AARP Hearing Center

AARP Wyoming hopes that some of the most effective tools for facilitating fraud and scams will come under the purview of Wyoming regulators after the 2026 Legislative Session.

Crypto kiosks or crypto ATMs are a rather new phenomenon in Wyoming. The machines allow citizens to deposit cash into them, instantly convert that cash into cryptocurrency such as bitcoin, and then transfer the cryptocurrency to another “wallet,” or person, which is often a scammer. In fact, in Iowa and the District of Columbia, regulators have reported that more than 90% of transactions facilitated by crypto kiosks have been found to be fraudulent.

“If our readers take nothing else away from reading this story, know that if someone calls you and tells you to put money into a crypto ATM to take care of a fine, or pay a bill, it is most certainly a scam,” says AARP Wyoming’s Tom Lacock. “Scammers love these machines because they allow for near-instant transfer of money in a way that cannot be reversed.”

- AARP Wyoming is asking lawmakers to institute the following rules around crypto kiosks:

- Written disclosures are to be required near machines, warning of the risks of their use in fraud and scams.

- The Cheyenne and Gillette Police Departments have demonstrated to us the importance of paper receipts for use in their investigations. AARP wants paper receipts to be the standard.

- A proposed transaction limit of $1,000 per day and $10,000 per month. Keep in mind the average transaction for the kiosks is $300 per transaction.

- Transaction fees to be refunded in the case of scams. These kiosks typically charge a high transaction fee, generally ranging from 7% to 26%. As an example, if a victim has deposited $50,000 into a kiosk in what turns out to be a scam, the fees to the kiosk operator would be $10,000, assuming a 20% transaction fee.

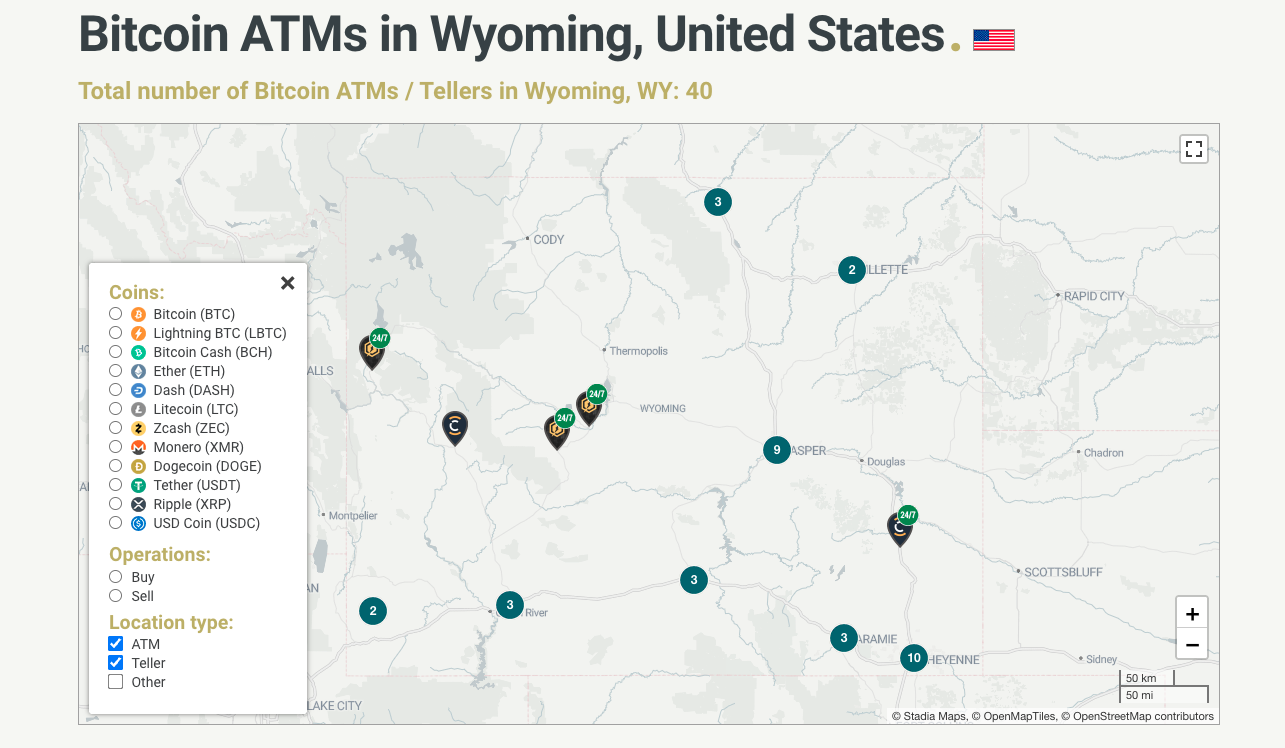

Where are these machines?

In Wyoming, approximately 50 of these machines are operating in gas stations and grocery stores (11 in Cheyenne alone), many of which are branded under names such as BitCoin Depot and CoinFlip. The overall virtual crypto market is $3.95 trillion, and kiosks made up just $182 million of that in 2023. Chainalysis, a blockchain analytics company, has informed AARP that virtual currency kiosk transactions account for less than 1% of all virtual currency transactions. The bulk of cryptocurrency transactions are performed on centralized exchanges, such as Coinbase, Kraken, Crypto.com, and others. Unlike most kiosks, to use a centralized exchange, a customer must undergo a Know Your Customer (KYC) identification verification process, which offers more consumer protection. The exchanges typically charge transaction fees ranging from 0.24% to 3%. Kiosks can run up to 26% transaction fees.

During a legislative committee meeting in Laramie this fall, BitCoin Depot representatives informed legislators that their target market is the “crypto curious,” or individuals who wish to purchase small amounts of cryptocurrency for the first time. However, Gillette police tell AARP Wyoming they aren’t convinced there is a conceivable legitimate use, and first saw these machines pop up in prostitution cases. Now, the Gillette PD is seeing these used more commonly in narcotics investigations.

How big is the problem?

In 2024, the FBI received nearly 11,000 complaints of fraud involving crypto kiosks, resulting in $246.7 million in losses nationwide. This represents a 99% increase in the number of complaints from 2023 and a 31% increase in the amount of money lost. Sadly, 85% of that cash lost came from adults aged 60 and above. Finding reliable fraud data is challenging, as most fraud goes unreported to law enforcement. However, the FBI suggests that there were 30 cases of fraud involving crypto kiosks in Wyoming in 2024. However, the Cheyenne Police Department tells AARP Wyoming that it has had more than 50 reported cases of scams involving crypto kiosks in the last 16 months, with losses to victims exceeding $650,000. Sheridan police suggest that there have been an additional 20 cases in the last two years, with one case costing more than $800,000 and another costing more than $650,000. Gillette PD reports they receive a complaint about fraud using kiosks “several times a month.”

“From those 50 incidents we’ve seen over the last year and three quarters, the median impact is $6,500,” says Cheyenne Police Department Detective Kevin Malastesta.

How do the scams work?

Scams involving kiosks aren’t new; however, the means for transferring money via kiosks to scammers is relatively new. Law enforcement tells AARP Wyoming that the impostor scam, in which someone claims to be from a government agency, such as the IRS, remains a common occurrence. A number of police impostor scams are currently targeting Wyoming residents, who are being told they have a warrant issued for their arrest or a fine that needs to be paid through a cryptocurrency ATM for missing jury duty. The golden oldies, such as the grandparent scam, romance scam, or even someone calling claiming to be a power company or bank, encouraging the person to address an urgent matter by putting cash into a crypto kiosk, are also common. Scammers will call, make a payment demand in the form of crypto, and stay on the phone with the victim as they go to their bank to withdraw cash and direct the victim to a crypto kiosk.

“The most common scams we see are the law enforcement scam or your jury duty scam,” Malatesta said. “These are someone calling you and saying you have a warrant and convinces the victim they need to pay for the warrant or pay for not attending jury duty.”

Forest Rothleugner of the Gillette PD says most of the scams come from organized crime syndicates in Nigeria, India, and Burma, and some who are making the calls have been kidnapped or human trafficked into a life of making scam calls.

What is happening elsewhere

Sixteen other states in the union are working on or have passed legislation regulating these machines. We know from states that have implemented daily transaction limits for virtual currency kiosks that they do work. Law enforcement has testified that they have seen a reduction in virtual currency kiosk scams and fraud since the daily transaction limits became effective. They also testified that they had seen a reduction in the use of virtual currency kiosks for escort services, which are known to involve human trafficking.

While this model legislation may seem like overregulation to some, the reality is that other states have attempted more aggressive stances toward kiosks. Two months ago, the District of Columbia Attorney General filed a lawsuit against a cryptocurrency ATM company, alleging that the company had financially exploited residents of the District. The lawsuit alleges that 93% of deposits made into Athena’s Bitcoin Teller Machines (BTMs) were linked to scams, many of which targeted seniors and vulnerable residents. The AG also claims that Athena charges fees of up to 26% without disclosing them. Bitcoin purchased through other apps and exchanges typically has fees of 0.24% to 3%.

Meanwhile, in Iowa, the Attorney General is suing two crypto ATM companies under the Iowa Consumer Fraud Act. It is the AG’s claim that Iowans have lost at least $20 million in transactions to the two companies, CoinFlip and Bitcoin Depot. The investigation began in October 2023, when the office subpoenaed 14 crypto ATM companies. The subpoenas requested information on Iowans’ transactions through crypto ATM kiosks over a nearly three-year period. Investigators then called and emailed hundreds of Iowans who had made transactions through the crypto ATMs. The office also collected data using consumer complaints, police reports, and self-reported scams. The investigation has found that 98% of the money Iowans reported sending through Bitcoin Depot and 94% of the money sent through CoinFlip were scam transactions.

“(The AARP proposal) does a lot of things we have wanted to do, that is, put some kind of sticker or placard on the ATM as to what this thing is,” Malatesta says. “Have some notice on there that these things are used to perpetrate scams, and if someone is on the phone with you trying to get you to put money into this thing, that should be a giant red flag that this is a scam. The other thing that is exciting is limiting the amount of money that goes into these machines on a transaction. If a person takes a step back and thinks about it, they will not be scammed. If they have that break from that contact from the person who is on the phone with them, they are not likely to get scammed. I think that is one great thing in this proposal because it offers that break, that cooling period.”