers were the beta testers with a formal launch of OregonSaves in the fall.

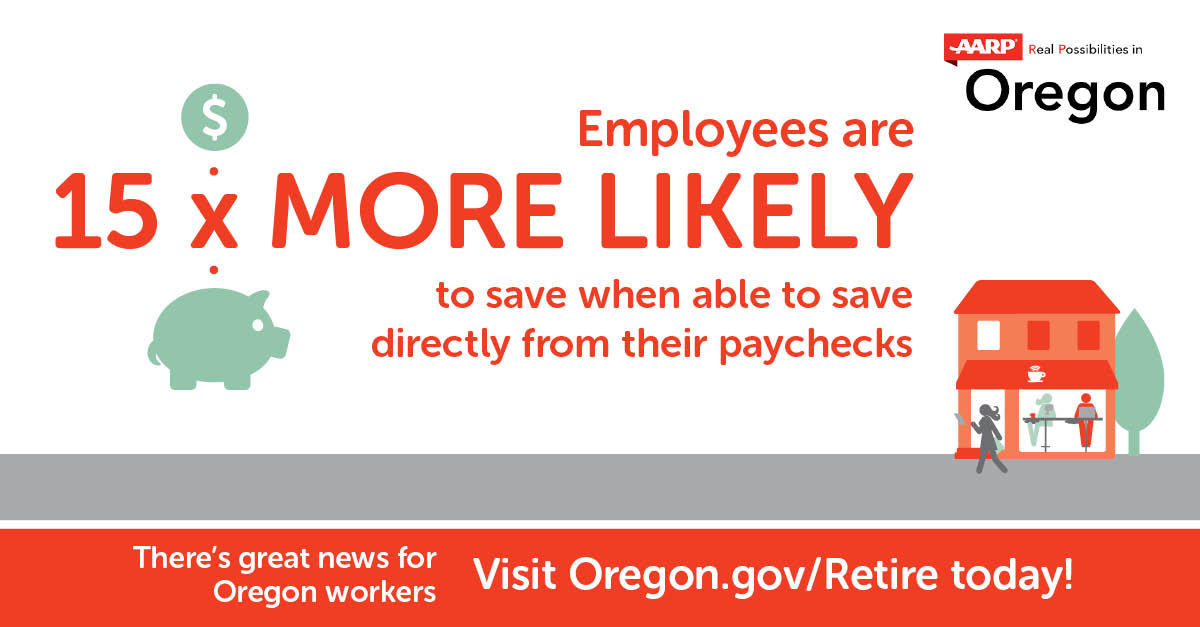

All we needed to know was, “Will it work?” Oregon employers are required to offer OregonSaves if they don’t have another plan for their employees. But would people actually participate? Well, it has a secret ingredient economist Richard Thayer calls a “nudge”. Employees have to actively opt out, or they are automatically in with 5% of their paycheck going into a retirement account that is owned by them and portable from job to job.

The nudge worked. About 77% of Oregon employees who have access to the program stayed in and began building retirement assets.

Three years later, OregonSaves is doing what it was designed to do. Oregonians from 18-80 have participated in the program that now has assets of about $60 million. The program is helping thousands of Oregonians save for retirement, many for the first time. And it's popular. A 2018 DHM research report found overwhelming support for OregonSaves among rural and urban folks, conservatives and progressives.

While Oregon pioneered the program, California and Illinois were right behind us, and now more than 25 states either have a similar program or are working to create one.

Congratulations to the Oregon State Treasury on delivering OregonSaves to the public, and thanks to the Oregon Legislature, Mayor Ted Wheeler, Treasurer Tobias Read, State Senator Lee Beyer and the hundreds of advocates and business who helped to make this program a success. It’s been a privilege to work on a project that is building the wealth and financial security of Oregonians.

Thanks also to the amazing AARP staff at the state and national office, the dedicated volunteers, and community partners who helped create this wonderful new program for Oregon. A special shout out to volunteers Juanita Santana and Edward Brewington for serving on the program board.

**Check out this fun video of the Rose City Rollers talking about OregonSaves

Watch our 60 sec TV spot

Joyce De Monnin is the Communications & Media Relations Director for AARP Oregon.