AARP Eye Center

CLOSE ×

Search

Popular Searches

- right_container

- Health

- Money

- Work & Jobs

- Advocacy

- Social Security

- Medicare

- Caregiving

- Games

- Travel

- More...

- Entertainment & Style

- Family & Relationships

- Personal Tech

- Home & Living

- Auto

- Staying Sharp

- Podcasts

- Videos

Have you thought about entrepreneurship as a new career option? Research has found one-in-four Americans between age 44 and 70 are interested in starting a new business within the next five to ten years.

By Charmaine Fuller Cooper

GOLDSBORO – In appreciation for military families and veterans, AARP will be exhibiting at Wings over Wayne 2015, May 16-17, providing information and support to help people live healthier and more financially secure lives. Visitors to the AARP air show exhibit at Seymour Johnson Air Force Base can participate in fun activities, receive free personal commemorative event photos, win prizes, and enter a chance to win smart tablets and VIP tickets to the Kellie Pickler concert on Saturday, May 16.*

Do you talk to your kids about your money? Have you had a family discussion about your financial matters? Financial advisers suggest that all family members be kept in the loop. It becomes even more important as you get older.

RALEIGH – AARP North Carolina is urging State Legislators to pass a law already adopted in forty states to recognize adult guardianship orders uniformly across state lines and allow guardians to provide for their loved ones regardless of where they live. State House Bill 817, the Uniform Adult Guardianship Act, would create a simple solution to iron out costly and timely jurisdictional issues for family caregivers.

RALEIGH -- AARP North Carolina is urging State Legislators to pass a law already adopted in forty states to recognize adult guardianship orders uniformly across state lines and allow guardians to provide for their loved ones regardless of where they live. State House Bill 817, the Uniform Adult Guardianship Act, would create a simple solution to iron out costly and timely jurisdictional issues for family caregivers.

Is starting a small business right for you? Millions of 50 plus Americans are finding a fit for their passions and generating good income by starting their own businesses.

By AARP NC Associate State Director Charmaine Fuller Cooper

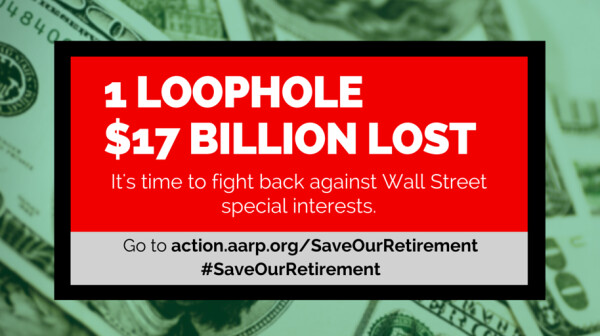

You’ve worked hard to save for retirement and you deserve a financial advisor who works just as hard to protect what you’ve earned. Right now, loopholes in the law allow bad-actors in the financial industry to provide retirement savings “advice” based on what’s best for their pocketbook, not yours. The result? They can recommend investments with higher fees, riskier features, and lower returns because they earn more money, even if those investments are not the best choice for you. Bad advice is wrong, and it is costing Americans up to $17 billion per year.

RALEIGH -- In a first-of-its-kind effort, AARP North Carolina and Shaw University Divinity School have announced a pilot program on financial literacy. This effort is being implemented to improve the savings rates of individuals of all ages so people can be better prepared to meet the financial demands of the future.

Search AARP States

Connecting you to what matters most, like neighbors do. Find events, volunteer opportunities and more near you.

Sign Up & Stay Connected

)