AARP Hearing Center

In the next decade as many as 750,000 Minnesotans will reach retirement age. However, according to a recent AARP Survey, an alarming number of them haven’t saved nearly enough.

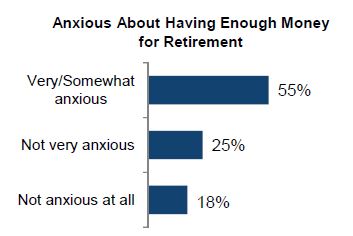

Approximately half of all workers surveyed expressed worry that they won’t be able to save enough for retirement and 36% reported that they are behind on their retirement savings. Compounding this problem is the fact that 40% of Minnesota workers – around 1 million people – don’t have access to a retirement plan at work.

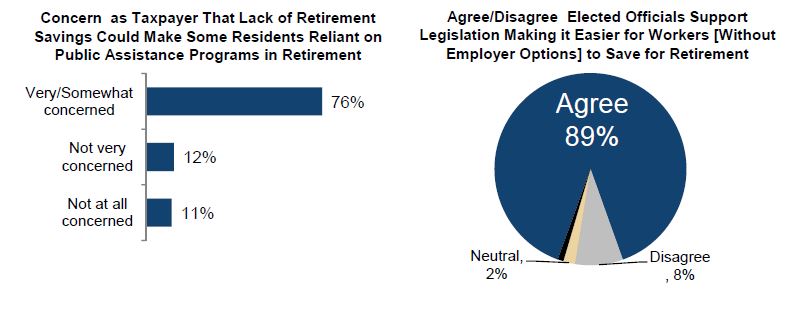

Across the nation, states have begun creating alternative savings models where workers can invest their own funds and not be subject to unfair fees and withdrawal penalties. Support for such a plan was overwhelming in the AARP survey, 79% said they would invest in such a plan if it was available and 89% think the state should pass legislation making it easier for workers to save.

With a rapidly aging state, financial security in retirement – or the lack thereof – could have a severe impact on Minnesota’s economy. More than 76% of the people AARP surveyed indicated they were concerned the impact that a lack of retirement savings for a large segment of state workers will have on social safety net programs.

To view the full survey visit: www.aarp.org/retirementsavingsMN