AARP Hearing Center

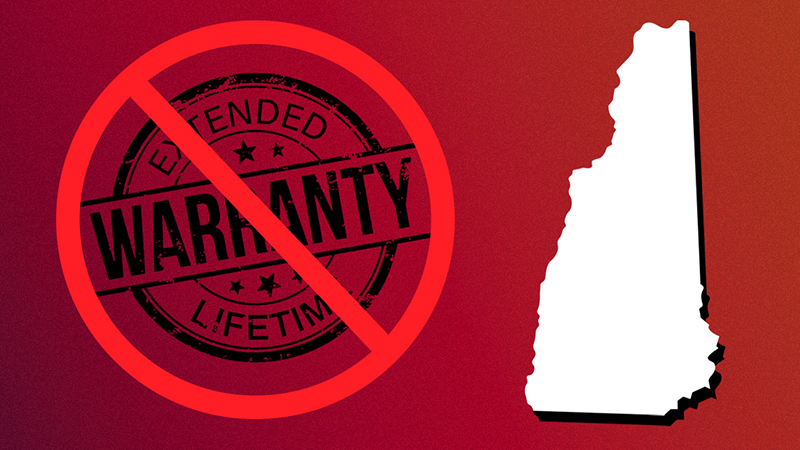

The Granite State is cracking down on companies that use aggressive tactics to sell fraudulent extended warranties to older adults, thanks in part to advocacy from AARP New Hampshire.

Many products these days — cars, cellphones, appliances — come with a free manufacturer warranty, which is basically a promise from that company that your product will be repaired or replaced if it’s faulty or becomes damaged within a certain period. Extended warranties provide similar guarantees, but usually for more years than the manufacturer’s standard warranty. They are often sold by a third party, cost extra and have different terms and conditions than the original warranty.

But fraudsters have increasingly infiltrated the extended warranty market, adopting fearmongering tactics that pressure consumers into paying for fake coverage, or selling coverage that never comes to fruition.

The AARP-backed law that takes effect Jan. 1 aims to stop such behavior. It outlaws marketing flyers that lack information about the company selling the warranty. It also requires all warranties to be registered with the state and gives the New Hampshire Insurance Department more authority to go after vendors selling bogus warranties.

"These measures are vital for ensuring that consumers are not misled or exploited by unscrupulous businesses seeking to profit through deceptive practices,” said AARP New Hampshire State Director Christina FitzPatrick. “By enhancing oversight and accountability, the law will contribute to building trust between consumers and the businesses they engage with."

Protecting older adults from fraud

The bill passed the state legislature with bipartisan support, and Gov. Chris Sununu signed it into law July 3.

In a news release after the law was enacted, New Hampshire Deputy Insurance Commissioner Keith Nyhan credited AARP and other organizations for helping to pass the bill.

“By strengthening enforcement measures and enhancing consumer protections, we are creating a fairer marketplace for everyone,” Nyhan added.

In 2023, the state insurance department received nearly 100 complaints about extended warranties, also known as consumer guarantee contracts, New Hampshire Insurance Commissioner DJ Bettencourt wrote in an op-ed published in the New Hampshire Business Review in March.

Marketers targeted older adults, often with aggressive tactics that created “a false sense of urgency through limited-time offers, deadlines or discounts,” he said. He said the complaints resulted in the recovery of nearly $30,000 in fraudulent charges and pointed to one case involving an older adult who lost $5,000 after purchasing an extended warranty for a furnace.

The new law “establishes protections against financial exploitation of senior citizens and ensures fair treatment in claims handling and contract cancellations,” the insurance department news release said.

Learn more about how to protect yourself from scams and keep up with our advocacy work in New Hampshire.

Natalie Missakian covers federal and state policy and writes AARP’s Fighting for You Every Day blog. She previously worked as a reporter for the New Haven Register and daily newspapers in Ohio. She has also written for the AARP Bulletin, the Hartford Business Journal and other publications.

Also of Interest:

A Brief Guide to Extended Warranties

Is an Extended Car Warranty Worth the Cost?

AARP Applauds New Financial ‘Bad Actor’ Registry