AARP Eye Center

By Laura Mecoy

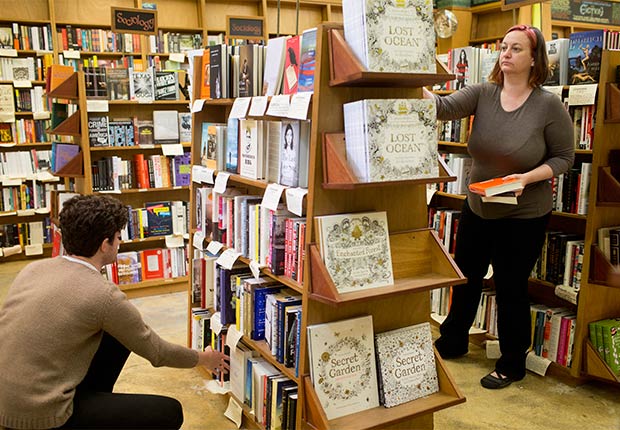

The Booksmith’s 12 employees are like many other retail workers in San Francisco: They are more worried about paying their sky-high rents than saving for retirement, owner Christin Evans said.

So while Evans wanted to provide a retirement savings plan, she said she couldn’t justify the cost and administrative burden of creating one for the bookstore’s workers.

Now Evans is looking forward to the adoption of state legislation that would implement the California Secure Choice Retirement Savings Program, which she sees as a winning option for small businesses.

Under the proposal, which advocates expect will pass this year, small businesses could provide a retirement plan with minimal administrative costs and responsibilities.Their employees could save for the future, through an automatic payroll deduction, and take their accounts with them when they switch jobs.

“This is a low-threshold, easy-to-use program that is quite ideal for our employees,” Evans said. “Most of our staff will go on to another step in their career, so portability is important to them.”

About 7.5 million Californians work for employers that don’t offer retirement plans. Two-thirds of these workers are employed by businesses with 100 or fewer employees. Already, 19 percent of state residents 65 and older rely on Social Security for almost all their income, and almost a third have incomes less than 200 percent of the federal poverty level, considered a measure of economic hardship in high-cost California.

“Far too many Californians don’t save for their retirement because their employers don’t offer a 401(k) or other retirement program,” said Nancy McPherson, AARP California state director. “Secure Choice will change that by giving workers an easy way to save, helping them build a more solid financial future.”

In 2012, California took the first step toward a voluntary retirement savings plan, establishing the California Secure Choice Retirement Savings Investment Board. A recent study for the board determined that the retirement plan was legally and financially feasible.

Automatic enrollment

Now the California Legislature is considering a bill by Senate President pro tempore Kevin de León (D-Los Angeles) to implement the program. The state would join Illinois, Oregon, Washington, New Jersey and Maryland in launching “work and save” plans.

“Our goal is to get this bill signed by the governor this year to have the program up and running as soon as possible so workers can start to build their retirement savings,” de León said.

Under the proposal, employers who don’t provide a retirement plan and employ five or more people would be required to offer the Secure Choice program to their staff. The employers would automatically enroll workers in the savings plan unless an employee decided to opt out.

Employees could contribute between 2 and 5 percent from each paycheck to their savings plan. The amount contributed could escalate each year up to 8 percent. Upon retirement, employees could withdraw all their funds or receive monthly checks. The exact contribution percentages and the taxable status of contributions and withdrawals are yet to be determined.

The investment board would oversee the program and work with financial institutions on savings plans to be offered.

Anne Staines, president of Sagent Marketing, said Secure Choice holds great promise for small businesses like hers. She said she had to spend more than 80 hours poring over a thick binder of information and completing the paperwork just to set up the 401(k) plan for her Sacramento business that employs 10 people.

“It is frightening for a small business to go from one person to hiring employees,” she said. “Secure Choice would be a turnkey solution to help businesses get from that one-person stage to having employees to whom they can offer a package of benefits, including retirement savings.”

For more information about Secure Choice, go to SecureChoiceCA.aarp.org.

Laura Mecoy is a writer living in Los Angeles.