AARP Eye Center

CLOSE ×

Search

Popular Searches

Suggested Links

How to strengthen and preserve Social Security for future generations is one of the most important decisions facing federal policymakers. This campaign season, questions about Social Security’s fate belong on the forefront.

Today’s workforce looks drastically different than it did even a decade ago. A swift rise in alternative “gig economy” jobs (like Uber drivers, freelancers, and seasonal workers) means fewer workers have access to workplace retirement plans. In fact, half of American workers have no way to save for retirement out of their regular paycheck, and the private sector has failed to fill this gap over the last 40 years. But, we know people are 15 times more likely to save if they can do so at work. Work & Save programs offer an innovative solution to these changing realities. This 529 style retirement program will allow more workers, like Millennials moving from job to job, to grow their savings and take control of their future. Work & Save provides an easy, low-cost plug-and-play option for businesses to offer employees a way to save for retirement out of their regular paychecks. Work & Save accounts put hard-working Americans in control. The accounts are voluntary, so it’s up to the employee to decide if they want to participate and how much they want to put away automatically from their paycheck. And, the savings is the employee’s own money that they can take with them from job to job, and rely on to take care of themselves in later years. Can We Afford Not to Change?While Social Security is a critical piece of the puzzle, it is not enough to depend on. The average Social Security benefit for a 65+ family is only about $18,000 per year, even though older American families on average spend $20,000 a year on food, utilities, and health care alone. At this rate, one out of every two households won’t be able to afford their basic needs, and may need to rely on public assistance later in life. But, Work & Save can change that! Giving employees an easy way to grow their savings means fewer Americans will need to rely on public assistance later in life, which will save taxpayer dollars. In fact, states taking action today could save taxpayers as much as $33 billion over the next 10 years. States Leading the WayThis week, I’m joining nearly 1,500 legislators and staff in Los Angeles at the annual National Conference of State Legislatures to share more about the many benefits of Work and Save, since states have been leading the way in addressing this critical issue. It’s sure to be an exciting time as I’ll be joined by Jean Chatzky, AARP’s personal finance ambassador.

Governor’s Consumer Health Advocate joins volunteer board

Janice Alpern, an AARP Nevada volunteer and coordinator of our popular Cinemaniacs movie club, runs through Sunday's Academy Awards nominations and her personal picks and point of view on who should take home the Oscar.

The popular AARP Nevada Voices Podcast is back for its second year! We kick it off with an update on where AARP will focus its efforts in 2018.

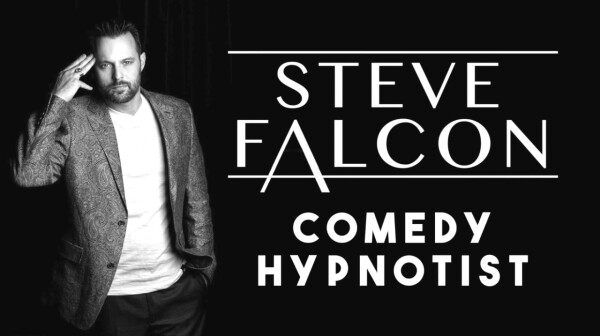

Join AARP Nevada with the wild wonderings of hypnotist Steve Falcon as he demonstrates just how memorizing scammers can be! Then learn how to protect yourself with the professional insight of the FBI. This event is part of the work of the AARP Nevada Fraud Watch Network.

AARP Nevada today announced that it is joining forces with the AARP Fraud Watch Network and the U.S. Postal Inspection Service for Operation Protect Veterans -- a campaign to warn those who have served in the military about scams and fraud schemes that target veterans. The major educational campaign will reach out to veterans in communities across Nevada and nationwide.

Despite their individual sacrifices for our nation, Veterans are increasingly becoming the target of scammers bent on using their service to rip off our men and women who served.

While the wounds are still raw from the terrible tragedy of October 1, 2017 in Las Vegas, the AARP Nevada staff discussed the event in this month's Nevada Voices podcast.

Famed scammer-turned-FBI consultant speaks to a packed crowd in Las Vegas

Search AARP States

Connecting you to what matters most, like neighbors do. Find events, volunteer opportunities and more near you.

Sign Up & Stay Connected