AARP Hearing Center

The word is out on the IRS scam phone calls (click here here and here.) So the scammers have upped their game to mail, and it’s quite convincing at first. Since the IRS has said they would never call you demanding money for payment, only send mail letters, it was only a short amount of time until these frausters did so too.

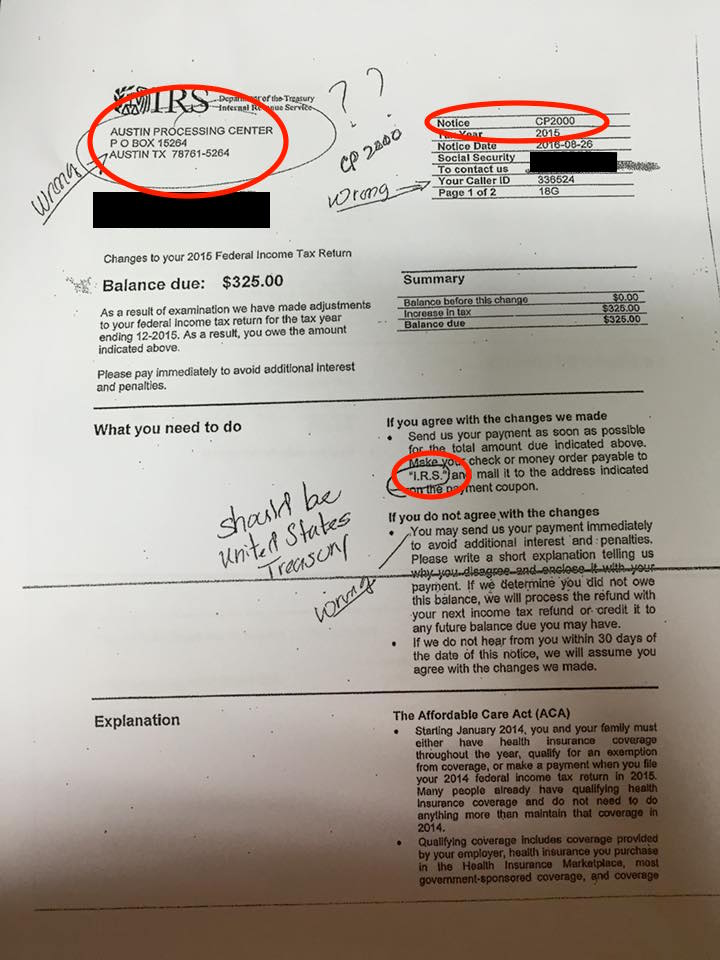

How do you know it’s phony? Let’s take a look :

- The processing center in Austin address is incorrect. The correct address is on the IRS website.

- The form number doesn’t exist (but that doesn’t mean the fraudsters won’t change it)

- You never make a check out to the IRS but rather the Treasury Department.

Here’s what the IRS tells you to do if you get a letter you can’t deem authentic. If you know someone who doesn’t have internet access, the phone number for the IRS hasn’t changed in decades: 800-829-1040.

You receive a letter, notice or form via paper mail or fax from an individual claiming to be the IRS but you suspect they are not an IRS employee go to the IRS home page and search on the letter, notice, or form number. Fraudsters often modify legitimate IRS letters. You can also find information at Understanding Your Notice or Letter or by searching Forms and Pubs .

- If it is legitimate, you'll find instructions on how to respond or complete the form.

- If you don't find information on our website or the instructions are different from what you were told to do in the letter, notice or form, call 1-800-829-1040 to determine if it’s legitimate.

- If it's not legitimate, report the incident to TIGTA and to us at phishing@irs.gov.