AARP Hearing Center

The rising cost of essential necessities, including groceries, utilities, and health care, combined with the increasing fiscal burden created through higher taxes, are growing concerns for millions of Illinoisans, especially for older and retired Illinoisans living on fixed incomes. As countless Illinois households struggle to make ends meet, an overwhelming majority of Illinoisans aged 50 plus have come out in strong opposition to the prospect of a new tax on retirement income to fix the state's ongoing budget crisis. AARP conducted a survey of individuals 50 plus across the state and today revealed its compelling results during a press conference in the state's capitol.

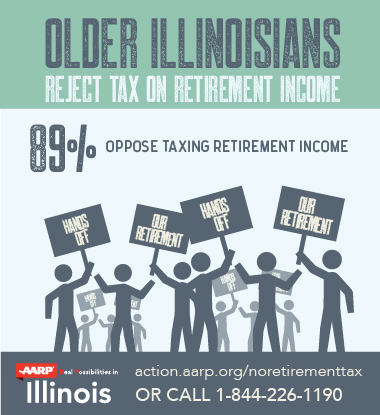

"Older taxpayers overwhelmingly reject a tax on retirement income as they know it would have a major impact on their household budgets, on their ability to prepare for a secure retirement, and even on their ability to stay retired," said AARP Illinois State Director Bob Gallo. "With nearly 9 in 10 older Illinoisans rejecting this proposed tax, there is a clear message to the Governor and to the General Assembly that taxpayers need to be at the table as the state tries to figure out how to put an end to its recurring fiscal crisis."

AARP Illinois' 2015 survey of 1,000 state residents ages 50 and older shows the unequivocal concerns of taxpayers regarding the state's current fiscal crisis, the divisiveness among Illinois' elected officials, and the impact that new taxes, particularly taxes on retirement income, could have on individuals and households.

According to the survey's results, over 87% of Illinoisans consider a lack of cooperation among Illinois elected officials as a major problem preventing a fix to the state's budgetary woes. Moreover, over two-thirds of Illinoisans view the amount of state and local taxes residents have to pay as a major problem.

The potential taxation of retirement income, in particular, faced strong opposition:

- Nearly 9 in 10 Illinoisans 50 plus oppose a proposal to tax retirement income;

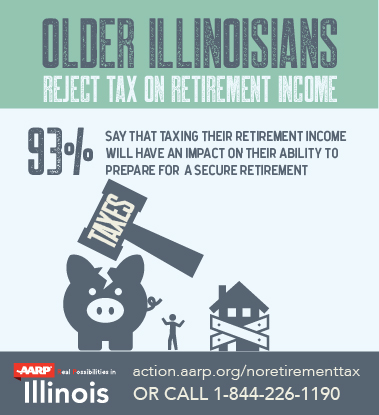

- Over 92% believe a tax on retirement income would have a negative impact on their household budget;

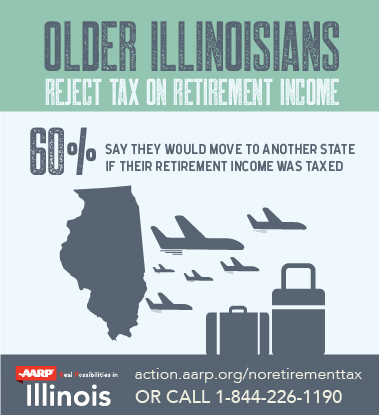

- Nearly 60% would consider moving to another state if Illinois starts taxing retirement income;

- Nearly 70% would be forced to reduce their household spending;

- A third would have to return to the workforce;

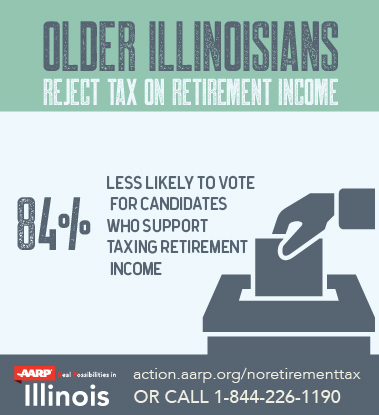

- Over 8 in 10 older Illinoisans (84.3%) would be less likely to vote for a candidate who supports taxing retirement income.

" Illinois retirees did not create the current state budget crisis and should not be singled out as the top-grossing revenue option to rebuild our state's economic outlook," Gallo added.

AARP, on behalf of its 1.7 million Illinois members and all individuals aged 50 plus and their families, has expressed its support for House Resolution 890, which opposes efforts to create a new tax on retirement income. AARP further stressed that Illinois retirees currently pay federal income taxes and state and local taxes, including motor fuel taxes, sales taxes, and the second-highest property taxes in the nation. Taxing retirement income, on top of their already existing tax burden, will drastically limit retirees' quality of life in Illinois and may serve as a catalyst to relocate to states where taxes are less burdensome.

Calls for taxing retirement income fail to acknowledge the vast number of older Illinoisans who contribute financially to the well-being of their children and grandchildren, and act as primary caregivers. Taxing retirement income will minimize a retiree's ability to care for their loved one's needs and provide assistance with food, housing, transportation and medical costs.

"AARP maintains its position that we need comprehensive reform proposals on the table, starting with an evaluation of a revenue system that aims to make life better for all, including retirees, working families, and low-income households," Gallo stressed. " Illinois needs a comprehensive look at all taxes paid by Illinoisresidents and businesses, and an equitable tax reform approach to raise revenue, rather than a piecemeal approach shouldered by Illinois' retirees."

AARP is asking Illinoisans to contact their legislators and urge them to oppose proposals to tax retirement income. AARP's toll-free hotline is 1-844-226-1190.