AARP Hearing Center

The dream is to make financial investments that will provide you with not only the financial security you need, but the luxury you crave.

And along comes someone who offers you such an investment to fulfill your “phantom rich” desires. It’s guaranteed. Risk free.

Welcome to the land of financial investment scams. A land where, if something sounds too good to be true, it probably is.

“All investing involves risk,” warned Christine N. Kieffer, senior director of the FINRA Investor Education Foundation.

That’s one reason smart investors don’t put all of their assets in the same basket of securities and other money-making endeavors.

The problem for investors, even those who consider themselves pretty savvy, is that the investment scammers practice their trade constantly and are increasingly clever and sophisticated.

“This is their job,” said Robert Mascio, FINRA’s director of Investor Education Outreach. “They make their living by trying to take advantage of individuals, and they are very nimble.”

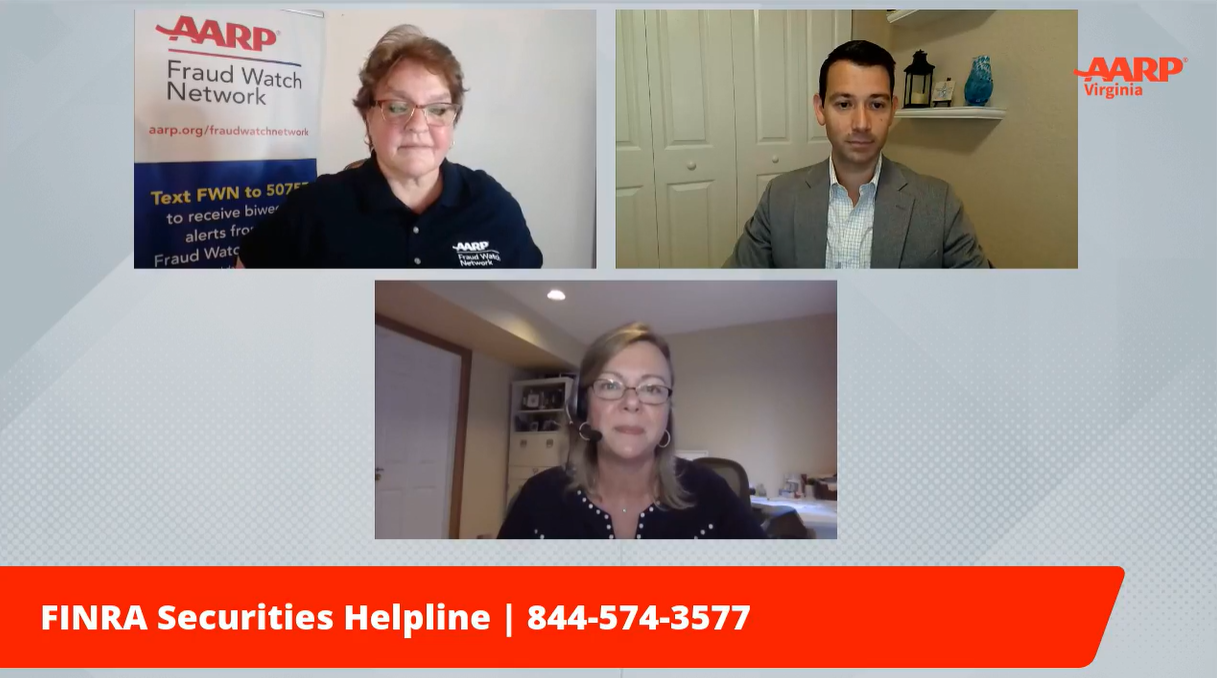

Kieffer and Mascio appeared on a recent AARP Virginia Friday Fraudcast to discuss ways that people can protect themselves against investment fraud and what to do if they feel they have been the victim of such practices. The full 39-minute FraudCast can be found on the AARP Virginia Facebook page.

FINRA (the Financial Industry Regulatory Authority) was created by Congress but it is not a government agency, although it is overseen by the federal Securities and Exchange Commission. It works closely with government entities as well as non-profit organizations such as AARP to help regulate the securities industry and educate the public about safe investing. It regulates more than 3,500 brokerage firms and 630,000 registered securities representatives.

Here are some ways to avoid financial investment fraud, according to the FINRA officials.

- Check advisors’ credibility: Investment advisors, even those with high-rise offices and fancy certificates on the wall, may look and sound legitimate. But are they really? Are they licensed and registered with the appropriate federal, state or other regulatory agencies for the types of investments they handle? One way to find out is to check with FINRA BrokerCheck at www.finra.org/brokercheck. It provides information on the license, background, and disciplinary records of investment professionals and firms. Even if you’ve been using the same broker for years, an annual check is a good idea.

- Beware the scarce opportunity: The investment sounds great, but you have to act fast or the opportunity will vanish, goes the sales pitch. Probably not. It’s a good idea to take time and step back and independently check the investment proposal. To deter scammers efforts to entice you to make an immediate commitment, it’s a good idea to have a “refusal script” already laid out: You can’t do anything until you check with your spouse, or your adult children.

- Beware heightened emotions: Scammers play on your emotions, your fears and your desires. If an investment opportunity seems so good that your palms are sweating (literally or figuratively) give yourself time to cool down and make a more unemotional assessment. “If something comes to you and you weren’t looking for it, do you need it?” Kieffer asked.

- Look for the downside: Sure, the scammer will weave a tale of solid investment returns with practically no risk. But what if those returns don’t pan out? Do your research and ask the questions: How does this investment make money and can this investment lose money? What if this investment goes bust? Don’t just look for positive reviews on search engines; look for negative ones as well. “It’s important to look at both sides and do searches to elicit information that you don’t want: like is it a fraud, could it be a scam?” she said.

If you have questions or concerns about an investment or an investment professional, contact the FINRA Securities Helpline for Seniors. The FINRA officials urge people to contact them even if they haven’t been victimized because such contacts may result in a potential scam being shut down.

But what if—even after being careful—you still find yourself the victim of an investment scam?

It happens, said Mascio. Unfortunately often people are too embarrassed to report that they’ve been victimized. That delays the opportunity to catch the scammers and prevent others from falling victim. It also denies a person who was victimized the opportunity to possibly recoup some of their loses.

If you think you have been scammed, it’s important to keep detailed records of all communications and transactions, Kieffer said. Reporting can be made to FINRA, federal agencies such as the Federal Trade Commission or Securities and Exchange Commission, to local or state agencies, or to non-profit organizations such as the AARP Fraud Watch Network, which can refer cases to the appropriate agency.

It’s always a good idea to protect your identity from theft, the FINRA officials said. That means being careful not to access or input financial information when using a public wi-fi system, such as at an airport or coffee shop.

While there are numerous financial scams, major disasters such as wildfires, hurricane and even the coronavirus offer new opportunities for scammers to bilk potential investors, Kieffer said. Such scams might involve alleged opportunities to get in on the front end of a new vaccine or special access to personal protective equipment.

Important investing tips and tools for consumers can be found at www.finra.org/investors. For general investor insights, the officials recommended subscribing to the The Alert Investor Newsletter.