AARP Hearing Center

In 2021, state lawmakers created the Texas Financial Crimes Intelligence Center to investigate stolen credit card information, forged checks and other types of financial fraud.

But the center soon expanded its focus to include crimes involving cryptocurrency, as losses to such fraud soared across the country. Many of the crypto schemes it investigates involve cryptocurrency kiosks, sometimes referred to as ATMs, says Corey Thomas, a criminal intelligence analyst with the center.

The crimes frequently involve older Texans who may not be as familiar with digital currency, Thomas notes. Individuals will deposit $3,000 to $30,000 or more into a crypto ATM—often losing “their entire life savings,” he says.

AARP Texas is urging lawmakers during the current legislative session to pass a range of fraud-fighting measures, including protections for consumers who use crypto ATMs. AARP wants limits on daily transactions, something that’s already been done in other states. It says that kiosk operators should also be required to post warnings about scams and be registered in Texas, thus helping law enforcement track suspicious activity.

AARP is also pushing for tighter regulations to combat fraud in the solar panel industry, including licensing requirements for salespeople.

Complaints about the solar industry have soared in recent years, says Stephanie Mace, an associate state director of advocacy and outreach for AARP Texas. They cover a range of issues—such as salespeople who get customers to sign 30-year contracts or who falsely claim that all customer costs will be offset by tax credits or electric bill savings.

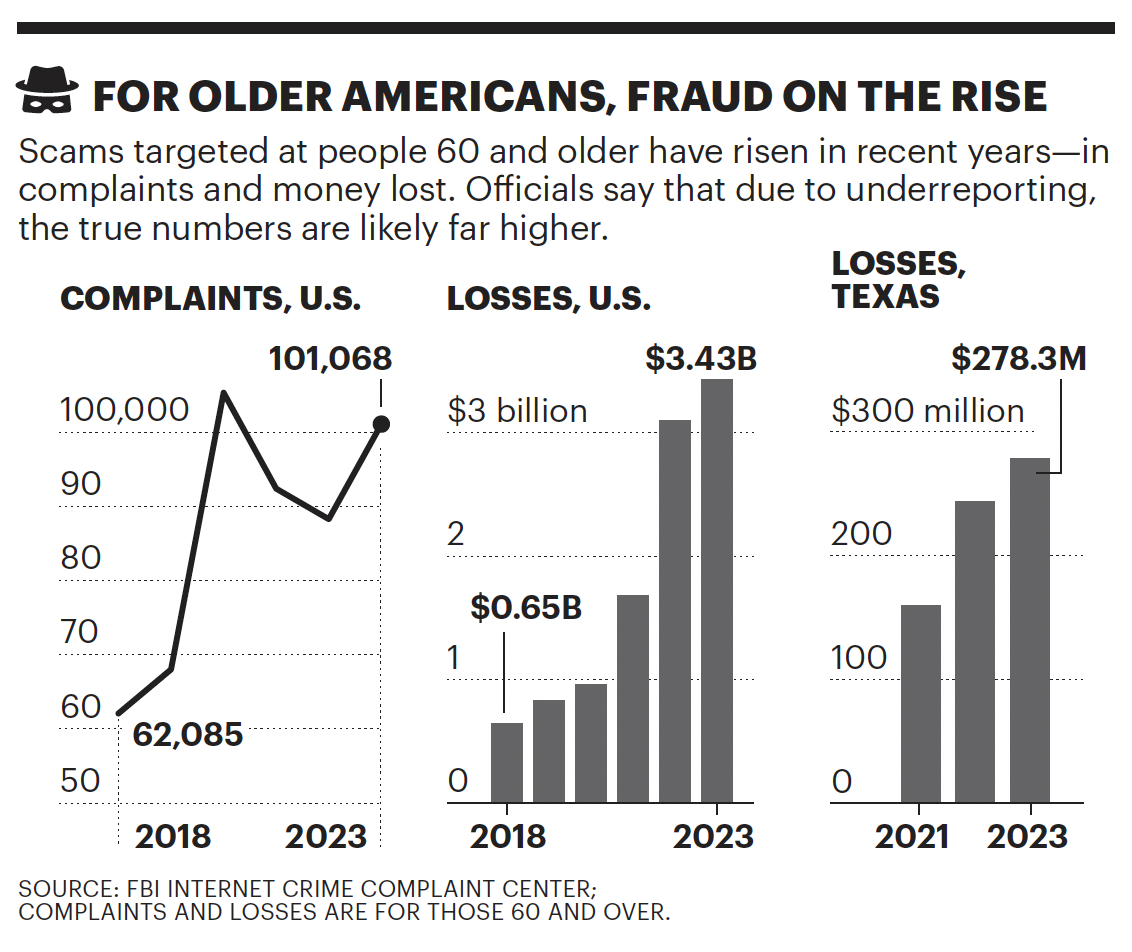

Losses on the rise

Statewide in 2023, consumers in Texas reported fraud losses totaling $663.4 million, Federal Trade Commission data shows. But officials note that fraud is typically underreported.

Scams involving cryptocurrency kiosks in particular are on the rise nationwide. Consumers in 2023 reported losing more than $110 million to scams involving crypto ATMs that take Bitcoin and other types of digital currencies, according to the FTC. That’s a nearly tenfold increase from 2020. Data from the first half of last year also shows that people over 60 were more than three times as likely as younger adults to report a loss using one of the machines, the FTC notes.

In crypto ATM scams, criminals often pose as government agents or bank employees and warn the person being targeted that he or she owes unpaid taxes or must pay a fine to avoid arrest. The scammers then instruct the individual to deposit money into a crypto kiosk to fix the problem. The machines often look like a traditional ATM and can be found in businesses such as gas stations.

AARP last year backed efforts in other states to regulate crypto kiosks. Vermont set a $1,000 daily cash transaction limit, while Minnesota capped daily transactions at $2,000 for new customers. In Texas, the state’s financial crimes center is working with AARP to pursue similar legislation.

Crypto schemes are among many other ways criminals target older adults, including romance scams, says Adam Colby, the center’s director.

AARP Texas is working to increase fraud awareness through community outreach events. It will hold “Texas Shred ’Em Day” on Saturday, May 3—a statewide event where Texans can destroy sensitive financial documents.

Residents can also learn how to spot and avoid fraud by attending presentations led by AARP volunteers. “You have to advocate for yourself,” says Enedelia Obregón, a 67-year-old AARP Texas volunteer who gives fraud talks in the Austin area.

Among Obregón’s tips: Don’t answer calls from unknown numbers. Don’t reply to emails or click on links from accounts or numbers you don’t recognize (even if the email or text appears to be from a friend). Remember that government agencies, banks and legitimate businesses will not call unsolicited and ask for sensitive information.

For more information on fraud prevention resources in your community, call 866-227-7443 or email aarptx@aarp.org.

Carina Storrs, a New York–based journalist, covers aging, health policy, infectious disease and other issues.

More on Fraud

- 25 Great Ways to Avoid Scams

- Five of the Biggest Scams to Watch For in 2025

- 10 Red Flags Your Tax Preparer is a Fraud