AARP Hearing Center

Since the new administration took office in Washington, D.C., AARP has initiated a campaign to champion the Credit for Caring Act. This proposed legislation seeks to provide working family caregivers with a non-refundable tax credit to help alleviate caregiving expenses.

We’re giving Congress 100+ reasons to prioritize a tax credit for family caregivers in the first 100 days of the new presidency. Reason #1 in the series, for example, reveals that family caregivers, on average, spend over $7,200 annually — 26 percent of their income — on out-of-pocket caregiving costs. Reason #60 focuses on the economic value of unpaid family caregiving, which is roughly $600 billion per year.

We’ll share your reasons with Congress so that they understand what family caregivers experience day-in and day-out as they care for their loved ones.

It’s time for Congress to put money back in the pockets of these hardworking Americans by including a tax credit for family caregivers in the tax package.

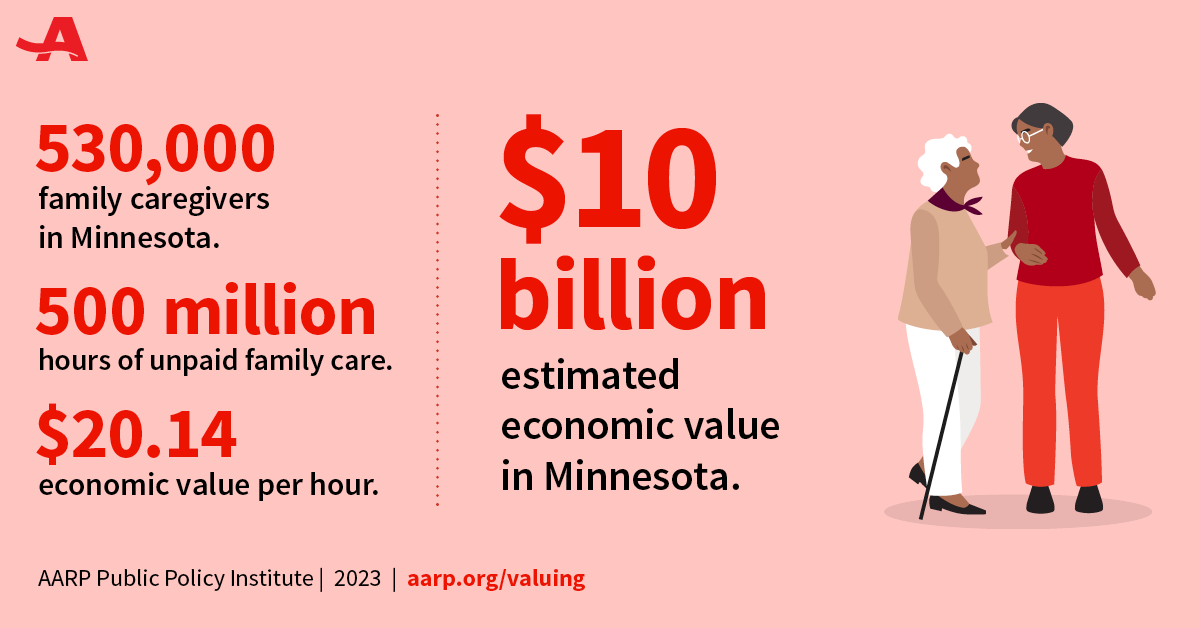

Family caregivers put family first. They take responsibility to help their parents, spouses and other loved ones stay at home—where they want to be. Without the 500 million hours of unpaid labor Minnesota caregivers provide each year, more older Americans would be forced out of their homes and into costly nursing homes—with the government and taxpayers footing the bill.

Family caregivers play a vital role in Minnesota’s health care system, whether they care for someone at home, coordinate home health care, or help care for someone who lives in a nursing home. We want to ensure all family caregivers have the financial, emotional and social support they need, because the care they provide is invaluable to those receiving it and their community.

Advocating for the Credit for Caring Act

The goal of AARP’s 100 Reasons campaign is to increase support for the millions of working family caregivers across the country who largely go unrecognized. There are more than 48 million unpaid caregivers in the U.S. and 61 percent of them are juggling either full or part-time work, according to AARP and S&P Global research.

AARP has endorsed the Credit for Caring Act since it was first introduced into Congress. Over the past year, our members have sent more than half a million letters to lawmakers in support of the proposal. Earlier this month, AARP was one of over 100 organizations and companies that signed a letter to Congress urging members to take up and pass the proposal in any upcoming tax legislation.