AARP Hearing Center

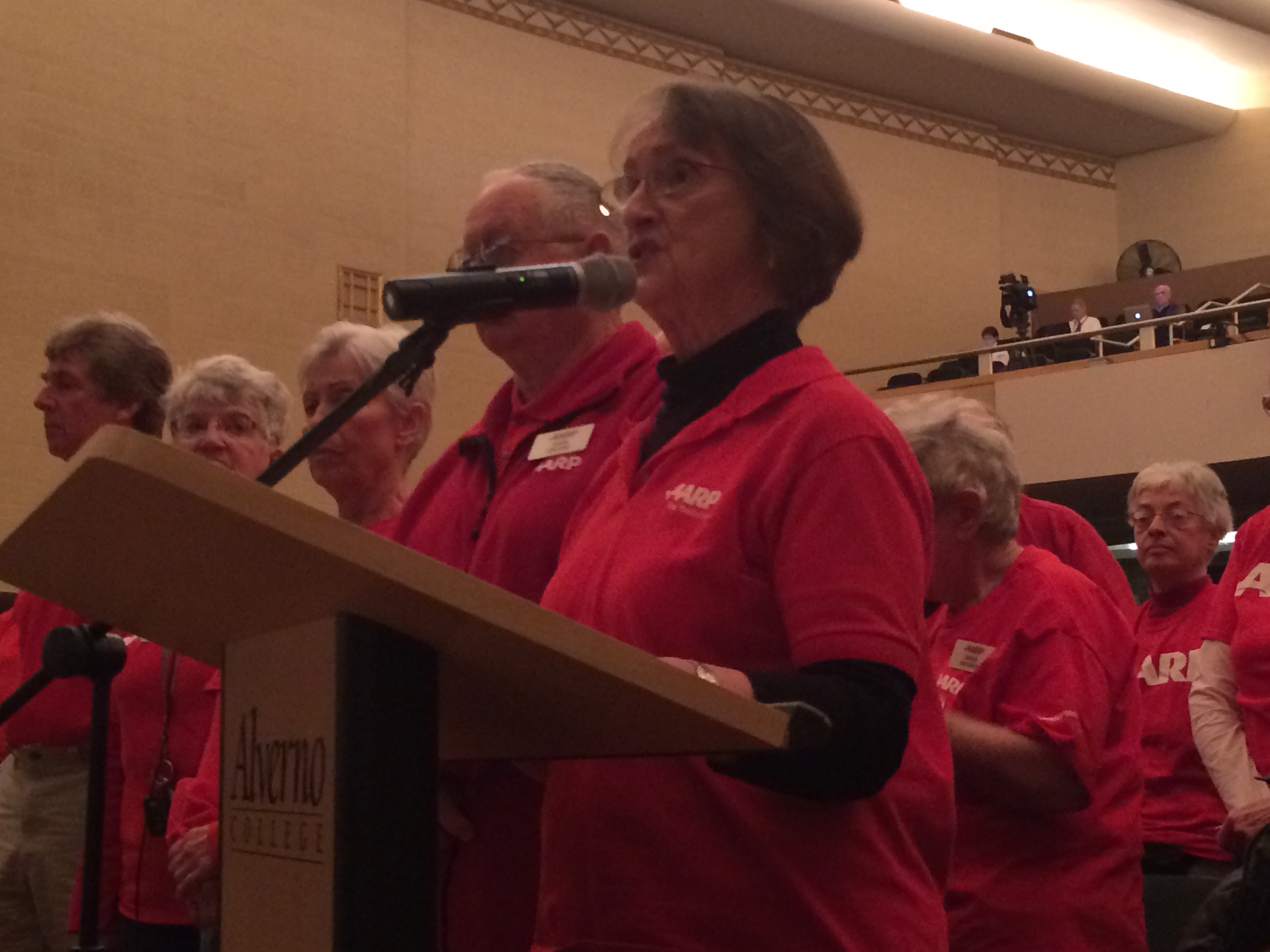

The following testimony was provided by AARP Executive Council Member Sandy Drew at the Joint Finance Public Hearing in Milwaukee on March 20, 2015.

Good morning. My name is Sandy Drew. I am a member of the Executive Council and a volunteer advocate for AARP Wisconsin. I am serving as the spokesperson for the group of AARP Wisconsin Advocates here today.

AARP Wisconsin has four major issues they wish either be included in or removed from the Governor’s proposed budget. We hope to see the language concerning SeniorCare and the changes to Family Care removed. We hope to improve the budget by adding Medicaid expansion and including the language in the proposed Wisconsin Private Secure Retirement Act. Since there are four hearings and four important positions for AARP Wisconsin, we plan to address one of these important issues at each of the four hearings. Today I am going to talk about SB 45/AB70, the Wisconsin Private Secure Retirement Act and why it should be added to the budget.

Wisconsin has a national reputation in the field of pensions due to our well-funded and well-managed Wisconsin Retirement system, which is available to public employees. We would like to build on that expertise and create a similar system for private sector employees. By creating a system to pool the retirement savings of those private employees without a retirement saving plan currently available to them at their place of employment, we can help them achieve a more secure financial retirement.

We think the Wisconsin Private Secure Retirement Act (SB45/AB70) should be put in the budget because it requires a small investment in this budget but could have a very huge impact on future state budgets. Budgets help plan for the future both for state government and for the residents of our state. Putting the Wisconsin Private Secure Retirement Act in the budget will be an important signal to Wisconsinites, who want financial security and peace of mind during retirement, that the ability to adequately have a retirement nest egg in place in not limited to those who have the luxury of those options being offered by their employer. There is much talk of the aging tsunami and the effect it may have on government programs. This is a way to help people help themselves so they can work and save for a more independent future and not find themselves dependent on government services throughout their retirement years.

The Wisconsin Private Secure Retirement Act is a commonsense solution that explores the idea of a public-private partnership (modeled on the Wisconsin Retirement System) that would allow private workers to save for retirement at work via payroll deduction. We are asking today that the Joint Finance Committee include the cost of the feasibility study in the budget. This proposed feasibility study requires limited state funding but is needed to decide if Wisconsin should move forward with this idea.

There is a need to help people save for retirement. The average household has only $3,000 in retirement savings. 30% of Wisconsin’s seniors have only Social Security as their income. The average Social Security benefit in Wisconsin is $1,281 per month. Wisconsin workers have very limited access to retirement savings plans at work. 42% of Wisconsin workers have no access to a work place savings plan. And studies show that people are 1300% more likely to save for retirement if it is done through the workplace.

What features are there in a Wisconsin Private Secure Retirement Plan that would make it attractive to both the employee and the Joint Finance Committee? First, the plan would be portability so that the employee could keep paying in even if they change jobs. Two, it would have low costs to employees and low initial costs, and eventually no cost, to the taxpayer. Third, there is no ongoing cost or fiduciary risk for the state. The state is not responsible for employees’ gains or losses in the market. Fourth, the plan is intended to be self-sustaining and 100 percent participant-funded after initial start-up costs. Fifth, ease of administration would allow employee contributions to be deducted automatically from each paycheck. Lastly, it would be voluntary. Employees have the choice. It’s up to each employee to decide if, and how much, he or she wants to contribute to an account.

So what is the takeaway for members of the Joint Finance Committee? The inclusion of SB45/AB70, the Wisconsin Private Secure Retirement Act, in the budget would allow the state to explore all of the potential benefits that have been stated in my testimony. It would allow the state to take a solid first step toward facilitating new models of retirement savings that foster financial independence and choice for employees seeking greater opportunity to prepare for retirement. And, it has the potential to put the state on a positive trajectory toward easing future growth of safety net programs that are often the only way Wisconsinites have to alleviate their financial shortfalls during retirement.

Please add SB 45/AB70 the Wisconsin Private Secure Retirement Act to the budget.

Thank you.