AARP Hearing Center

AARP Virginia is asking lawmakers to give people who take care of their loved ones at home at home a tax break.

Check back for updates on the status of legislation.

Tell your legislator to support the Family Caregiver Tax Credit.

Progress

- Jan. 10 — House Bill 1078 pre-filed by Del. Sam Rasoul (D-Roanoke) and referred to the Committee on Finance

- Jan. 10 — Senate Bill 419 pre-filed by Sen. Chris Head (R-Roanoke) and referred to the Committee on Finance and Appropriations

Background

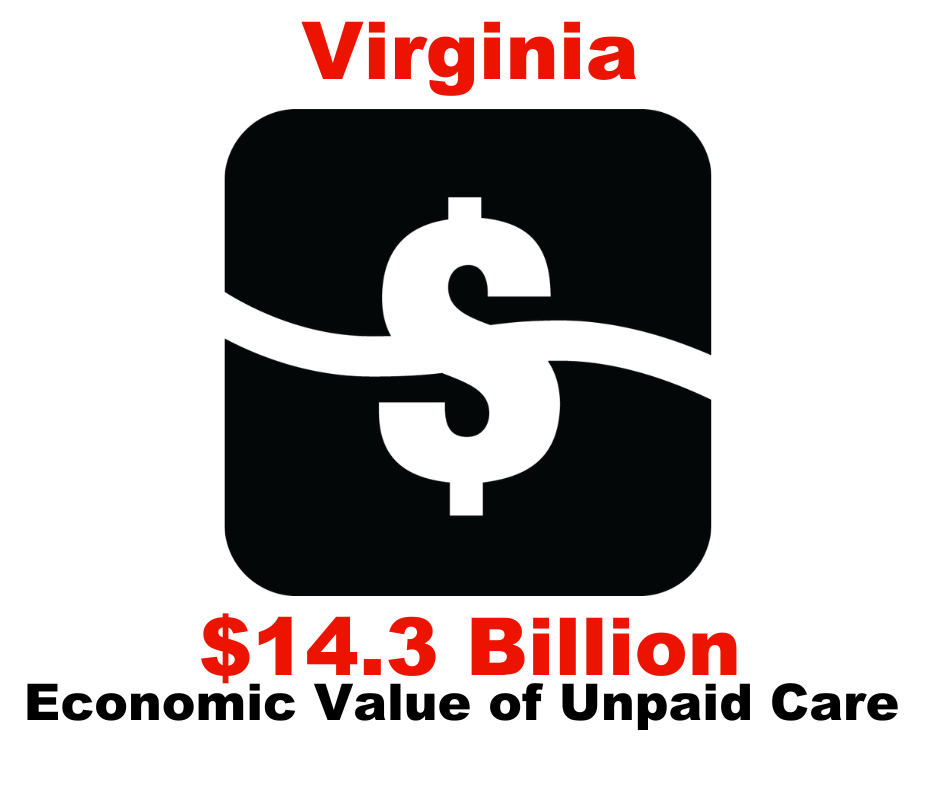

Nearly one million Virginians are providing unpaid care to loved ones.

- The economic value provided by Virginians caring for family members was $14.3 billion in 2021. Comparatively, Virginia’s total Medicaid spending for fiscal year 2021 was about $16 billion

- Family caregivers are a vital part of our healthcare system, and save Virginia taxpayers massive amounts of money by keeping people out of long-term care facilities and in their communities

- Family caregivers spend more than $7,200 per year — 26% of their income on average — on caregiving activities

The Policy

- Create a nonrefundable income tax credit of up to $1,000 for Virginians caring for a loved one

- Apply to eligible expenses incurred by an individual in caring for a family member, such as livability alterations to the person’s home, hiring a home care aide or equipment and technology that assists the family member in living their life

- Provide badly-needed relief to hard-working Virginians caring for family members, the invisible backbone of our healthcare system