AARP Hearing Center

When AARP volunteer Toni Mula gives presentations about Social Security at community events, the 61-year-old retired U.S. Air Force pharmacist finds that many people come to learn the basics. They don’t expect to also hear that the federal program is facing financial uncertainty.

With its trust fund reserves shrinking, the program may not have enough money to fully cover benefits by 2035, according to a 2024 report by the Social Security Board of Trustees.

“There definitely needs to be something done, because [for] a lot of people, [Social Security is] their only income,” says Mula, who lives in the Minneapolis suburb of Edina.

That’s why AARP Minnesota is ramping up efforts to increase awareness about the importance of Social Security and encourage candidates in the November election to make shoring up the program’s finances a priority.

Social Security is critical for many older adults, helping to keep a roof over their heads, put food on the table and pay for life saving medications, says Cathy McLeer, AARP Minnesota state director.

“We want everyone in Minnesota to be asking their elected officials and candidates how they will work to protect Social Security for both current and future generations,” McLeer says.

The AARP state offices in Minnesota and North Dakota are teaming up to host the Social Security Thought Forum: Economic Power of the 50+ on Tuesday, Aug. 27, from 10 a.m. to 2 p.m., in the Fargo-Moorhead area. It will bring together economic and demographic experts and lawmakers to discuss ways to protect Social Security. AARP Minnesota will also pair up with the AARP Wisconsin office for Social Security events on Monday, Oct. 21, in Superior, Wisconsin, and on Tuesday, Oct. 22, in Duluth, Minnesota. All sessions will be open to the public.

Minnesota residents can also get Social Security information from AARP at the Minnesota State Fair in St. Paul and at Farmfest in Morgan, in south-central Minnesota. AARP volunteers will educate attendees about what’s at stake and distribute handouts with questions about Social Security to discuss with elected officials and candidates at town halls and other events.

Searching for solutions

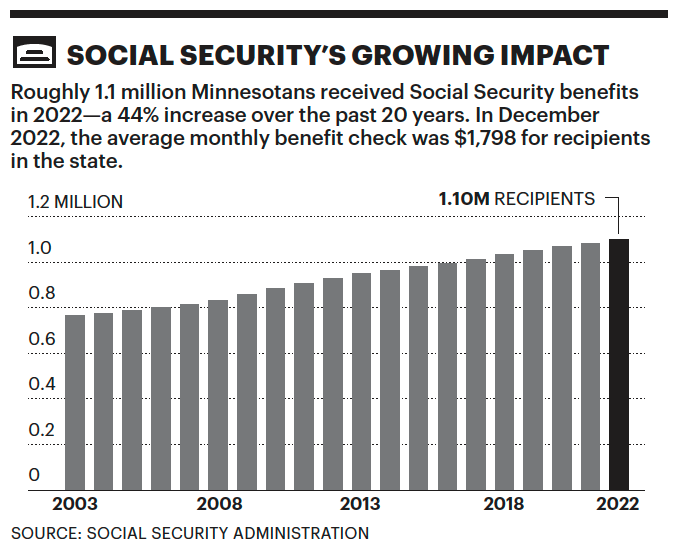

Roughly 1.1 million Minnesotans receive Social Security benefits — approximately 78 percent of those are retirees.

An estimated 42 percent of Minnesota recipients who are 65 and over, or nearly 392,000 people, live in families that rely on the program for at least half of their income, according to AARP Public Policy Institute research.

“The need for Social Security is only going to grow,” says Susan Brower, the Minnesota state demographer.

In 2023, some 17.4 percent of Minnesotans were 65 and older, U.S. Census Bureau data shows. The Minnesota State Demographic Center estimates that by 2030, 20 percent of the state’s residents will be in that age group. Brower attributes this increase, which is occurring across the United States, to boomers aging.

Other factors contributing to Social Security’s challenges are longer life expectancies and lower birth rates, resulting in fewer workers contributing to the program. Also, the payroll tax rate for the program — 12.4 percent — has not increased since 1990.

Boomers have less stability than previous generations because employer-sponsored pension plans started going away during their tenure in the workforce, says Brower, who will participate in AARP’s Aug. 27 forum. Younger generations have the further challenge that they have been less able to buy homes and build wealth that way, Brower adds.

Congress needs to start thinking about Social Security funding as soon as possible so the program does not get close to the point where it would be unable to fully cover benefits, McLeer says.

Get details about AARP’s upcoming Social Security events at aarp.org/mnevents. ■

Carina Storrs, a New York–based journalist, covers aging, health policy, infectious disease and other issues.

More on Social Security