AARP Hearing Center

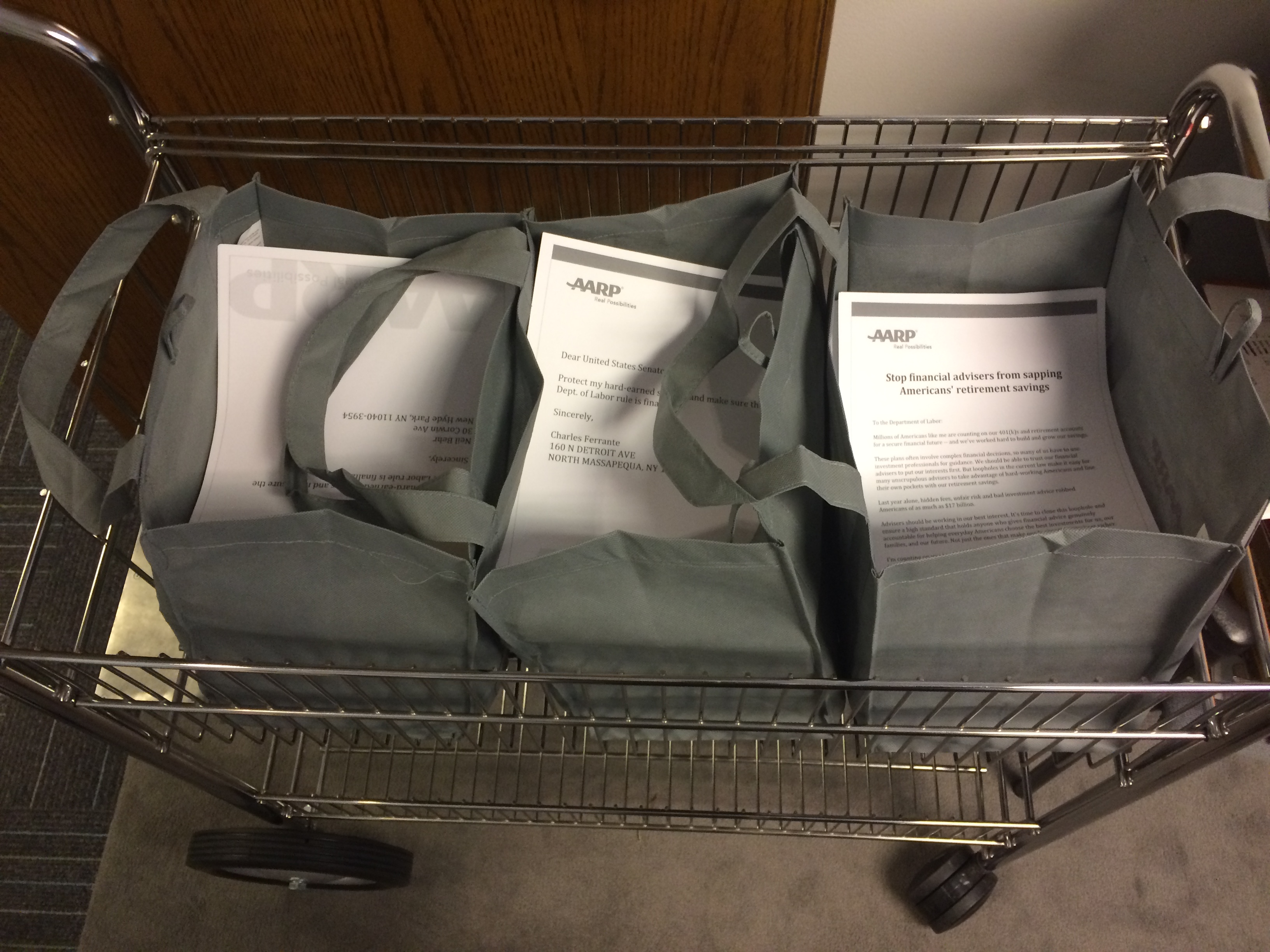

NEW YORK, NY – AARP this week delivered over 5,000 petitions to U.S. Senators Charles Schumer and Kirsten Gillibrand urging New York’s representatives to reject any congressional interference in a move to protect the retirement security of millions of hard working Americans who have been losing an estimated $17 billion a year to unscrupulous investment advisors.

President Obama visited AARP in February to announce plans to “close the loophole” in current rules that allows investment advisors to put their own financial interests ahead of clients when making recommendations about retirement accounts. He directed the U.S. Department of Labor to develop new standards that protect Americans’ hard-earned savings by ensuring financial professionals act in the client’s best interest.

“As traditional pensions continue to disappear, 401(k) plans and other retirement plan investments become all the more critical,” said Beth Finkel, State Director of AARP in New York State. “It is absolutely crucial and simple common sense that this loophole be closed to ensure financial advisors act in their clients’ best interests.

“Investments are complex and can be confusing, and most Americans can’t be expected to know good investments from bad,” Finkel added. “That’s why they count on professionals’ advice. We are calling on Senators Schumer and Gillibrand to do the right thing and resist the inevitable attempts at interference with efforts to close the loophole.”

While many investment professionals do what’s right, the loophole allows some on Wall Street to take advantage of hard-working Americans by recommending:

- Investments with higher fees, riskier investments, and investments with lower returns - to make higher profits for themselves.

- Rolling over 401(k) savings into IRAs with higher investment expenses than those in the 401(k).

- Investing IRAs in variable annuities that charge high fees, lock up money for years, and provide no tax benefits beyond what the IRA already offers.

Analysis shows that a retirement saver who moves money out of a 401(k) plan and into an IRA based on conflicted advice can expect to lose 12 to 24 percent of the value of his or her savings over 30 years – about five years’ worth of retirement savings.

A 2013 report by the Government Accountability Office (GAO) found financial firms:

- Aggressively encouraged rolling 401(k) plan savings into an IRA with only minimal knowledge of a client’s financial situation.

- Claimed 401(k) plans had extra fees and IRAs “were free or had no fees,” or argued that IRAs were always less expensive, even though the opposite is generally true.

- Sometimes offer financial or other incentives to financial advisers who persuade workers to perform a rollover.

The President’s proposal would require that all financial professionals who offer retirement advice make recommendations designed to serve the client’s best interests.

Contacts: Erik Kriss, ekriss@aarp.org; Donna Liquori, dliquori@aarp.org

Follow us on Twitter: @AARPNY and Facebook: AARP New York

AARP is a nonprofit, nonpartisan organization, with a membership of more than 37 million, that helps people turn their goals and dreams into real possibilities, strengthens communities and fights for the issues that matter most to families such as healthcare, employment and income security, retirement planning, affordable utilities and protection from financial abuse. We advocate for individuals in the marketplace by selecting products and services of high quality and value to carry the AARP name as well as help our members obtain discounts on a wide range of products, travel, and services. A trusted source for lifestyle tips, news and educational information, AARP produces AARP The Magazine, the world's largest circulation magazine; AARP Bulletin; www.aarp.org ; AARP TV & Radio; AARP Books; and AARP en Español, a Spanish-language website addressing the interests and needs of Hispanics. AARP does not endorse candidates for public office or make contributions to political campaigns or candidates. AARP Foundation is an affiliated charity of AARP that is working to win back opportunity for struggling Americans 50+ by being a force for change on the most serious issues they face today: housing, hunger, income and isolation. AARP has staffed offices in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. Learn more at www.aarp.org .

####