AARP Hearing Center

By Ronald E. Roel

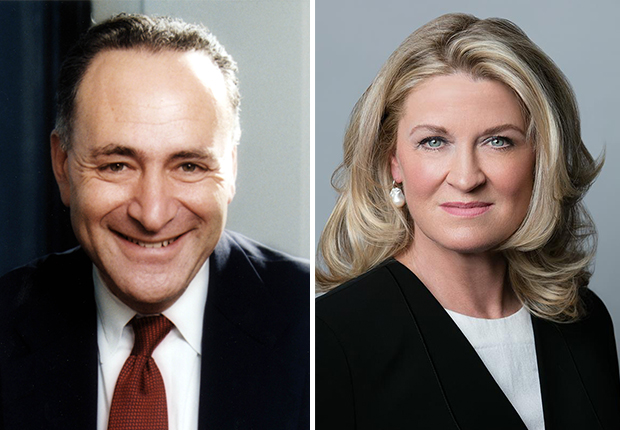

New York voters face a choice on Nov. 8 in the U.S. Senate race between incumbent Charles Schumer, a Democrat, and Republican challenger Wendy Long. Both strongly support Social Security and Medicare, but they differ significantly in their approaches to sustain the programs.

Schumer, 65, was first elected to the Senate in 1998 and is seeking his fourth term. He serves on several committees, including the Finance Committee, which has jurisdiction over Social Security, Medicare and Medicaid.

Long, 56, is a former partner of a New York City law firm. Also a candidate on the Conservative and Reform parties’ ballots, Long unsuccessfully ran against Democratic Sen. Kirsten Gillibrand in 2012.

Schumer responded to questions by email; Long, via email and in a subsequent telephone interview.

Both oppose any cuts in Social Security benefits. But unless something is done, Social Security’s retirement fund will face a nearly 25 percent benefit cut after 2034.

Schumer said proposals to cut or privatize benefits are “nonstarters.” He also supports legislation introduced last year by Sen. Elizabeth Warren (D-Mass.) that would provide a onetime cash payment to Social Security beneficiaries who did not get a cost-of-living adjustment this year, primarily because low gas prices held down the inflation rate.

“The problem is that many seniors don’t drive, so the savings from lower gas prices may not have affected them, while the price of everyday goods, like rent and groceries, went up,” Schumer said. The bill would provide Social Security beneficiaries with a onetime $581 payment, equal to a 3.9 percent increase for most recipients, which would be paid for by eliminating a tax provision that allows corporations to deduct a portion of executive compensation over $1 million.

Long said she would support “any good proposals to save and protect [Social Security], so long as they do not increase taxes or renege on promises” to those who have paid into the system. Policymakers should “prioritize economic growth,” she said, “which will solve many, many problems.”

Long added that younger workers should be allowed to move their federal payroll-tax contributions to personal retirement accounts. These accounts would be controlled by individual recipients, but they “should be subject to some rules to keep the investments safe,” she said.

Medicare Approaches differ

Under current projections, the Medicare Part A (hospital) trust fund will be depleted by 2028.

“We need to cover essentials for the elderly without means, but for people with means, they need to pay more,” Long said.

She proposed that the key to reducing costs is encouraging competition with private plans and increased savings incentives. She advocates finding ways to fill gaps in Medicare coverage, like dental, vision or hearing care, but “not with government funds. We need a competitive marketplace for such items.”

Schumer said Medicare health plans offered by private companies, known as Medicare Advantage plans, are “an important option” for seniors, and he opposes any further cuts in their federal subsidies. Last year, about 1.2 million New Yorkers were enrolled in Medicare Advantage, about 37 percent of total Medicare recipients in the state, according to the Kaiser Family Foundation.

AARP does not endorse candidates or give money to campaigns but seeks to inform voters about the issues. Voters can learn more about New York candidates’ positions in the AARP voter guide, available at aarp.org/yourvote.To find out where the presidential and congressional candidates stand on Social Security, go to 2016takeastand.org.

Ronald E. Roel is a freelance writer and editor living in Glen Cove, N.Y.