AARP Hearing Center

100+ AARP Volunteers from Across NYS Urge Legislators to Include Governor’s Voluntary “Secure Choice” Option in Final State Budget

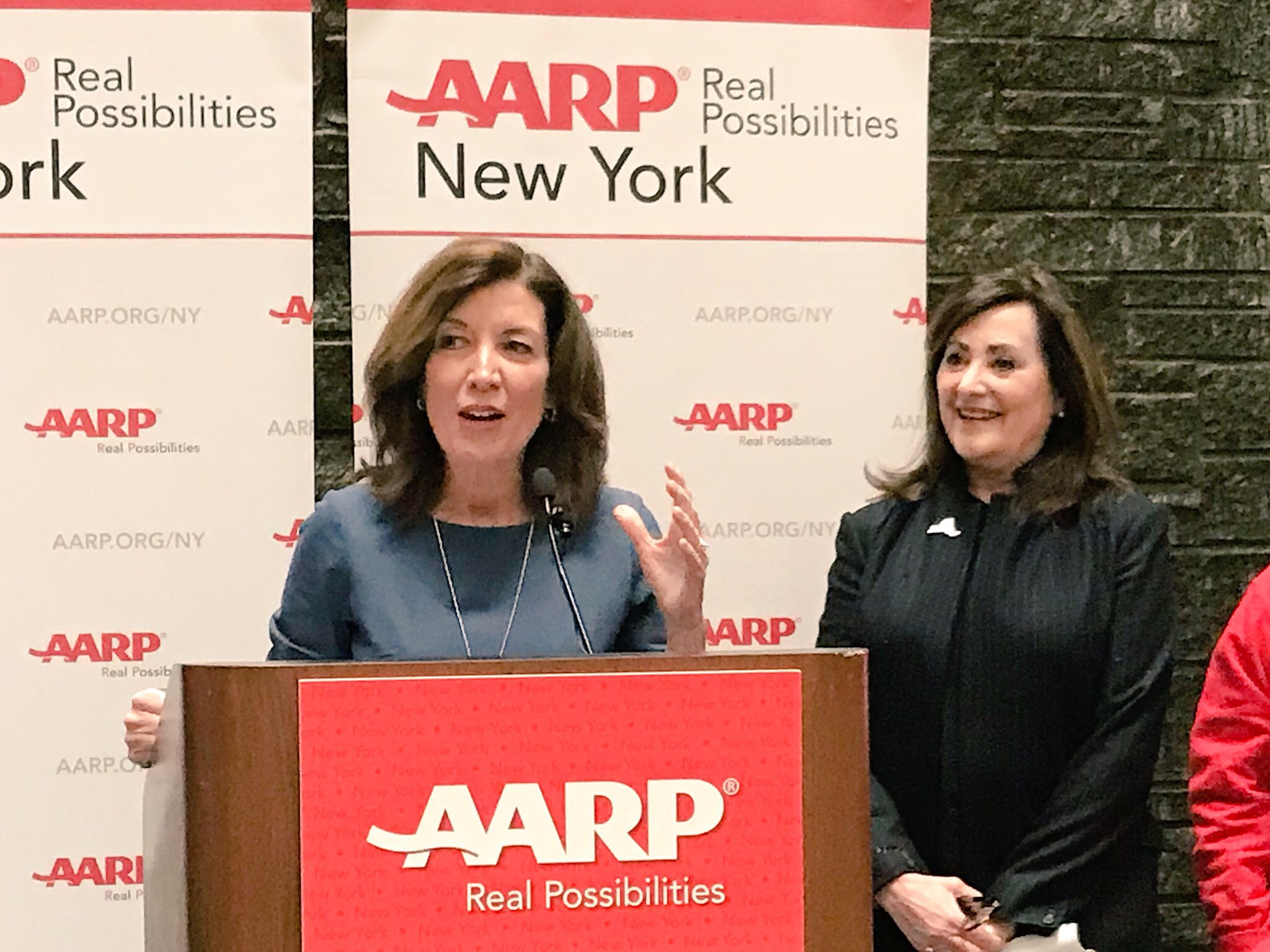

ALBANY, N.Y. – Lieutenant Governor Kathy Hochul and bestselling personal finance author Jean Chatzky joined AARP volunteers from across New York today and a small business owner to urge state legislators to include in the final budget Governor Andrew Cuomo’s proposal to make it easier to save for retirement.

AARP members are visiting over 70 legislative offices today to promote “ Secure Choice,” which would establish a payroll deduction Roth IRA option for businesses to offer their employees if the business does not already offer its workers a retirement savings plan.

Three dozen organizations from across New York have joined AARP in signing a Secure Choice Sign-on Letter to Senate Majority Leader John Flanagan, Assembly Speaker Carl Heastie and Senate Coalition Leader Jeff Klein urging that Secure Choice be enacted as part of the final 2018-19 state budget due April 1.

Secure Choice, which Governor Cuomo included in his state budget proposal last month, would provide an easily accessible workplace savings option that could empower up to millions of private sector working New Yorkers to take control of their futures – and choose how they live as they age. The program would be voluntary for both businesses and for employees of companies that choose to offer it.

“From my days in Congress fighting to protect Medicare and Social Security, I have always understood the stresses our seniors are under when it comes to enjoying financial security in their later years,” said Lieutenant Governor Kathy Hochul, appearing with AARP at an event in The Well of the Legislative Office Building. “Women are particularly vulnerable because over their lifetimes they are paid less than men, and by retirement, many slip into poverty. In our state, we believe that the Secure Choice payroll deduction will create savings that will protect our seniors after a lifetime of work. We truly appreciate the advocacy of AARP to help the Governor and I get this passed.”

“If you can’t see it, and you can’t touch it, you won’t spend it. Of my 100 Money Rules, this is the one I cite most often, because it explains the magic behind 401(k) and other workplace retirement plans,” said Jean Chatzky, bestselling personal finance author, AARP financial ambassador and New York resident. “Too many New Yorkers don’t have the ability to save this way, and this has to change. I support Governor Cuomo’s inclusion of Secure Choice in his budget proposal and I strongly urge the Legislature to make it part of the final state budget.”

“The best part about Secure Choice is the fact that it is completely voluntary and that it is super easy to implement,” said Kojenwa Moitt, who owns Zebra Public Relations in Brooklyn and responded to an AARP survey which revealed that nearly three quarters of the state’s small businesses that don’t provide their employees a retirement savings plan likely would offer a state-provided option. “It is a choice to financially empower my company and to do so as well for my employees.”

“As the sponsor of the New York Secure Choice Savings Program, I was very pleased to see the Governor include the plan in his budget proposal and look forward to seeing it cross the finish line,” said Senator Diane Savino, chief Senate sponsor of legislation similar to the Governor’s proposal. “Tens of thousands of New Yorkers do not have savings sufficient to allow them to retire in dignity. We need to do something.”

“It’s time that New York State takes action to ensure that everyone has access to retirement savings by including the Secure Choice Savings program in this year’s budget,” said Assembly Member Robert Rodriguez, chief Assembly sponsor of the legislation. “The retirement savings crisis will only worsen if we do not take action.”

Assembly Speaker Carl Heastie recently voiced his support for Secure Choice, saying during an appearance on New York City’s WBLS-FM radio, “I’m sure we will include it in our one-house” budget resolution next month.

“Saving for a secure retirement is becoming harder and harder as fewer businesses are able to offer their employees a pension, a 401(k) or any kind of savings plan,” said AARP New York State Director Beth Finkel. “We and our members are here today from across New York to tell our lawmakers that they need to fill the gap. Secure Choice would provide a helping hand to millions of middle class New Yorkers with an effective way to save their own money – and not become dependent on government later in life.”

Over half of all private sector employees in New York – more than 3.5 million New Yorkers – lack access to a pension or 401(k) at work as fewer businesses offer retirement savings options.

The Savino-Rodriguez legislation has nearly 100 sponsors from both parties in both houses. Illinois, Oregon, California, Connecticut and Maryland have already enacted similar plans.

A 2016 AARP NY/Siena College poll found 82 percent of New York Generation Xers and Baby Boomers support a state-facilitated workplace retirement savings option for those who lack access.

Secure Choice ( see pages 170-185) would be overseen by the state’s Deferred Compensation Board and would cost no ongoing taxpayer dollars to run. Employee contributions would be managed by a professional investment firm, and each employee would own their IRA – and could take it to any new job. Participating businesses would have no fiduciary responsibility, would not match employees’ contributions, and would simply need to add an automatic deduction line to employees’ paychecks.

AARP volunteers today are also urging lawmakers to support a new family caregiver tax credit, Governor Cuomo’s proposal to expand the use of telehealth, and a $25 million increase for cost-effective services like home-delivered meals and assistance with activities of daily living that help New Yorkers age in their own homes, rather than in far costlier and taxpayer-funded nursing homes.

Contact: Erik Kriss, ekriss@aarp.org

Follow us on Twitter: @AARPNY and Facebook: AARP New York

AARP is a nonprofit, nonpartisan organization, with a membership of nearly 38 million that helps people turn their goals and dreams into 'Real Possibilities' by changing the way America defines aging. With staffed offices in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, AARP works to strengthen communities and promote the issues that matter most to families such as healthcare security, financial security and personal fulfillment. AARP also advocates for individuals in the marketplace by selecting products and services of high quality and value to carry the AARP name. As a trusted source for news and information, AARP produces the world’s largest circulation magazine, AARP The Magazine and AARP Bulletin. AARP does not endorse candidates for public office or make contributions to political campaigns or candidates. To learn more, visit www.aarp.org or follow @AARP and our CEO @JoAnn_Jenkins on Twitter.

###