AARP Hearing Center

For Ellen Klem and Billie McNeely, fighting elder fraud is an ever-evolving battle. But it’s well worth it if they can help older Oregonians lead safe, financially secure lives.

And occasionally, Klem says, they feel like they’re getting traction — such as with a project that has trained bankers to be on the lookout for large withdrawals or other transactions by older adults that may signal financial abuse.

But as soon as one crime seems to be easing, another one will pop up. That’s when Klem, an attorney in the Oregon attorney general’s office, and McNeely, a state investigator, realize their job is far from done.

Their work is one element of a wide-ranging effort by local, state and federal law enforcement officials — as well as nonprofit organizations such as AARP — to help older residents and their families protect themselves against fraud. AARP’s efforts will include two free events to highlight the latest fraud battles.

The most recent scams have involved cryptocurrency. Scammers devise a ruse to persuade a person to convert their money into cryptocurrency, sometimes to protect it from other criminals. The criminals walk a victim step-by-step through the process over the phone. Sometimes they direct them to a local crypto ATM, but the crime can be accomplished online without the victim ever leaving home.

And cracking those crimes is difficult, says McNeely, a financial exploitation special investigator for Adult Protective Services with the Oregon Department of Human Services.

“It’s hard for law enforcement or even the FBI to trace,” she says.

Fraud growing, changing

The stakes are high when older adults fall victim to financial crimes. On top of devastating financial losses, they may experience shame or embarrassment.

Everyone is susceptible to fraud, but for older Americans, it can be catastrophic, says Kathy Stokes, AARP’s director of fraud prevention programs. “When you’re 83 and you lose $800,000 and that’s all you had, it’s life-altering,” she says.

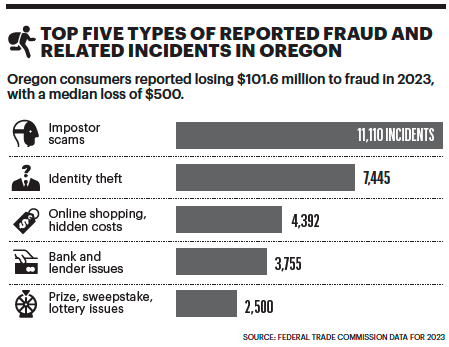

Elder fraud is on the rise, according to the FBI’s most recent annual report on the issue. And Oregon’s population is getting older, growing the target population: By 2030, 1 in 5 Oregonians will be 65 or over.

Klem got her start fighting fraud in the state after the 2012 election of Oregon Attorney General Ellen Rosenblum (D), who has made fighting elder abuse a top issue. Klem serves as the director of consumer outreach and education for the attorney general’s office.

“I was hired to … really prevent cases from coming to us in the first place,” says Klem, who has worked on legal issues affecting older adults for the American Bar Association in Washington, D.C.

Under Rosenblum, Klem says, the Oregon State Legislature agreed to fund positions dedicated to elder abuse prosecution. Now, a prosecutor and two investigators support local district attorneys’ offices that often lack the time and expertise to litigate complex financial cases.

On the preventive front, Klem has been part of education campaigns such as a “Just Hang Up!” program that encourages older adults to simply disconnect from callers they don’t know.

McNeely, a former police officer in Portland’s suburbs, assists with investigations, trains law enforcement on elder exploitation and educates bank employees on fraud prevention. In 2022, she won the Oregon Department of Justice’s Wilma’s Justice Award, recognizing outstanding work on behalf of older Oregonians.

McNeely says her commitment is fueled by heart-wrenching cases she sees. She recalls one man who ended his life after the savings he planned to pass to his children was stolen through fraud. In another case, a man lost $100,000 in a romance scam but refused to speak with authorities about it, insisting the romance was real.

Older adults who are isolated and lonely are the most vulnerable, McNeely says — “especially if the family’s not super involved.”

Learn how to protect yourself at oregonconsumer.gov and aarp.org/fraudwatchnetwork. More on AARP’s Strike Out Fraud event in July and a Scam Jam in September at aarp.org/or.

Stacey Shepard, a California-based journalist, writes about health care, the environment and other issues.

More on Fraud