AARP Hearing Center

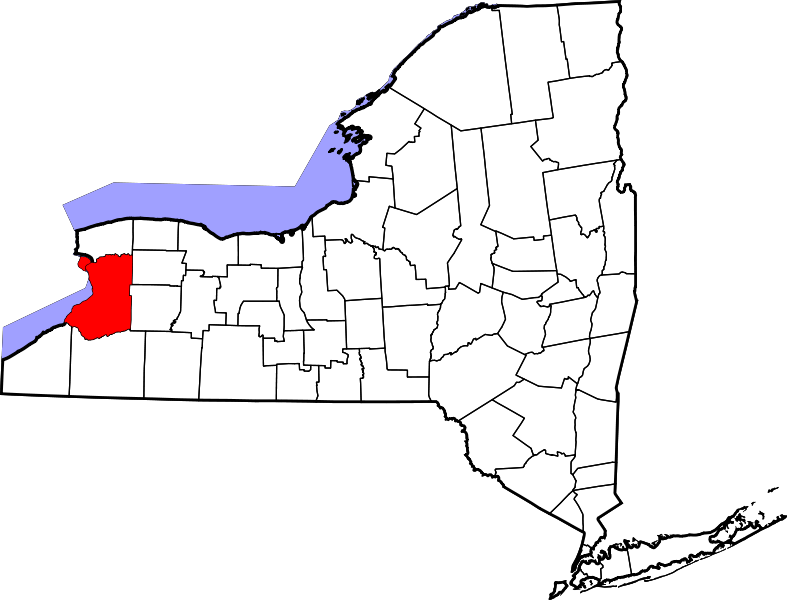

Erie County’s Gen Xers and Baby Boomers face major retirement savings hurdles that could deprive them of financial independence in their golden years - while increasing the need for taxpayer-funded public assistance, a groundbreaking AARP survey of voters in the two generations has found.

With the first Gen Xers turning 50 this year, AARP commissioned the survey of Erie County voters ages 35-69. High Anxiety: Erie County Gen X and Boomers Struggle with Stress, Savings and Security found sizeable majorities of Gen X voters are worried about not saving or planning enough for retirement, and with good reason, since over a quarter of them - and more than a third of Baby Boomer voters - have neither a work-sponsored nor personal retirement savings plan.

The survey, which parallels an AARP statewide survey, was released today during a round-table discussion at Salvatore’s Italian Garden that included Stanley Lichwala, CFP® for Wellsfargo Advisors LLC. It found high anxiety in Erie County as voters look toward retirement:

- 67% of Gen Xers and 59% of Boomers worry about not saving enough.

- 60% of Gen Xers and 56% of Boomers worry about not planning enough for retirement.

- 28% of Gen Xers and 35% of Boomers lack any kind of retirement savings plan.

- 20% of working Gen Xers and 24% of working Boomers are not confident they’ll ever be able to retire.

- 54% of both generations feel anxious about achieving a comfortable retirement.

Among working survey respondents, 18% of Gen Xers, 22% of Boomers and 39% of small business owners and employees lack access to any kind of employer-sponsored retirement savings plan – either a pension or a 401(k) type account. This lack of coverage is much worse for younger generations and private sector employees; statewide, 52% of private sector workers aged 18 to 64 – over 3.5 million New Yorkers - lack access to any kind of retirement savings plan through their employer, according to AARP research.

Workplace savings plans are critical since Americans are generally 15 times more likely to save for retirement when they have an option available for them to do so at work.

AARP NY is proposing a state-facilitated, payroll-deduction workplace retirement savings option for those who lack one. It would be modeled on the 529 college savings program and could help millions of New Yorkers help themselves achieve financial independence in retirement and avoid the need for taxpayer-funded assistance.

The plan has the backing of 64% of Erie County’s Gen X and Baby Boomer voters, and 73% of working survey respondents who lack employer-sponsored retirement savings options say they would take advantage of one if it were available. At this summer’s White House Conference on Aging, President Obama directed the U.S. Labor Department to develop guidelines by the end of the year for states to design and enact workplace retirement savings plans.

“As the first Gen Xers turn 50 this year, they are juggling multiple responsibilities – caring for aging parents, trying to pay for their own or their children’s college educations, and working long hours,” said Beth Finkel, State Director of AARP in New York State. “Lost is the time to manage their finances. A state-facilitated retirement plan would ease worries and promote savings among the many whose employers offer no 401(k) or pension.”

Adding to voters’ stress, 39% of Gen Xers don’t expect to receive any Social Security, 70% of Gen Xers are either current or expected future student loan borrowers for themselves and/or their children – and about two thirds of those say the debt makes it harder, or will make it harder, to save for retirement – and about four in 10 in both generations are concerned about affording their utility bills and their rent or mortgage in the coming years.

This high anxiety portends a potential “Gen-Xodus” from Erie County; 57% say they’re at least somewhat likely to leave the state in retirement, as do 48% of Boomers.

“Boomer flight and a ‘Gen-Xodus’ could prove a major drain on Erie County’s economy,” said Bill Armbruster, Associate State Director of AARP for Western New York. “The 50+ contribute disproportionately to New York’s GDP, not to mention their valuable cultural, family, social and volunteer contributions. We can’t afford to lose them.”

Despite their specific worries, the majority of working Gen X voters confident they’ll be able to retire expect to do so by 65, reflecting a reality gap paralleling national trends and underscoring the need for solutions. A lack of solutions could have dire consequences: 80% of survey respondents worry insufficient savings will make some New Yorkers reliant on public assistance.

Follow us on Twitter: @AARPNY and Facebook: AARP New York

AARP is a nonprofit, nonpartisan organization, with a membership of more than 37 million, that helps people turn their goals and dreams into real possibilities, strengthens communities and fights for the issues that matter most to families such as healthcare, employment and income security, retirement planning, affordable utilities and protection from financial abuse. We advocate for individuals in the marketplace by selecting products and services of high quality and value to carry the AARP name as well as help our members obtain discounts on a wide range of products, travel, and services. A trusted source for lifestyle tips, news and educational information, AARP produces AARP The Magazine, the world's largest circulation magazine; AARP Bulletin; www.aarp.org ; AARP TV & Radio; AARP Books; and AARP en Español, a Spanish-language website addressing the interests and needs of Hispanics. AARP does not endorse candidates for public office or make contributions to political campaigns or candidates. AARP Foundation is an affiliated charity of AARP that is working to win back opportunity for struggling Americans 50+ by being a force for change on the most serious issues they face today: housing, hunger, income and isolation. AARP has staffed offices in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. Learn more at www.aarp.org