AARP Hearing Center

CLOSE ×

Search

Popular Searches

- right_container

- Health

- Money

- Work & Jobs

- Advocacy

- Social Security

- Medicare

- Caregiving

- Games

- Travel

- More...

- Entertainment & Style

- Family & Relationships

- Personal Tech

- Home & Living

- Auto

- Staying Sharp

- Podcasts

- Videos

Stay up-to-date on federal and state legislative activities. Learn how AARP is fighting for you in Washington D.C. and right here at home.

Most people have to rely on money saved over years of work to fund their retirement, and often this money is accumulated through a 401(k) plan at work or some other type of investment. Long gone are the days when a guaranteed pension gave workers financial security in retirement; today, only one in five workers has access to such a plan. This means workers have to take on the risk of investing, which is a scary proposition. Investment losses can be devastating late in life, as there aren’t decades of work ahead to replace it.

Guess what’s turning 50? For many AARP members who know that milestone well, it’s a program that is invaluable for their health and financial independence. Medicare turned 50 on July 30. Former President Harry S. Truman received the first Medicare card immediately after President Lyndon B. Johnson signed Medicare into law in 1965, and since then it has helped redefine “real possibilities” for many Americans, often freeing them from the fear of devastating medical bills that could jeopardize their individual and economic survival.

AARP applauds the bipartisan action taken on July 16, 2015 on S. 192, the reauthorization of the Older Americans Act (OAA) introduced by Senator Lamar Alexander (R-TN) with Senators Richard Burr (R-NC), Patty Murray (D-WA) and Bernie Sanders (I-VT). The Senate passed the bill the week that the OAA celebrated its 50 anniversary of providing invaluable services to older adults.

Notalys LLC released its report, Expanding Utah's Health Insurance Options today at a press briefing at the Utah State Capitol, outlining the differences between two plans that were under consideration by the Utah legislature during the last session. Governor Herbert's Healthy Utah plan was passed by the Utah Senate, and Utah Cares was passed by the Utah House of Representatives. Because no agreement was reached on how to cover the more than 50,000 low-income Utahns who currently fall into a health insurance coverage gap--making too much to qualify for Medicaid but too little to qualify for health insurance subsidies--a committee of House and Senate leaders, the Governor Herbert, and Lt. Governor Spencer Cox set July 31 as the deadline for coming up with a plan to address this population.

The following press release was issued by AARP on Tuesday, June 16.

from the AARP Media Relations Office

By Danny Harris, Advocacy Director, AARP Utah

In a statement released today, AARP Utah State Director Alan Ormsby said, “AARP Utah is disappointed that the Utah legislature did not advance Healthy Utah into law this session. This means that thousands of people who fall into the coverage gap will continue to suffer because of their lack of access to affordable health care. Some will die while waiting for treatment. It is truly disheartening when political posturing gets the upper hand over the outpouring of support for Healthy Utah from the public and organizations around the state. We hope that this vital piece of legislation will be considered and passed quickly in a special session of the legislature and intend to work with the committee to help ensure that this happens.”

With the Utah House failing to support SB164 Healthy Utah during a committee hearing Wednesday night—advancing HB446 Utah Cares instead—hundreds rallied at the capitol Thursday, March 4, in support of Governor Herbert’s bill. AARP Utah State Director joined legislators, religious leaders, citizen advocates, and health professionals to ask, "What's the hold up?" His comments are below:

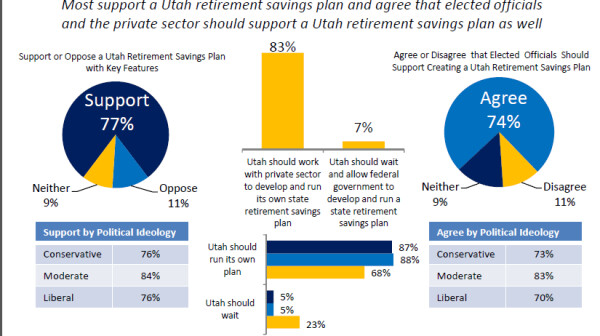

AARP Utah unveiled a statewide survey that showed a growing concern over retirement savings in the state. The survey, Making Retirement a Reality: Helping Utahns Age 25-64 Save and Take Control of Their Future, engaged 1,000 Utahns age 25-64 and found that 85 percent wish they were able to save more money for retirement and 77 percent support the idea of a state-created retirement plan for those who lack access at their place of work. One in six of those surveyed has less than $5000 in savings. Currently in Utah, 53 percent of private sector workers [1] – and 21 percent of those surveyed -- do not have access to a retirement savings plan at their place of work. The results were presented during AARP Utah’s Democracy Day event at the Utah State Capitol on February 12.

Search AARP Utah

Connecting you to what matters most, like neighbors do. Find events, volunteer opportunities and more near you.

Sign Up & Stay Connected