AARP Hearing Center

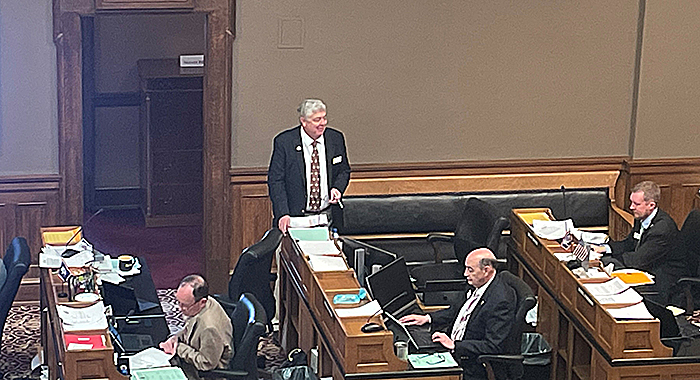

Mike Gierau leads debate on House Bill 99 during Friday's Third Reading of bills at the State Capitol.

The session isn’t completely over this afternoon, but it is winding down. In fact, I don’t see myself ironing a week’s worth of shirts this weekend. I might be good with just one or two freshly starched button-downs this week.

The tone of the House especially has gotten more of an edge as the session nears an end. If you didn’t see it, Leo Wolfson of the Cowboy State Daily did a great job of describing what was going on between two factions of the House. Check it out here. More on that issue as we talk about next week in Cheyenne. For now, here’s what you need to know from this week in the Capitol

- Property Tax Refund Passes Both Chambers

- Property Tax Amendment Still

- What Comes Next In The Session’s Final Week

Property Tax Refund Passes Both Chambers

The Property Tax Relief picture is starting to come into focus. On Friday, the Senate passed the Property Tax Refund program. The bill has now passed both chambers, but won’t go to the Governor’s Desk just yet. Senator Larry Hicks brought an amendment to change the amount of money applicants can ask to receive from 90% of their tax paid in the previous year to 75%, which is what the program currently allows.

A conference committee made up of three House members and three Senate members will now debate the version of the bill the House passed versus the version the Senate passed and hammer out a compromise. One thing we do know is that the program’s eligibility will be increased to allow those making 125% of the county median income to receive a refund. Click here to see if your household would be eligible for a refund if Governor Gordon signs the bill into law. Once these changes become law we will work with the Revenue Department to make sure folks know how to apply for the refund.

Moving HB99 forward was our top priority for AARP Wyoming during the 2023 session, so color us thrilled with today’s news. Thanks for the impassioned pitch on the Senate floor from Senator Mike Gierau. Also speaking on behalf of the bill were Bill Landen, Tara Nethercott, Wendy Schuler, Dan Dockstader, and others.

There is one other property tax relief bill still out there. Senate File 136 would lower the state’s property tax rate from 9.5% to 8.5% until 2025. The major criticism of this bill has thus far been its fiscal note (cost to the state) of up to $40 million per year by 2026. The bill currently sits in House Appropriations. If the bill isn’t reported out of House Appropriations by Friday afternoon, the bill is dead.

Constitutional Amendment for Elderly and Infirm Still Alive

We came into the Legislative session with around 10 bills that sought to offer property tax relief, including some that would amend the Wyoming Constitution to make such relief permanent. Currently, there is just one amendment still alive. Senator Dan Dockstader’s Senate Joint Resolution 3. It is a very simple bill that would trigger a statewide vote to add property tax relief for the elderly and infirmed to the constitution.

If that vote passed, it would be up to the Legislature to determine how that property tax relief is granted and to whom. Right now, the bill suggests it would be limited to those age 75 and over who have lived in Wyoming for 40 years. Our recommendation is to make those requirements as open as you can, lest the constitution have to be re-opened each time there was an interest in changing the terms of the relief.

SJ003 was supposed to be heard on third reading in the House on Friday, but was laid back as more amendments are coming. If you want to send a note to your House member to encourage them to vote yes on SJ003, feel free to use this link.

What Comes Next

We’ve written about bills that die an administrative death by not hitting deadlines and you are about to see a lot of that take place next week. The House has been debating each bill to death on all three readings and as a result, expect a number of bills to die before Monday’s deadline for first reading.

Since Legislative Subcommittees are no longer hearing bills (the deadline to pass bills out of committees was Friday), the committees do meet next week to consider interim topics. The process involves individuals and organizations making a pitch to lawmakers for specific topics to be studied by their committees. The committees then ask the Legislature’s Management Council for permission to study their favored topics and the Management Council assigns a list of topics to each committee.

AARP Wyoming asked for three topics to be considered in the interim. They are:

Long Term Care and Aging Costs: The State’s Medicaid program spent $200 million on long term care like nursing home and home services for older adults who cannot afford them in Wyoming last year. There were roughly 70 contested races for legislative seats last year and the topic of long term care for older adults was probably not mentioned once. The topic doesn’t make for good political theater on Facebook, but how we take care of our older adults who need care is important and we intend to make sure our lawmakers are aware of that.

Legislative Process: If you have ever looked at the billtracker and noted the headlines in the paper and the bill text itself doesn’t seem to match up, it could be due to the way amendments and versions of amended bills are reported. If amendments are approved on a bill, they are listed separately from the bill and there is not an “engrossed,” version of the bill until that bill moves to the other chamber of the Legislature. That means lawmakers may not understand what they are voting on, and difficulty on the part of the public in taking part in the legislative process. We’d like to find out if there are other options for this process.

Retirement Security for Private Businesses: Did you know if you have the opportunity to save for retirement through a workplace deduction you are 15 times more likely to save for retirement? How do we make it easier for our working age adults to save for retirement so they don’t outlive their savings? Other states are looking into this issue and so should Wyoming.

On Wednesday, March 1, the Governor will sign a proclamation declaring Wyoming a Hidden Heroes State – which recognizes the caregivers of veterans across Wyoming and shines a light on some of the available resources. This proclamation is something that AARP and the Elizabeth Dole foundation have worked on together and has recently been signed by Governors in North Carolina, Montana, and other states. Keep an eye out next week and we will share more information what it means to be a Hidden Heroes State next week.